China's National People's Congress 2024

Top story

Prioritizing tech, Beijing offers little substance on how it will fight current woes

This year’s National People’s Congress (NPC) showed Beijing’s conviction that the Chinese Communist Party (CCP) knows best. However, the leadership offered domestic and foreign audiences little explanation about how it intends to balance the competing goals of realizing long-term strategic ambitions and addressing current economic woes.

China’s national legislature sent clear signals about ambitions to drive economic recovery – symbolized by an ambitious economic-growth target of five percent for 2024. This leaves the leadership with a mountain of homework: The government has to deal with a real-estate and stock-market downturn, stagnating incomes, unemployment, gaps in the social security and pension systems, and in parts stifling local government debt. A year after the end of the Zero-Covid restrictions, the country’s economy is still sluggish and business and consumer confidence weak.

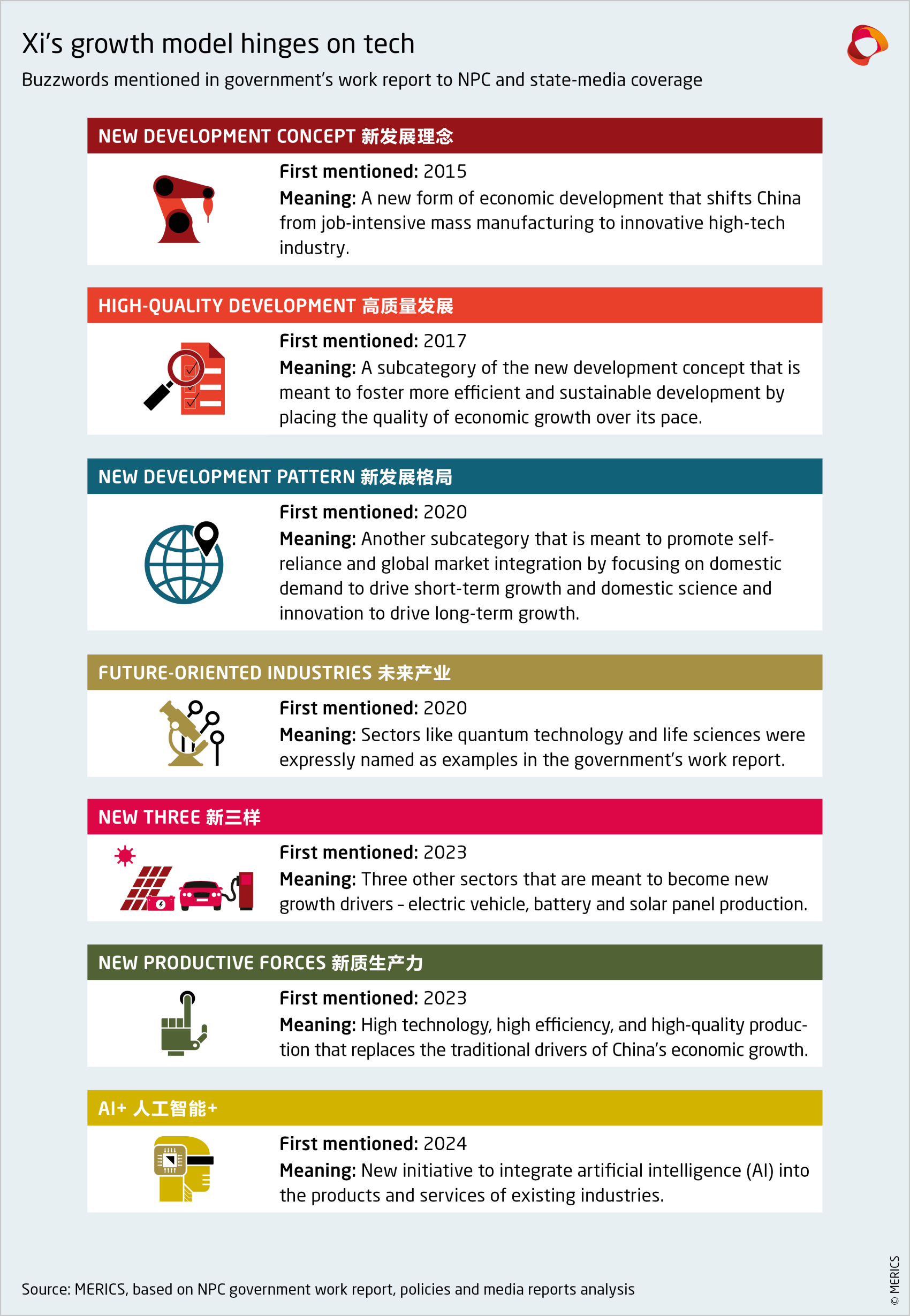

In his “work report” to the assembled delegates, premier Li Qiang pledged to respond to the “expectations” of citizens and enterprises alike. But a closer reading of the blueprint for the coming year and beyond reveals what the main priority will be. “High quality growth” and “new productive forces” are the current buzzwords (see graphic). Li focused on the potential of technology to become China’s main driver of growth, making his pledges to create jobs, safeguard the livelihood of citizens, ease internal migration restrictions and ensure basic social welfare seem more like afterthoughts. All of these will be difficult to achieve in a labor market transformed by increasing technology adoption – and will require additional funding to materialize.

Despite paying lip service to reform and opening, the focus on party steering and decreasing responsiveness was illustrated by two procedural items. The NPC’s revision of the State Council Organic Law strengthened the party’s power over policymaking. And the Chinese government’s scrapping of its annual media briefing at the end of the NPC extended a recent trend of government information disappearing from public view and new legal barriers to information gathering, such as the newly revised State Secrets Law.

MERICS analysis: “The scrapping of the government press conference was a detail that spoke volumes. Just like that, Beijing did away with a 30-year tradition that had been called into life to signal openness and transparency, especially to a foreign audience,” says Katja Drinhausen, Head of MERICS Politics and Society Program.

More on the topic:

- Tech-driven growth takes priority over public welfare in China’s vision for development, MERICS Comment by Katja Drinhausen and Max J. Zenglein

