EU-China FDI: Working towards more reciprocity in investment relations

Report by MERICS and Rhodium Group

1. EU-China FDI: Working towards reciprocity in investment relations

Key Findings and Recommendations

- Europe continues to be a favorite destination for Chinese investors. China’s global outbound investment declined in 2017 for the first time as Beijing enacted capital controls. Chinese FDI in the EU followed the global trend and dropped to EUR 35 billion, a 17% decline compared to 2016. However, the pace of Chinese deal making in Europe is more resilient than in other advanced economies, and state-related investors are staging a comeback.

- European FDI in China remains lackluster because of slowing growth and persistent market access hurdles. The level of European FDI in China has hovered around EUR 10 billion per year in the past five years before 2015 and has further declined in 2016 and 2017 to EUR 8 billion per year. Despite promises to level the playing field, European companies continue to face major formal and informal investment restrictions in the Chinese market, especially in sectors with high growth opportunities.

- By all available measures, there is a significant gap in investment openness between the EU and China. Chinese investors enjoy one of the most open investment regimes in Europe, with almost unfettered access to all industries. China on the other hand continues to strategically limit access for foreign companies in many sectors and there is rampant informal discrimination against foreign firms.

- The lack of investment reciprocity harms European interests. The lack of reciprocity violates fairness principles that the post-WWII economic order was built on. It also is a threat to efficient market allocation of resources, which can cause serious harm for European producers and consumers. Finally, the perception of China as a free rider undermines popular support for economic cooperation with China and for an open, liberal economic order in Western democracies.

- Moving toward greater reciprocity is ultimately in China’s own interest: China’s leaders are aware that the current investment barriers not only stoke foreign discontent but are ultimately also detrimental to China’s own economic welfare. Beijing has pledged to level the playing field for foreign investors and it has made some initial progress in removing investment barriers. At the same time, the timeline is unclear and doubts about implementation remain.

- A robust bilateral investment agreement with China should be the EU’s priority but success is uncertain. Negotiating a robust bilateral investment treaty with China based on a narrow negative list is the best approach to address reciprocity concerns. However, negotiations are slow and China’s latest track record raises serious doubts about its ability to implement tough reforms. Moreover, a bilateral investment agreement may not be able to fully address concerns about informal discrimination and other post-market entry hurdles for European businesses.

- Europe needs strategies to build greater leverage to respond if China continues to drag its feet. Europe should prioritize Chinese upward convergence to EU trade standards in investment openness. At the same time, it needs to expand its toolkit and create additional leverage. Europe should ratchet up pressure to resolve long-standing market access issues; build an efficient and transparent regime that screens foreign acquisitions for security risks; explore new avenues for competition policy that consider asymmetries in market access; and increase coordination with like-minded market economies.

Introduction

The European Union (EU) has become one of the favorite destinations for Chinese outbound foreign direct investment (OFDI). Annual Chinese OFDI in the 28 EU economies has grown from EUR 700 million in 2008 to EUR 35 billion in 2016. In 2017, Chinese investment in the EU dropped to EUR 30 billion, the first decline in four years, in the wake of China’s regulatory crackdown on outbound capital flows.

Despite the drop, 2017 was still the year with the second largest inflow of Chinese FDI into the EU, and it was the year with the largest Chinese investment in Europe when counting the EUR 38 billion Syngenta takeover in Switzerland. Moreover, deal making picked up later in the year, and the 2018 pipeline is filled with more than EUR 10 billion of pending acquisitions.

The growth and resilience of Chinese investment flows is eliciting both enthusiasm and anxiety in Europe. Some politicians are excited about the prospect of new investments to revitalize their local economies and better connect them with the booming Chinese consumer market. Others are concerned about potential security risks and negative economic impacts.

The discussions about potential risks from Chinese FDI have continued throughout 2017 and into 2018, despite the apparent slowdown of Chinese investment activity. One increasingly important concern is the lack of reciprocity in EU-China investment relations. While Chinese investors enjoy the same rights in the EU market as any European business, China still heavily restricts foreign investment in its markets, and it has not delivered on many promises to remove formal and informal hurdles for European companies operating in China.

This gap in investment openness raises concerns about detrimental economic impacts – such as unfair competition and resulting market distortions – but it also creates a sense among EU citizens and businesses that the playing field between Europe and China is not level. This strengthens protectionist sentiment and fuels political backlash against economic engagement with China. Thus, the resolution of reciprocity concerns will be critical for the future trajectory of EU-China economic relations.

The European debate about reciprocity is often guided by emotions and preconceived notions of an unfair China. There has not been much systematic effort to collect empirical evidence of reciprocity gaps. This lack of reliable information allows the debate to be politicized by special interests, which in turn undermines the argument vis-à-vis China.

In this report, we first explain what reciprocity means and what role it has played in creating today’s institutional environment for global trade and investment. Then we describe why the emergence of China as a global investor is challenging those principles. Finally, we discuss the negative impacts for Europe from this reciprocity gap and illustrate the urgent need to address the existing gap. We conclude by offering recommendations to European policymakers.

1.1 The diagnosis: EU-China investment relations lack reciprocity

“Reciprocity” (or the lack thereof) has become the new buzzword in EU-China investment relations. The term is commonly used to describe an unfair gap between market access of Chinese investors in Europe and European companies in China. However, it is poorly defined and used in different contexts. In this section, we first clarify the basic concept of reciprocity, then review different metrics to help quantify the EU-China reciprocity gap, and lastly discuss why European leaders urgently need to address the gap.

1.1.1 Reciprocity is a guiding principle for economic globalization

Reciprocity is an important concept in social and political relations. In the broader context, reciprocity refers to (rough) equivalence in “actions that are contingent on rewarding actions from others and that can cease when these expected reactions are not forthcoming.”1

Between sovereign states it is considered a standard of behavior which can produce cooperation and constitutes the foundation of international legal obligations. In the context of international economics, the concept of reciprocity has mostly been associated with liberal trade policies. Major international commercial treaties since the 18th century have referred to reciprocity in trade concessions. Most importantly, the reciprocity principle is the central norm of the General Agreement on Tariffs and Trade (GATT) and the World Trade Organization (WTO). In addition to serving as guiding principle for coordinated liberalization (“upward convergence” in openness), reciprocity can also refer to in-kind responses to both beneficial or harmful acts, such as countries or politicians lowering (or increasing) market access barriers in reaction to declining (or increasing) levels of protection in another country.

Historically, most bilateral and multilateral economic agreements were not based on “absolute” reciprocity requirements (i.e. full equivalence of market opportunities), but on the notion of relative equivalence of benefits that consider a country’s specific characteristics and developmental situation. For example, the integration of developing and emerging economies into global arrangements such as GATT/WTO was based on relative reciprocity concepts that allowed “phase out” periods, grandfathering preexisting provisions and other exceptions.

While reciprocity principles have been the foundation for many trade agreements, their application on investment relations has remained rare. Rules related to reciprocity in investment relations inside the WTO framework remain limited and attempts to promote investment reciprocity in multilateral agreements in the late 1990s (the OECD Multilateral Agreement on Investment) have failed.2 Today, international agreements on investment openness are limited to bilateral investment treaties and several regional arrangements with investment provisions.3 In the absence of global agreements, global investment openness was mostly promoted by a coalition of advanced economies as well as unilateral measures to liberalize foreign capital inflows irrespective of the same treatment overseas. For instance, the EU Treaties include the principle of free movement of capital toward not only EU members but also third countries on an explicitly non-reciprocal basis.4 Existing EU and OECD commitments explicitly rule out most forms of reciprocity conditionality regarding investment openness.5

1.1.2 The China problem

For most of the past three decades, this status quo worked well since global cross-border investment flows were dominated by OECD economies that – by and large – all followed those basic principles of mutual investment openness. Asymmetries in investment openness between OECD nations and China were a second order priority for policymakers. For one, China had few legal obligations under WTO/GATT to liberalize investment access. Two, the Asian Financial Crisis of 1997 and the Global Financial Crisis of 2008/2009 reinforced the notion that it was prudent for an emerging economy like China to only gradually liberalize its capital account. Third, multinationals were making handsome profits in China despite investment restrictions, and the Chinese government promised to continue liberalization of closed sectors. Fourth, as Chinese outbound investment remained negligible for the first three decades of reform, there were no Chinese companies that benefited from the tilted playing field outside of the Chinese market.

Several of these variables have changed in recent years. Growth rates in the Chinese economy have slowed, increasing competition and thus the need for a level playing field. At the same time, Beijing has been slow delivering on FDI liberalization and other market-oriented reforms. Finally, Chinese outbound investment has soared, allowing Chinese corporations to enjoy European openness while being protected from foreign competition at home.

