EV tariffs + Ukraine-China + Job market

Top story

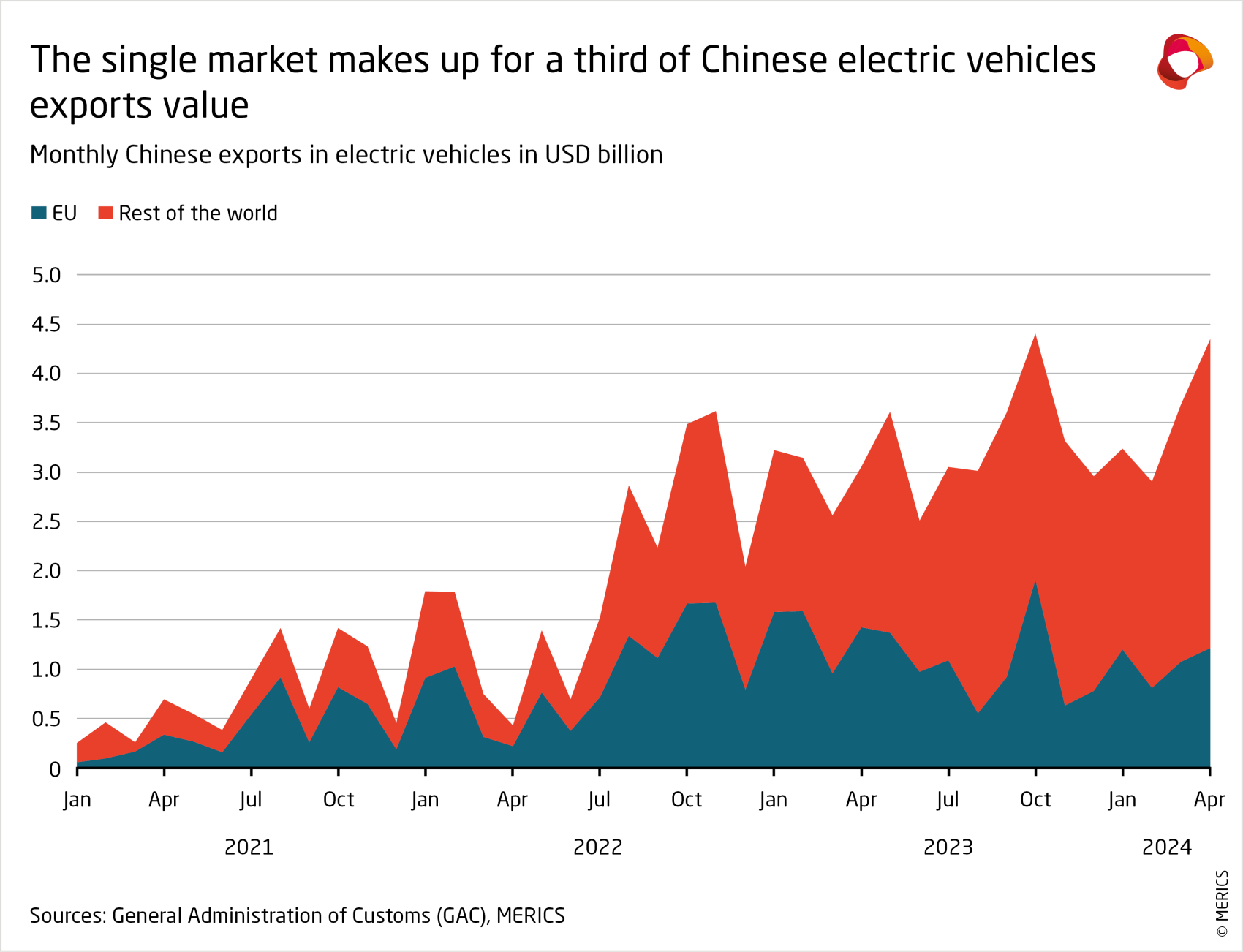

Brussels proposes higher tariffs for Chinese EVs as Beijing signals retaliation

Just days after European Parliament elections the European Union faced up to the biggest test yet of its resolve to stand up to Beijing. Amid warnings about economic retaliation, the European Commission proposed additional import tariffs on Chinese electric vehicles (EV) to offset competition-skewing subsidies. On top of an existing 10 percent tariff, Brussels announced an additional levy of 17.4 percent for BYD EVs, 20 percent for Geely, 38.1 percent for SAIC, 21 percent for other companies that had cooperated with its probe, and 38.1 percent for those that had not. The top rate is considerably higher than the 25 percent tariff that had been expected.

The EV probe was Brussels’ largest subsidy investigation to date and its outcome must be seen as a success for the outgoing European Commission under the leadership of Ursula von der Leyen. It had dedicated considerable energy to developing a “toolkit” to improve the EU’s capacity to reduce distortions from China’s state-dominated economic model – and had recently also brought it to bear in areas like medical devices, food additive, steel pipes and security scanners. The proposed EV duties will apply provisionally until November, after which the new Commission – possibly again led by von der Leyen – will be able to apply definitive levies if it can secure a qualified majority of EU states’ votes.