- The increasing challenge of obtaining information from Xi's China, MERICS Report by Vincent Brussee and Kai von Carnap

Media coverage and sources:

Metrix

26.5

This is the percentage of women among the 2,977 delegates of the 14th NPC. Female representation has risen slowly but steadily over recent terms, putting the NPC within reach of the US House of Representatives’ 29.2 percent. But this improvement is countered by declining female representation in China’s top leadership – there are currently no women in the Communist Party’s Politburo and only one among government ministers. Although Xi has emphasized China’s commitment to gender equality, he a few months ago called on women to focus on family and childbearing to contribute to China’s development. (Source: NPC Observer)

Topics

No relief for populace as Beijing fixates on geopolitical and financial risks

An unbending loyalty to Beijing’s economic policy agenda at this week’s National People’s Congress suggests that the party-state recognizes China’s deteriorating economy but won’t adjust its strategy to alleviate strains on the populace. The NPC’s economic policy agenda exhibits much of the same wishful thinking as last year’s, with some new labels for old ideas (see graphic). Yet again, the growth target is “around 5%,” new job targets are around/over 12 million, and the unemployment rate target is around/under 5.5%. Officials must juggle prioritizing support for technology and innovation, upgrading industry, advancing green targets, cutting debt at the local level, supporting property prices while winding down the real estate bubble, and boosting consumption.

Many of these goals involve tradeoffs that will impair other goals – officials will struggle to reduce debt while supporting both the supply (production) and demand (consumption) sides of the economy, just to take one example. Something has to give – and Xi’s words and deeds over the last year suggest that domestic risks like debt and the real-estate bubble and geopolitical risks like technology restrictions and military modernization will remain Beijing’s main goals. Socio-economic stress will be tolerated, as shown by the NPC’s lack of meaningful reforms to structural problems in areas like pensions and healthcare, the Hukou caste system that restricts social mobility, and the unchanging retirement age.

MERICS Analysis: “It is remarkable that Beijing’s response to huge stresses in China’s economy is ‘steady as she goes,’” says Jacob Gunter, Lead Analyst at MERICS. “It shows discipline and loyalty to Xi’s strategic goals have supplanted the party-state’s traditional responsiveness to the economic expectations and needs of China’s middle class.”