The reciprocity problem with China extends to restrictions at market entry (i.e. foreign companies are not allowed to invest in certain sectors) as well as formal and informal discrimination post market entry (i.e. companies can invest but face disadvantages operating in China compared to Chinese-owned companies). Recently announced policies to level the playing field are ambitious but they have not yet led to a measurable improvement of either dimension, and the recent track record casts significant doubts on the Chinese government’s determination to fully implement them.

China prohibits and restricts foreign investment in many sectors

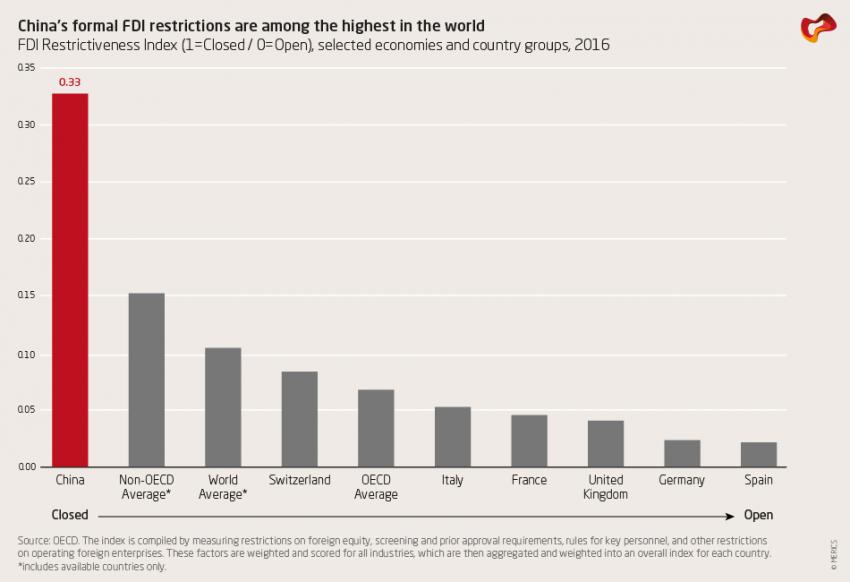

One dimension of openness is “de jure” openness to FDI, i.e. to what extent laws and regulations prohibit foreigners to invest in a country’s economy. Using this yardstick, EU member states are considered among the most open economies in the world, in comparison to the global average as well as other advanced economies (Figure 1). China, on the contrary, despite its history of “reform and opening up,” remains heavily restrictive. On aggregate, China ranks as one of the most restrictive economies in the world, well below the OECD average and even below most emerging markets.6

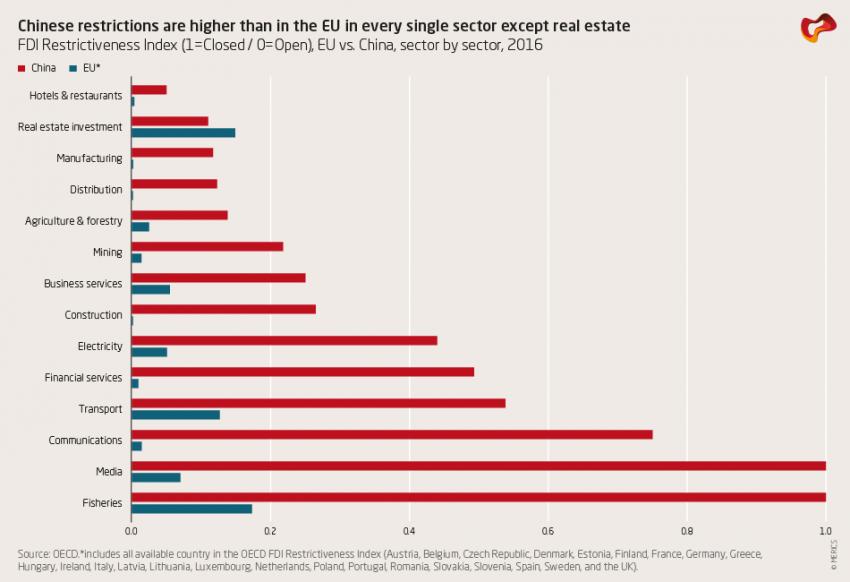

A more detailed breakdown of FDI restrictions by industry reveals discrepancies across sectors (Figure 2). In virtually all industries, China is vastly more restrictive compared to EU economies. The discrepancies are especially large in the service sector, which remains heavily protected in China and restricted for foreign companies. Real estate is the only sector, in which EU economies, on aggregate, have restrictions similar to those in China.

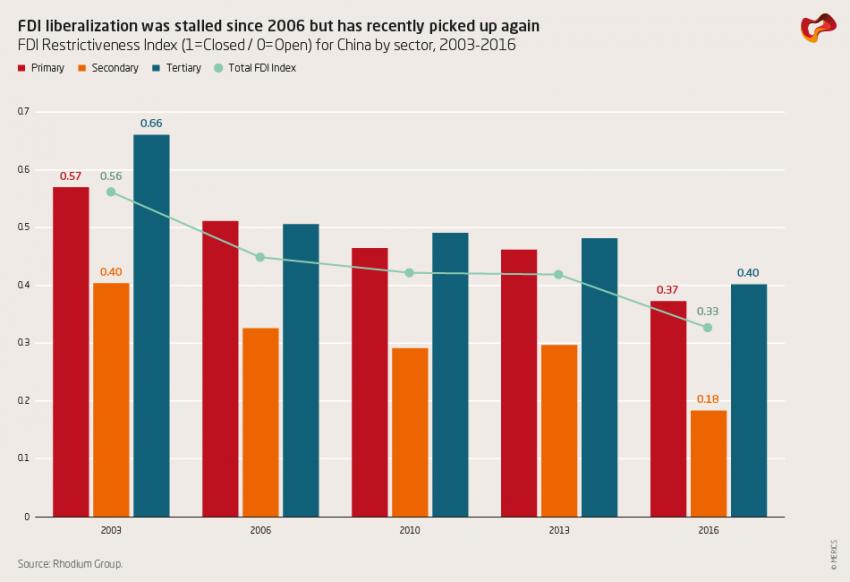

Another useful perspective is the evolution of FDI restrictiveness over time. Figure 3 illustrates that China’s FDI reform momentum was strong in the early 2000s but slowed since 2006. That progress virtually stalled until 2013. Since 2014, the pace of reform has picked up again. This reflects China’s efforts to transition from an approval system (based on three lists of prohibited, restricted and encouraged sectors) to a new regulatory framework for FDI that will give foreign investors access to all sectors except ones defined through a negative list. If properly implemented, the new regime would legally abandon the distinction between foreign enterprises and local private firms in those sectors that are not on the negative list. In addition to this general administrative overhaul Beijing has recently made some progress in removing several sectors from the list of restricted or prohibited sectors.7

China discriminates against foreign companies post market entry

A second important dimension of reciprocity is the treatment of foreign companies post market entry. While foreign companies enjoy equal rights and regulatory treatment in the European Union, China still treats European and other foreign businesses vastly different from local firms. For decades, “foreign-invested enterprises” have been defined a separate group in the Chinese economy, which was subject to special treatment and different rules than domestic (i.e. Chinese-owned) companies. Informal discrimination against foreign-owned businesses continues to be widespread, especially on local government levels. There is abundant research documenting a wide range of administrative practices restraining foreign investors post-establishment.8 Surveys among foreign businesses broadly confirm these findings. Over the past decade, companies have regularly complained about unequal enforcement of laws and other discriminatory practices.9

Notably, while formal FDI restrictiveness shows improvement since 2014, survey data suggests that informal discrimination has worsened in recent years. For the past four years, more than half of European companies have consistently reported that they are treated unfairly compared to domestic Chinese companies. Moreover, foreign businesses do not report high confidence that China will be able to implement substantial reforms that can address these problems in the coming years. There are significant concerns that new policies (such as "Made in China 2025," ICT localization, cyber security or the implementation of the Anti-Monopoly law) will continue to tilt the playing field in favor of Chinese-owned businesses, even if China moves to legally abolish special treatment of foreign companies.

FDI reform announcements are positive but skepticism is warranted

Since 2014, Beijing has made a push to re-ignite reforms that would help to address both market entry restrictions as well as post-market entry discrimination, and it has made some progress on both goals in the course of 2017.

First, China has officially decided to abolish its traditional FDI regime and replace it with a framework that is based on pre-establishment rights restricted by a negative list only. This decision paves the way for China to abandon its planned economy approach to FDI and move closer to a modern approach for regulating FDI. While the negative list started out as an amalgamation of its lists of restricted and prohibited sectors, China has made some progress in cutting it down throughout 2017 and it has demonstrated greater seriousness in reducing red tape for foreign investors. In July 2017, MOFCOM updated its regulation on the recordal process for FIE establishment and change, formally eliminating approvals for foreign acquisitions in China.10 In August 2017, the State Council promised to open an additional 12 sectors, including electric vehicles and financial services, to foreign investment.11 During US President Trump’s visit in November 2017, China announced to further open up foreign ownership in the financial services sector.12 At the end of 2017, China announced to temporarily exempt foreign firms from taxes on profits reinvested in certain industries specified by Beijing.13 Other incremental changes in the past few months include further opening up of services sectors in the city of Beijing and regulatory changes to support opening up in the Free Trade Zones.14

Second, China’s leadership has vowed to address the discriminatory treatment of foreign-owned companies. At a central financial and economics Leading Small Group meeting in summer 2017, President Xi himself stated the goal that “after entry, [foreign and domestic companies] should be equal in law and consistent in policy, and have national treatment.”15 A State Council document on FDI reforms from August 2017 included the promise to “guarantee post-entry national treatment” for foreign companies. That same document also promised a range of policies aimed at tackling informal discrimination facing FIEs, including in taxation, personnel and visa, foreign exchange, intellectual property, and participation in initiatives such as Made in China 2025.16

These steps are positive, and China’s top leaders have promised to “exceed expectations of the international community” with further pushing forward reforms in 2018.17 However, serious concerns remain about China’s ability to fully and timely implement the announced FDI reforms. In general, Beijing has made very slow progress on the market-oriented reform agenda it promised in late 2013.18 To the contrary, China under Xi Jinping has in fact moved backwards in some regards by doubling down on industrial policies and greater party-state guidance in key sectors of the economy. Examples are the re-introduction of capital controls for foreign investors, the pursuit of industrial policies that discriminate against foreign companies, and the selective and sometimes mercantilist implementation of tools such as the Anti-Monopoly Law or the Chinese Intellectual Property regime. Ultimately, only with substantial progress towards more “rule of law” in China would foreign companies enjoy the necessary “contestability” for equal market participation. The past track record suggests that foreign skepticism about implementation of FDI reforms and their robustness is warranted.

1.1.3 The impacts: Why the lack of investment reciprocity is a problem

The described asymmetries in investment openness are not just a theoretical problem. They already cause major imbalances and distortions in capital flows between China and Europe, and they cause real harm to European businesses and consumers. Finally, the perception of China as a free rider of the international trading system amplifies protectionist sentiment in the European public and undermines efforts for deepening economic cooperation with China.

The reciprocity gap causes FDI imbalances

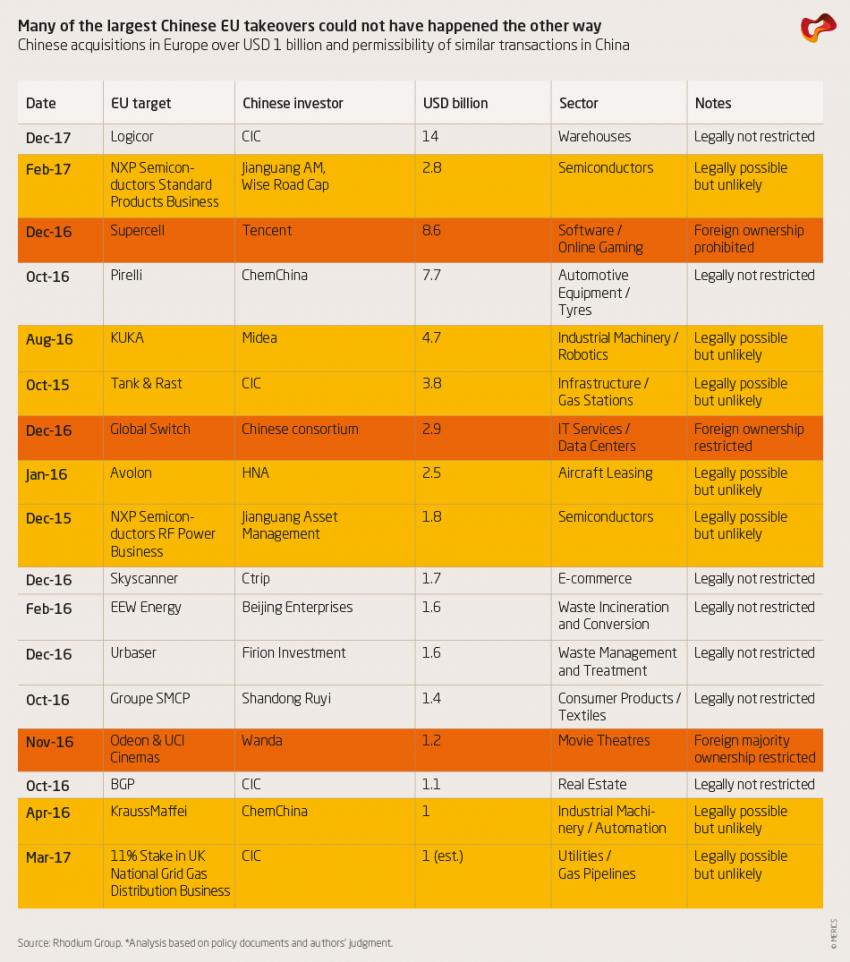

At the most granular level, the lack of reciprocity in market access leads to unfair competition between individual companies. Table 1 shows all Chinese takeovers with a value of USD 1 billion or more in the period from 2000 to 2017. One quarter of those deals could not have legally been possible in the other direction at the same time as foreign investment in those sectors was prohibited or restricted. In half of the instances, the transactions would have been legally permissible but highly unlikely to be approved because of state control, industrial policies and other factors.19 In other words, roughly three out of four of the largest Chinese acquisitions in Europe since 2000 could not have happened the other way around.

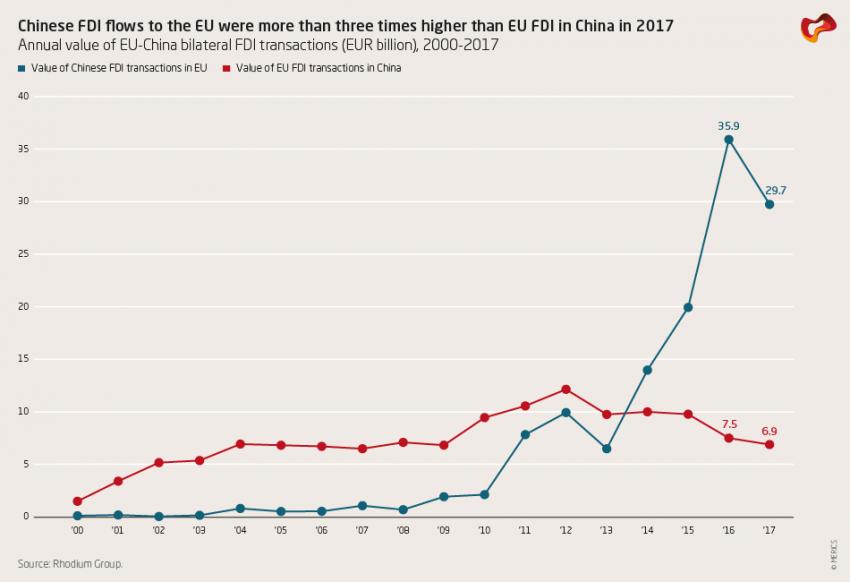

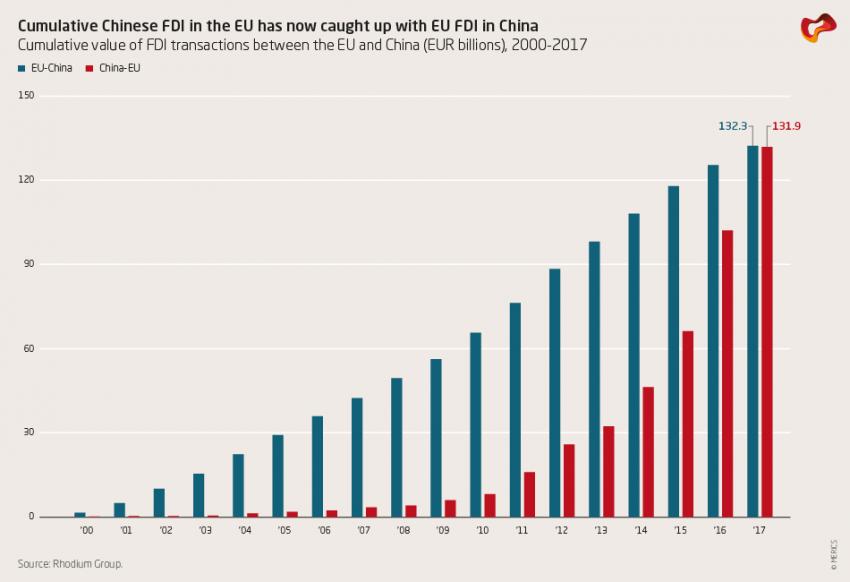

On an aggregate level, these existing barriers have already led to visible imbalances in EU-China FDI flows. Traditionally, EU FDI flows into China were significantly higher than Chinese outbound flows, which is in line with what economic theory would predict. Since 2010 the tide has turned rapidly, with Chinese FDI in the EU overtaking flows in the other direction since 2014. For the past three years, Chinese FDI in the EU surpassed EU FDI in China by a factor of three (Figure 4). These flows were almost exclusively driven by M&A activity, which remains heavily restricted in the other direction. Within a span of just five years, China’s FDI stock in Europe has caught up to Europe’s FDI stock in China (Figure 5).