Media coverage and sources:

China keeps resources flowing to fund its forthright geopolitical ambitions

The National People’s Congress (NPC) made clear that China’s leadership is satisfied with its assertive foreign-policy approach and it sees no reason to change course, despite the challenging international situation in which the country finds itself. Ever more resources are being dedicated to pursuing China’s global ambitions, even though they could usefully be allocated elsewhere to deal with pressing economic and social issues facing the country. This year China plans to spend CNY 1.67 trillion (about EUR 210 billion) on defense and CNY 60.78 billion on its diplomatic work – increases of 7.2 and 6.6 percent year-on-year, respectively. These expenditures effectively draw resources away from other areas, from healthcare and social security to tackling sizeable local-government debt.

But Beijing seems intent on doubling down on its geopolitical goals, as shown by the government’s “work report” to the NPC. It called for an “equal and orderly multipolar world” and for the reform of global governance. This forthright presentation of China’s broad foreign policy included not-so-oblique references to the US (and its partners) and “hegemonic, high-handed and bullying acts,” clearly identifying which country the leadership sees as its main adversary in the international arena. Meeting “the centenary goal of the People’s Liberation Army” (PLA) was named as key to achieving China’s global objectives – fully modernizing everything from equipment and training to strategy and combat readiness in time for the PLA’s 100th birthday in 2027.

MERICS analysis: “Even as Beijing is increasingly having to prioritize its spending, China’s military budget is not feeling the squeeze,” said MERICS Lead Analyst Helena Legarda. “This shows how important foreign policy and geopolitical goals are to Xi Jinping’s long-term plans.”

Media coverage and sources:

- NPC Observer (EN): Government work report

- Ministry of Foreign Affairs (CN): Readout of Central Foreign Affairs Work Conference

- MFA (CN): Wang Yi’s press conference at the NPC

Beijing banks on AI and digitalization in industry to boost growth

The government’s work report presented to National People’s Congress showed just how much China is counting on technology like artificial intelligence (AI) to boost growth and revive its economy. The top item on its list of major tasks for 2024 bundled the goals of modernizing industry, developing the digital economy and promoting emerging industries such as electric vehicles. This shows the importance Beijing is placing on integrating technology into existing industries to achieve its economic growth strategy. Even if China continues to lag in critical technologies like chip making, European firms could see more competition in smart manufacturing and other areas they dominate.

The work report unveiled the initiative “AI Plus” which will push AI applications to aid key sectors – those the government has in recent years made clear it wants to support. In manufacturing, for example, this could mean digitalizing factories and introducing more robots. Healthcare could come to use big data to improve diagnostics or generative AI to aid in drug discovery. The focus on “New Productive Forces” and “New Three” sectors – electric vehicles, batteries, and solar panels – are evidence of the Chinese leadership’s emphasis on high-end manufacturing over digital service sectors such as gaming.

MERICS analysis: “Boosting the real economy – the production and trade of goods and services – is the target of Beijing’s high-tech focus,” says MERICS Analyst Wendy Chang. “Even though China continues to trail behind rivals in many cutting-edge technologies, the state’s concerted effort in high-tech sectors like industrial AI and cars could still pose a threat to European firms who currently enjoy leadership positions.”

More on the topic:

- Whole-of-nation innovation: Does China’s socialist system give it an edge in science and technology, MERICS & UCSD Policy Brief by Jeroen Groenewegen-Lau

Media coverage and sources:

- Global Times: China to launch AI Plus initiative: Government Work Report

- The Register: China pushes ‘AI Plus’ initiative to integrate technology

- South China Morning Post: ‘Two sessions’ 2024: China’s lawmakers call for more AI development to catch up with US, while keeping it under regulatory control

MERICS China Digest

Article 23: What you need to know about Hong Kong’s new national security laws (Reuters)

Hong Kong authorities recently proposed new national security laws that will update and extend rules prohibiting treason, sabotage, sedition, the theft of state secrets and espionage. Known as Article 23, the package could be passed within weeks. (24/03/08)

What does China’s Two Sessions mean for climate policy in 2024? (Carbon Brief)

The National People’s Congress set China only modest climate targets for 2024, as Carbon Briefs writes in an article about the country’s plans for coal power, clean energy technology and meeting climate targets. (24/03/13)