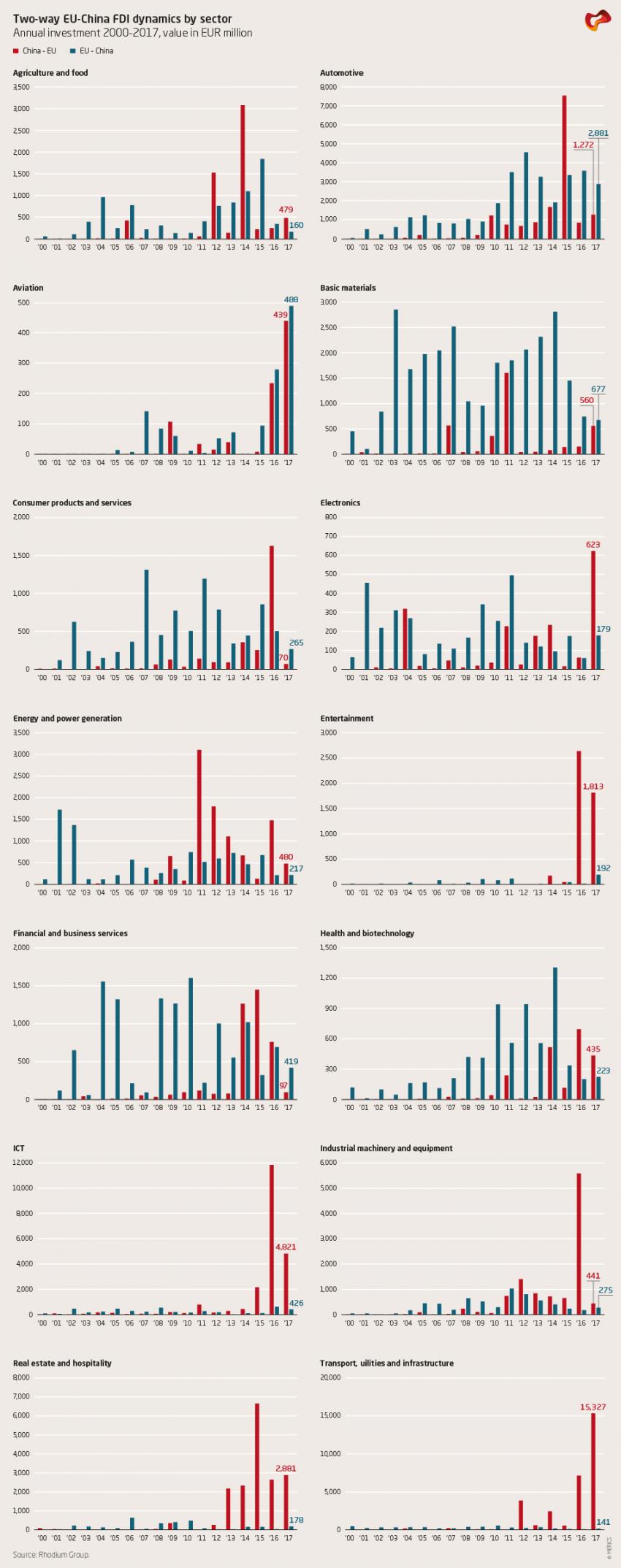

Bilateral FDI flows are of course rarely perfectly balanced and reflect a host of macroeconomic, commercial and firm-level factors including different development levels, comparative advantage, financial expectations and other variables. However, there is clear evidence that political factors are causing imbalances that would not exist under free market conditions. In 2017, Chinese investment in the EU was higher than EU investment in China in 10 out of 15 industries. Chinese restrictions are a major factor for this imbalance, plainly visible for example in transport and infrastructure, entertainment or energy and power generation (see Figure 6).

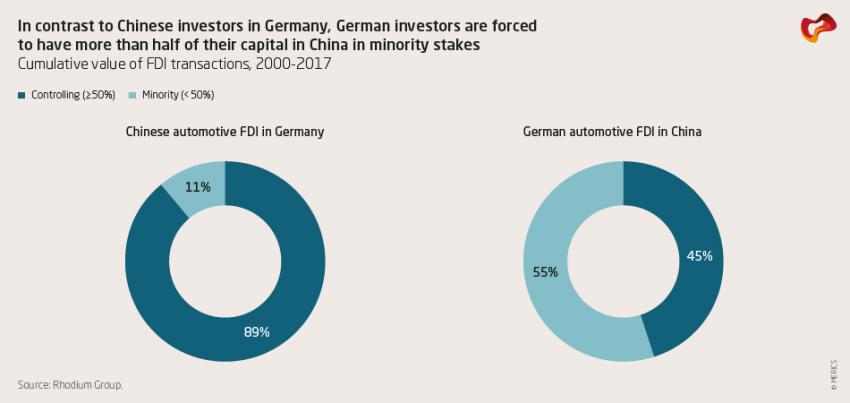

Moreover, the investment flows that are happening are clearly distorted by Chinese ownership restrictions that force foreign companies into minority joint ventures. Figure 7 illustrates that at the example of two-way FDI in the automotive sector between Germany and China. Of the $27 billion of German FDI in the Chinese automotive sector, 55% was invested in joint ventures in which German companies were by law only permitted to have a minority stake of 49% or lower. Flows in the other direction were lower ($4 billion), but almost exclusively went into operations in which the Chinese investor held controlling ownership stakes.

Lack of investment reciprocity has tangible negative economic impacts

If it persists, the lack of investment reciprocity can generate serious economic harm to European producers and consumers.

Uneven market access is a distortion of free competition, which poses a serious threat to the functioning of efficient markets. It protects less competitive Chinese firms from being defeated or swallowed by more productive overseas companies. It could even allow these less productive firms to acquire or defeat more productive overseas firms in their own home market, especially if additional subsidies and other distortions exacerbate the situation. If persistent, such patterns could lead to consolidation of an industry in the hands of inefficient but protected players. This in turn has serious negative implications for consumer welfare and innovation.

Take, for example, the automotive industry. European auto manufacturers face high tariffs of 25% and higher as well as taxes on car imports into China. For manufacturing and selling cars in China, they are required to engage in a joint venture with a Chinese company, which they cannot control (they can own a maximum of 49%) and are expected to share technology. Moreover, there are special requirements for localization of supply chains. Chinese companies on the other hand are free to enter the European market through 100% ownership of greenfield facilities, and they are free to acquire 100% ownership of existing European automakers as well as auto suppliers. In short, Chinese companies can utilize EU acquisitions and R&D operations to improve their competitiveness while they are protected through equity caps and import tariffs from European firms in China.

Reciprocity concerns get further elevated in the case of China because of its economic size. China is already the world’s second largest economy with a Gross Domestic Product of USD 12 trillion in 2017, and it is projected to surpass the United States as the world’s biggest economy around 2032.20 This is not a problem per se, but it means that China will have enormous weight and impact on global market structures and asset prices. If a country of the size of China pursues policies that cause major market distortions, it could inflict serious harm on global markets.

The EU-China reciprocity gap fuels anti-globalization sentiment

In addition to these economic concerns, the EU-China reciprocity gap also contributes to an erosion of support for a liberal economic order and plays in the cards of those opposing greater economic cooperation between China and the EU.

Reciprocity has been a core principle of globalization in the past decades. While it was legitimate for China to open its capital account in gradual steps, many of China’s provinces have now reached a development level that render arguments for protectionist policies such as enabling the growth of infant industry, invalid. The rapid rise in outbound investment by Chinese firms must be interpreted as evidence that Chinese companies can now compete at eye level with foreign players. This erodes the argument that they need protection at home.

The perception that China – a major beneficiary of a liberal global trade and investment environment – is not playing fair undermines popular support for further integration and fuels the rise of protectionist sentiment worldwide.21 Foreign dissatisfaction with the lack of reciprocity coincides with serious concerns about Chinese trade practices. China has delayed or ignored several key WTO commitments22 and its aggressive industrial policies (such as Made in China 2025) that aim at replacing foreign imports with domestic goods are violating the spirit of the WTO.23 This behavior has escalated frictions between China and its trading partners in recent years, and many governments are therefore re-configuring their external economic policies.24

1.2 The cure: Addressing the gap requires a European answer

In this report we have shown that there is a problematic gap in FDI market access between the EU and China. Re-establishing a sense of relative reciprocity in investment relations is important from a moral perspective (fairness), but also for the sake of economic efficiency and, perhaps most importantly, to avoid further alienation between China and major OECD economies.

While Chinas has been moving in the right direction lately, there are many reasons to remain wary. China’s track record of delaying economic reforms, of anti-foreign sentiment and top-down economic governance warrants caution. EU policy-makers need to start being more specific and realistic in defining what the EU can and should ask for to operationalize the principle of reciprocity. This needs to include sober considerations about the necessary political leverage and instruments of pressure. In the following we describe several core principles for a European Way to approaching investment reciprocity with China and then introduce a policy package for the EU to move forward.

1.2.1 The European Way

Europe is not alone in seeking the right response to the lack of reciprocity in investment and other aspects of economic relations with China. Many advanced economies (and increasingly also developing countries) are re-assessing economic relations with China in response to a perceived lack of fairness.

Perhaps the most radical re-assessment seems to be occurring in the United States, where the Trump administration has taken a more confrontational approach to certain Chinese practices, including trade defense cases and a far-reaching investigation into forced technology transfer based on a little known legal provision that can only be evoked under exceptional circumstances.25

European policymakers should pursue a more assertive economic agenda vis-à-vis China. They need to find policies that are effective but in line with European principles, values and political realities:

(1) Set realistic expectations: There are clear limits to what Europe and other advanced economies can expect from Beijing. For one, China will not converge with Western liberalism, and Beijing will not compromise on sectors it perceives as critical to the power of the Chinese Communist Party, for example media and communications. Two, China is facing tremendous economic challenges and it will maintain control over sectors that it perceives as critical for managing the transition to a new growth model, for example banking and other types of financial intermediation. These realities need to be considered when setting priorities for market access negotiations with China. Priority number one should be to push for Chinese convergence in sectors that have no national security dimensions and for equal treatment of foreign investors post market entry.

(2) Downward convergence should be the last resort: Europe has been a champion of investment openness, and it needs to defend these values. It should still aim for “upward convergence” in FDI openness and build up the necessary leverage to effectively pursue this goal. The feasibility of a “net benefit test” in the European context (a method employed by Canada that allows for incorporating economic considerations in the screening of investment), deserves debate as a potential move towards negative reciprocity if things turn worse. At the current stage, however, steps such as the introduction of absolute (sectoral) reciprocity requirements or other methods to shut down the European economy to Chinese investment are premature. Not only would they violate European values and interests, but they would require a fundamental overhaul of European treaties. The distortions caused by unequal market access are not yet large and acute enough to warrant such aggressive steps.

(3) Keep national security screenings separate from reciprocity goals: EU leaders and member state officials have repeatedly framed the proposal on investment screening presented by the EU Commission in September 2017 as a tool to level the playing field with China.26 This is wrong and dangerous. The new Commission proposal is focused on security interests and was not created to address the reciprocity problem. The proposed “enabling framework” might open the door for an expanded definition of strategic assets that allows member states – with the tacit support of Brussels and partners – to scrutinize and potentially block investments for strategic-economic reasons beyond very limited public security and public order concerns. Such an instrumentalization of a security screening framework to achieve economic goals through the backdoor is a slippery slope and would violate Europe’s principled openness. Not only will it most likely result in inefficient interventions, but it will also increase the chances of Chinese retaliation, which could lead to substantial economic losses and ignite a global protectionist spiral.

(4) Seek solutions based on existing frameworks and bureaucratic structures: Instead of creating additional layers of bureaucracy across various levels of European governance, European leaders should seek solutions that can be implemented through existing structures, and that do not require a fundamental overhaul of processes or legal frameworks.

(5) Cooperate with like-minded market economies: The EU would benefit from ramping up international coordination with like-minded economies. OECD economies are affected to Chinese behavior in different ways, but, fundamentally, they all share the goal of getting China back on track to convergence with market-oriented economic principles.

1.2.2 A policy package for Europe

Based on these principles, we have identified a set of policies that the EU and its member states should pursue to address reciprocity concerns:

(1) Push for a robust bilateral investment treaty: Europe’s current approach to achieving greater FDI reciprocity with China is centered on getting China to agree to a bilateral treaty that defines investment market access based on a negative list. Negotiations of a Comprehensive Agreement on Investment (CAI) between China and the EU have started in 2013 and assume that China has a self-interest in further opening up to sustain inflows as well as openness for Chinese investors in the European market.

A robust CAI with China would be the most elegant solution to address current reciprocity gaps. However, for it to be robust, any agreement will need to go beyond existing templates such as the FDI chapter in the Vietnam-EU FTA. European negotiators need to develop innovative solutions to address different channels of party-state influence in China’s corporate realities. They will also need to devise transparency and regulatory standards as a basis for sophisticated dispute settlement mechanisms. Given these complexities – and fundamental differences about how extensive the FDI negative list should be – it is uncertain that CAI negotiations are going to produce tangible results any time soon. Thus, EU leaders need to prepare for a scenario in which CAI negotiations go nowhere.

(2) Build an efficient, focused and transparent European framework for security screenings: The starting point for EU efforts to address reciprocity concerns must be the creation of a transparent and efficient process for screening foreign investment for national security concerns. A robust European framework is a prerequisite for keeping up public support for economic engagement with China, despite its authoritarian regime and increasingly aggressive geopolitical posture. An efficient security screening regime is also important because it would draw a clear line between security interests and purely economic goals.

The recent proposal for a pan-European EU investment screening regime, which operates with an updated understanding of what constitutes the European defense-relevant industrial base, is a step in the right direction. More transparency and a more coordinated, up-to-date approach to protect critical infrastructures, strategic assets and critical (enabling) technologies are sensible, and are long overdue.27 However, in our view, the current proposal still lacks teeth and requires finetuning before it can become the foundation of a more coordinated European effort: European legislators need to make sure that “enabling technologies” are properly defined to not evoke national debates about “strategic sectors”; ways for expanding the coverage of investment types and lower thresholds (currently screening only applies to FDI); dual-use technologies, data and information security require greater alignment with the export-control regime.

(3) Explore new avenues for EU competition policy to address China-specific concerns: In its search for instruments to identify and mitigate economic risks from Chinese investment, Europe must consider competition policy. The EU has in the past adjusted its competition policy to new challenges (most recently from US technology companies), and the emergence of Chinese companies as global players presents such a novel challenge. European merger control has already shifted towards a more encompassing assessment of (Chinese) corporate networks and control in horizontally and vertically related markets.28 While this is an important first step, it needs to be expanded beyond SOEs and formal aspects of state-holding. Going further, new avenues for competition policy could address many concerns related to Chinese practices, but European policy makers need to start this modernization process now.

Potential areas for modernization include:

- Treating the lack of two-way investment openness in innovative sectors and future industries as a potential barrier to market entry and participation when assessing mergers;

- Enabling public authorities to prioritize the availability of EU or OECD supply chains under limited circumstances (for instance by redefining what “substitutability” for relevant product and geographical markets means when assessing market shares);

- Allowing for more national leeway in defining legitimate public interest concerns depending on a EU member state’s innovation environment and its secure supply (not control) of enabling technologies;

- Strengthening the external grip of the EU’s state-aid regime for assessing market-distorting subsidies to cover investment-related activities of non-OECD foreign enterprises, for instance by defining domestic market protection as an implicit subsidy; and

- Strengthening the linkages of competition policy with intellectual property protection and standard setting policies to tackle technology appropriation more comprehensively.

Moving towards some of these suggested revisions will not be an easy task and might require fundamental changes, including of European treaties. It is also clear, however, that the EU needs to step up its game for a new phase of global competition in which FDI, innovation and standard-setting by state-influenced economies such as China’s will become a dominant force in global markets.

(4) Push for reciprocal market access where the EU has leverage: Access to European government procurement as well as European financial and digital markets can be used to create leverage vis-à-vis Beijing. China has so far shunned the notion of clean procurement processes and still has not joined the international Government Procurement Agreement. European governments need to align behind the EU Commission’s proposals to introduce an international procurement instrument (or IPI) that could potentially tackle some of the reciprocity issues in investment relations with China. The EU also could condition future Chinese activities in European financial and digital markets through coordinated low-key regulatory measures (for instance through transparency and privacy requirements or data security certification). The Chinese response to such measures will indicate how serious Beijing is about making changes, and how quickly Europe may have to consider “worst case” scenarios.

(5) Build coalitions with like-minded countries: OECD countries are in the same boat, yet there is relatively little coordination among them as to a joint strategy toward China. OECD members are, on the contrary, likely to enter into a race to the bottom in which certain countries will seek special treatment for their own investments in China at the expense of a collective approach. Several areas of cooperation should be prioritized:

-

First, large OECD members need to agree on a basic set of demands and timetables. This coalition should coordinate its assessment of which sectors it considers security-relevant or legitimately critical for developmental purposes. Officials from these countries should then ask for a clear timetable to open all sectors that are not on those lists, with milestones and measures to hold Beijing accountable. OEDC countries should not wait with their demands for liberalizing these sectors until Chinese state-supported enterprises already dominate the domestic market, preventing a reasonable participation of foreign actors. One particularly relevant framework of coordination would be US-EU exchanges on BIT-negotiations with China (despite different interests and approaches on both sides of the Atlantic).

-

Second, OECD countries need to intensify information sharing on persisting problems. Only then can policy debates about the lack of reciprocity with China and potential remedies be linked-up more meaningfully. Placing these themes on the research and policy agendas of international financial institutions could generate additional input and add legitimacy to European requests.

-

Finally, it will be critical to create incentives for Beijing to raise its standards through exclusive trade, data/privacy and investment agreements. Putting TPP and TTIP back on the table, or possibly moving forward with a more minimalist transatlantic approach (for instance on services) could go a long way in inducing Beijing to converge. An agreement on privacy, localization and cyber standards as well as relatively free data flows among a club of OECD members could also create leverage for reciprocal market access on European terms.

Not all of these efforts need to exclude China. On the contrary, Beijing should, for instance, be pulled much more forcefully into the orbit of OECD coverage and related policy exchanges, which would require equipping the institution with the necessary resources to expand its facilitating role and peer-pressure function. While designing a genuine multilateral approach to investment regulation together with China remains a longer term ambition, the G20 investment agenda deserves continuous support and clear direction by European leaders.

How to level the playing field and establish greater reciprocity in economic relations with China has become a major question in many capitals. As a major force in global FDI flows and an important destination of Chinese capital, Europe should not sit on the sidelines and let the U.S. take the lead. Europe is well positioned to help the world deal with Chinese investment without creating damage to productive Chinese capital or the global investment environment.

2. Chinese FDI in Europe in 2017: Rapid recovery after initial slowdown

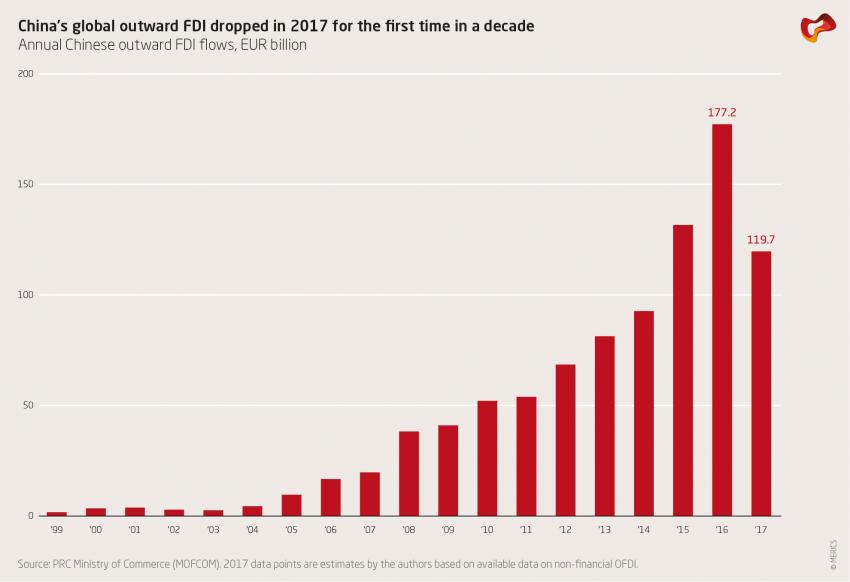

In 2017, China’s global outbound investment declined for the first time in more than a decade. According to China’s Ministry of Commerce (MOFCOM), outbound FDI by Chinese companies dropped by 29% (Figure 1).1 Other data sources that measure financial flows related to outbound investment record an even sharper drop, for example a 53% decline in SAFE figures on change in China’s FDI assets.2

This slowdown in global investment followed action by Chinese regulators to re-assert control over outbound investment flows. In late 2016, they had cracked down on informal “irrational” outbound investment to contain capital outflows, after the latter had grown to an average of more than USD 50 billion per month in 2016. In August 2017, these informal policies were codified through a new OFDI regime based on lists of encouraged, restricted and prohibited investments.3 Outbound investment was dragged down further by a campaign to reduce leverage in China’s financial sector. Regulators particularly targeted large private conglomerates, many of which had become aggressive overseas dealmakers in recent years.4

Chinese outbound investors also faced growing political and regulatory pushback around the globe, as major recipient countries of Chinese FDI beefed up their investment screening regimes to fend off perceived national security risks and, in some cases, economic risks.5

2.1. Chinese investment in the EU dropped by 17%

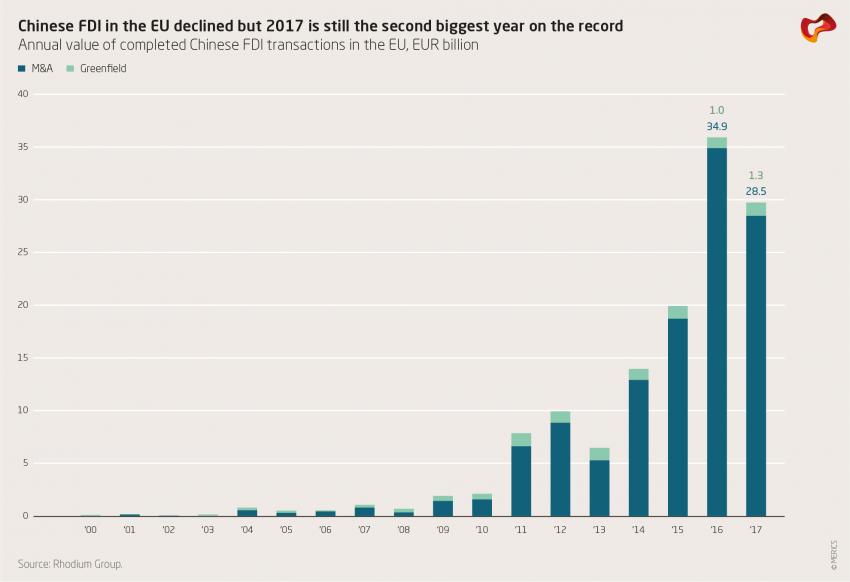

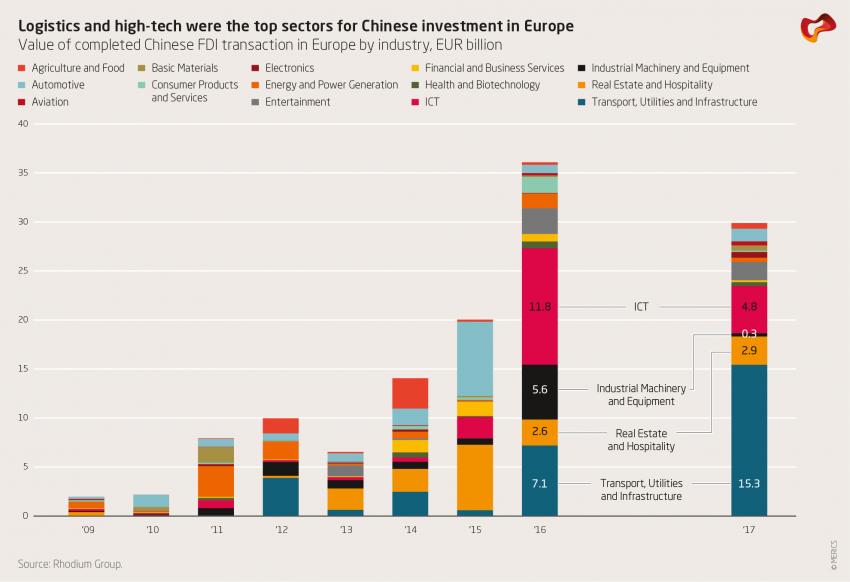

Following the drop in global Chinese OFDI, Chinese FDI in the 28 EU economies dropped to EUR 30 billion in 2017 (Figure 2). This represents a decline of 17% compared to 2016 but is still the second highest level ever recorded. Moreover, the decline is lower than the 29% drop in Chinese investment globally.

The split between acquisitions and greenfield projects remained similar as in previous years, with acquisitions accounting for 94% of total investment. Beijing’s crackdown on highly leveraged private companies has changed the investor mix: the relative share of sovereign and state-owned players in total Chinese investment in Europe jumped from 35% in 2016 to 68% in 2017. The biggest Chinese takeovers in the EU in 2017 were CIC’s EUR 12.3 billion acquisition of Logicor, China Jianyin Investment and Wise Road Capital’s acquisition of NXP Semiconductors’ Standard Products business for EUR 2.4 billion, and Wanda Group’s EUR 855 million acquisition of Nordic Cinema Group.

2.2. Investment remains focused on biggest EU economies

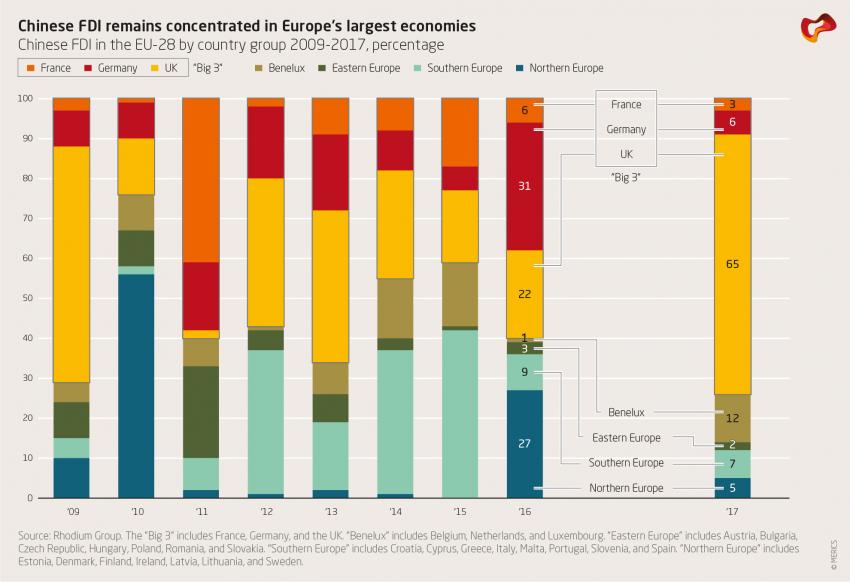

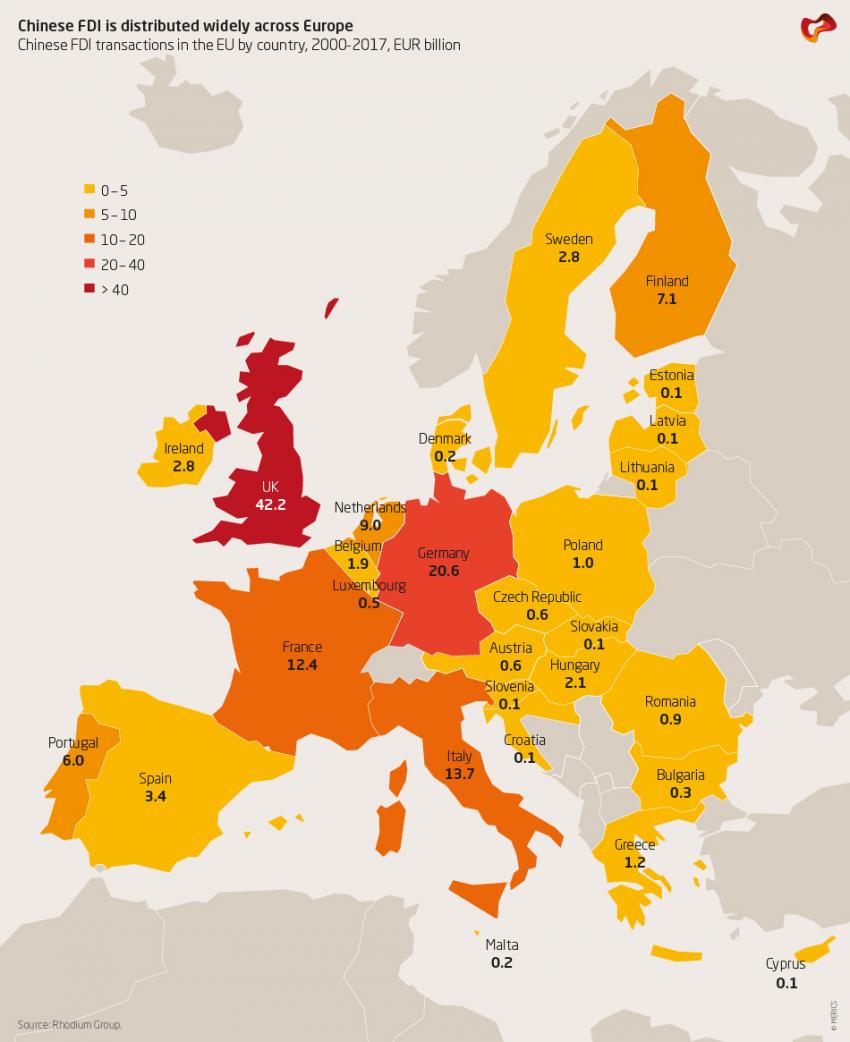

After a period of large investments in Southern Europe, Chinese investors returned to the largest European economies in 2016 and 2017. In 2017, the UK, Germany and France accounted for 75% of China’s total EU investment, the highest share in ten years (Figure 3).6

An outlier in 2017 was the Netherlands, which jumped to sixth place due to the acquisition of NXP Semiconductors’ standard products business and two other big transactions. Chinese investment in Eastern Europe remained small in scale, despite China’s Belt and Road Initiative (which mostly generated construction projects, not direct investment).

Investment in Germany dropped significantly, from EUR 11 billion in 2016 to EUR 1.8 billion in 2017. However, this low headline figure is mostly due to the timing of large acquisitions. Germany remains a favorite investment destination, but several big takeovers were not completed in 2017 due to regulatory delays or other reasons (for example Creat Group’s takeover of Biotest). Moreover, some transactions were not included in our FDI dataset since the Chinese stake remained below the 10% threshold for FDI or because of their clear Hong Kong – not mainland China – origin.7

2.3. New Chinese investment rules change industry composition

Transport, utilities and infrastructure has become the top sector for Chinese investment in Europe in 2017 (Figure 5). State-owned entities accounted for the majority of investment. The biggest investments were CIC’s EUR 12.3 billion acquisition of Logicor, CIC’s acquisition of a stake in UK national grid’s gas distribution business, HNA’s investment in Glencore’s petroleum products storage and logistics unit, State Grid’s acquisition of a stake in ADMIE in Greece, and COSCO’s acquisition of a stake in Noatum port in Spain. Europe clearly remains open to Chinese investment in infrastructure assets, despite growing discussions about the need to better protect critical infrastructure.

High-tech and advanced manufacturing industries also accounted for a significant share of total Chinese investment in 2017. ICT received EUR 4.8 billion of Chinese capital, including China Jianyin Investment and Wise Road Capital’s acquisition of NXP Semiconductors’ Standard Products business, the acquisition of LEDVANCE by a Chinese investor group, and Canyon Bridge Capital Partners’ acquisition of Imagination Technologies Group. Investment in industrial machinery dropped to EUR 0.4 billion (compared to a record EUR 5.6 billion in 2016) in the absence of large takeovers. Europe’s automotive sector continued to be a major attraction, receiving EUR 1.3 billion of Chinese investment. Technology investment could have been higher without the interference of the Committee on Foreign Investment in the United States (CFIUS), which derailed several acquisitions through its extraterritorial reach. Among others, CFIUS thwarted the purchase of a stake in Amsterdam-based mapping software company HERE Technologies by a group of Chinese investors.

Despite being included in Beijing’s new list of restricted sectors for outbound investment, real estate and hospitality was the third largest sector for Chinese FDI in the EU in 2017, with EUR 2.9 billion total investment. The biggest deals included Zhonghong’s acquisition of a stake in tour operator Abercrombie & Kent Group for EUR 366 million, Anbang’s acquisition of DoubleTree by Hilton at Amsterdam Centraal Station for EUR 350 million, Cindat Capital’s investment in Qhotels Group, and Beijing Capital Development’s investment in 30 Crown Place in London.

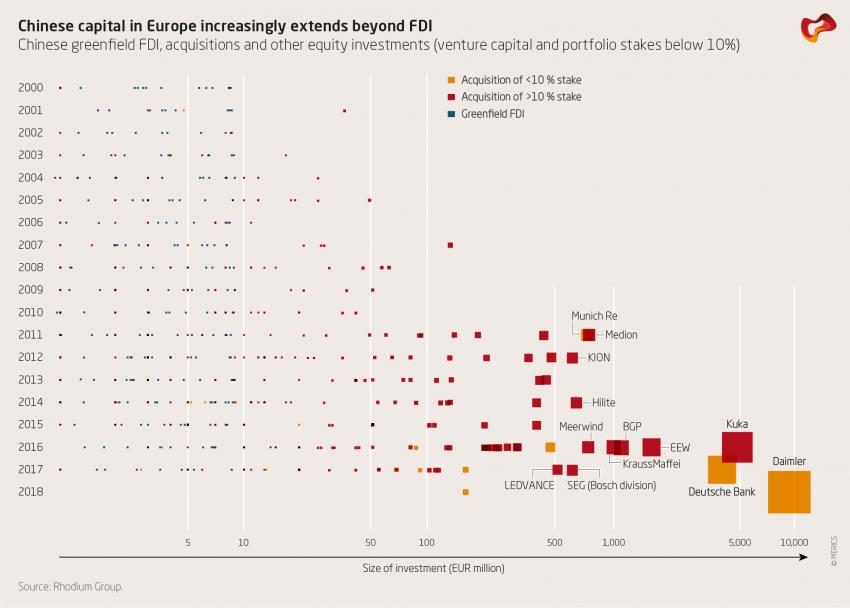

2.4. Outlook: Dealmaking rebounded in second half of 2017 and non-FDI investment is on the rise

After a period of slow dealmaking in the first half of 2017, Chinese outbound investment activity rebounded in the second half of the year. Large deals announced in Europe since the summer include CIC’s EUR 12.3 billion acquisition of Logicor, Geely Group’s EUR 3.25 billion stake in Volvo Group and its additional stake in Saxo Bank, and Legend Holdings’ acquisition of 90% in Banque Internationale à Luxembourg (BIL).8 As of January 2018, more than EUR 10 billion of Chinese acquisitions were pending, building a solid floor for Chinese investment in 2018.

Another important development that has gained more attention in early 2018 is the rise of Chinese non-FDI investment, including venture capital and portfolio investment stakes of less than 10%. The patterns of Chinese investment in Germany in the past three years illustrate this new trend, with large portfolio stakes in companies like Daimler or Deutsche Bank (Figure 6). These investments reflect the maturation of China’s economy and financial system, and they create additional opportunities for European business. However, as with direct investment, the special characteristics of China may raise new questions regarding transparency and governance, as well as potential security and economic risks.

In addition to strong commercial interest, the policy environment is still supportive of strong Chinese investment levels in Europe in 2018 compared to other regions. The stabilization of China’s balance of payments situation may allow Beijing to relax its outbound investment controls somewhat during the year, albeit we will unlikely return to the liberal regime seen in 2015 and 2016 since the fundamentals that triggered large-scale capital outflows have not changed. While the EU itself and several member states are making progress in tightening the security review processes in Europe for foreign acquisitions, we do not expect these to become serious headwinds for Chinese investors in 2018. This means that we could see a diversion of Chinese capital from the United States to Europe as a consequence of tighter US investment screening rules and a more confrontational US-China trade and investment relationship.9

- Endnotes

-

1 | Keohane, Robert O. (1986). Reciprocity in international relations. International Organization, 40(1), 1-27.

2 | TRIPS, The Agreement on Trade-Related Aspects of Intellectual Property Rights; and GATS, the General Agreement on Trade in Services.

3 | For example the North American Free Trade Agreement or the Vietnam-EU Free Trade Agreement to be signed in 2018.

4 | See ECJ Case C-101/05, Skatteverket v A, http://curia.europa.eu/juris/liste.jsf?language=en&num=C-101/05.

5 | See the OECD Code of Liberalisation of Capital Movements, http://www.oecd.org/daf/inv/investment-policy/Code-Capital-Movements-EN.pdf.

6 | The focus on formal restrictions distorts this perspective. If we were to take into account informal FDI discrimination, China would likely score better in a comparison with its emerging market peers. See section 2.2.

7 | Relaxations included lifting of ownership percentage in steel, ethylene, oil refining, paper manufacturing; opening-up of non-ferrous metal smelting, small construction machinery manufacturing, and ordinary bearings manufacturing; and opening-up of import and export commodity inspection and certification, railway freight transport, insurance brokerage, accounting companies and trust companies.

8 | This includes measures such as a targeted enforcement of laws, financial support and other favorable treatment for local companies, and limited access to government procurement on all levels of the Chinese administrative system. See http://trade.ec.europa.eu/doclib/docs/2014/august/tradoc_152739.08.10.pdf.

9 | http://www.europeanchamber.com.cn/en/publications-archive.

10 | http://www.mofcom.gov.cn/article/b/c/201707/20170702617581.shtml.

11 | The 12 sectors are: special-use vehicles and new energy automobile manufacturing, ship design, regional and general aircraft repair and maintenance, international maritime transport, rail passenger transport, gas stations, internet access service businesses (i.e. internet cafes), call centers, performance brokers, banking, securities, and insurance.

12 | http://www.gov.cn/xinwen/2017-11/17/content_5240376.htm.

13 | http://wzs.mofcom.gov.cn/article/n/201712/20171202691805.shtml.

14 | http://www.gov.cn/zhengce/content/2017-12/22/content_5249525.htm, http://www.gov.cn/zhengce/content/2018-01/09/content_5254764.htm

15 | http://www.xinhuanet.com/politics/2017-07/17/c_1121333722.htm

16 | http://www.mofcom.gov.cn/article/ae/ai/201708/20170802627851.shtml; http://www.gov.cn/zhengce/content/2017-01/17/content_5160624.htm.

17 | https://www.youtube.com/watch?v=2tDoVv0GPOE.

18 | http://chinadashboard.asiasociety.org/china-dashboard/.

19 | This classification is based on the authors’ personal judgment, considering legal documents, empirical data (precedents of foreign M&A in those sectors) and conversations with M&A professionals in China.

20 | Center for Economic Business Research (2018). World Economic League Tables.

21 | Chilton, Adam, Milner, Helen, & Tingley, Dustin (2017). Reciprocity and Public Opposition to Foreign Direct Investment. British Journal of Political Science, online first: 1-25.

22 | https://ustr.gov/sites/default/files/files/Press/Reports/China 2017 WTO Report.pdf.

23 | Wübbeke, Jost, et al. (2016). Made in China 2025: The making of a high-tech superpower and consequences for industrial countries. MERICS Papers on China No. 2, https://www.merics.org/de/papers-on-china/made-china-2025.

24 | https://www.nytimes.com/2017/09/27/business/wilbur-ross-china-trade.html?mcubz=0.

27 | See our long-standing views and recommendations, for example in: https://www.merics.org/fileadmin/user_upload/pdf/COFDI_Chinese_Foreign_Direct_Investment_EN.pdf

29 | See Ministry of Commerce release, available at http://www.mofcom.gov.cn/article/ae/ag/201801/20180102699398.shtml.

30 | See State Administration of Foreign Exchange release, available at http://www.safe.gov.cn.

31 | See the Guiding Opinions on Further Direct and Regulate Outbound Investment Direction, available at: http://www.gov.cn/zhengce/content/2017-08/18/content_5218665.htm.

32 | See http://finance.people.com.cn/n1/2017/0801/c1004-29441056.html.

33 | Examples for nations that have recently changed their investment screening frameworks or discussed changes include Australia, Japan, the United States, Germany, the Netherlands, France, Italy, Latvia, Hungary. Chinese investment has been the primary or only driver in some, but not all of these cases.

34 | Note that this trend is amplified partially by our method of logging transactions at the headquarters of target companies. We logged the entire value of the USD 14 billion acquisition of Logicor warehouse assets (which are spread across Europe) in the UK.

35 | See for example HNA’s 8.8% stake in Deutsche Bank, or more recently Geely’s purchase of a 9.8% stake in Daimler. The Cheung Kong takeover of energy metering firm Ista (EUR 4,5 billion) should for statistical and analytical reasons not be counted as mainland Chinese.

36 | Geely’s stake in Volvo Group only amounts to 8.2% of outstanding shares but it comes with 15.6% of voting shares.

37 | http://rhg.com/notes/a-post-engagement-us-china-relationship