Chinese Minister of Commerce Wang Wentao in recent weeks reportedly warned EU trade chief Valdis Dombrovskis that Beijing would apply higher import levies on agricultural and aerospace products, while state media mentioned European automotive exports to China as an option.

A recent MERICS internal analysis concluded that agricultural, food and beverage (AFB) products were the most likely target of these – and aerospace the least likely. European pork and dairy products are most exposed. Reducing imports would help China’s oversupplied post-African Swine Fever pork industry by boosting prices – and pit Europe’s pork-exporting states against other members. Dairy products, like cheese, are also an easy target, and Beijing is eyeing Spain and France as supporters of the Commission’s EV probe – both countries are major pork and dairy exporters.

Beijing also signaled that EU automotive exports to China could see a return to a 25 percent tariff from 15 percent. But in the six years since that move, Europe steadily exported fewer cars to China, down 40% in volume. European carmakers have “on-shored” production of cheaper models to China, which leaves mostly high-end model exports for less price-sensitive buyers exposed. In aerospace, Airbus has a backlog of over 8,500 aircraft orders worldwide. Talks about buying a further hundred jets could be abandoned, but such a move would be at best symbolic. Punishing Airbus would also drive airlines into the arms of Boeing, as China’s COMAC is still a small player.

MERICS analysis: “Beijing won’t target the EU products it still needs – machinery, high-quality industrial inputs, chemicals, medtech and others – and it certainly won’t go after the big European carmakers, considering their massive investments in China that generate jobs, tax revenues and economic growth,” said Jacob Gunter, Lead Analyst at MERICS. “Instead, Beijing will focus on agricultural, food and beverage (AFB) products – luxury items like cheese, which China’s consumers can do without, and commodities like pork, which China’s producers make in sufficient volume to satisfy domestic demand.”

Media coverage and sources:

Metrix

5/35

This number stands for May 35, a code some residents in China and Hong Kong use to mark June 4, a politically charged anniversary that has recently become a fraught double anniversary. 35 years ago, Chinese authorities brutally crushed the Tiananmen Square protest movement, while 30 years later, Hong Kong saw the largest pro-democracy protests the city had ever seen. Citizens this year once again risked arrest for the slightest public display of remembrance: six people, including a former organizer of memorial events, where charged with “inciting hatred” against the government after sharing social-media posts, a bookshop was visited by police for commemorating “6/4” by adding four days to May. (Source: NPR)

Topics

Ukraine shows how desperately it wants China to join peace talks it’s pushing

The facts: The Ukrainian government spent early June unsuccessfully scrambling to secure China’s participation in an international summit aimed at facilitating an end to Russia’s war against Ukraine. First Deputy Foreign Minister Andriy Sybiha on June 5 met with Chinese Vice Foreign Minister Sun Weidong in Beijing, only days after Ukrainian President Volodymyr Zelenskyy had publicly rebuked China for “disrupt[ing] the peace summit” under Russia’s influence and supporting Russia’s war economy. The June 15-16 “Global Peace Summit” in Switzerland is the fifth series of meetings that has been promoted by Kyiv.

What to watch: In Switzerland, Zelenskyy hopes to secure a large coalition in support of his proposals to end the war – an ambition for which major powers are crucial. The credibility of the summit had already suffered when important players like South Africa, Brazil, Saudi Arabia and Pakistan recently announced they would not be traveling to Switzerland. With Beijing again not joining the talks, the chances for any breakthroughs are very low.

MERICS analysis: “A Ukrainian official flying to Beijing to make a last-ditch attempt at winning support for peace talks shows that Kyiv views China as crucial to any negotiated settlement,” says Eva Seiwert, Analyst at MERICS. “Zelenskyy has emphasized common interests with China, such as nuclear safety and food security, but his outburst suggests a growing frustration with Beijing’s unfulfilled promises of not backing Russia.”

Media coverage and sources:

- NPR: Zelenskyy accuses China of helping Russia undermine peace summit

- Reuters: Ukrainian official in Beijing urges China to attend peace summit

- Chinese Ministry of Foreign Affairs (CN): 外交部副部长孙卫东同乌克兰第一副外长瑟比加举行中乌外交部磋商 (Vice Foreign Minister Sun Weidong and Ukrainian First Deputy Foreign Minister Sybiha hold consultations between the Chinese and Ukrainian Foreign Ministries)

- Chinese Ministry of Foreign Affairs (EN): Common understandings between China and Brazil on political settlement of the Ukraine crisis

- Peking University (CN): 中华人民共和国和乌克兰友好合作条约 (Treaty of Friendship and Cooperation between the People’s Republic of China and Ukraine)

Xi’s development model amplifies mismatch between graduates and jobs

The facts: Chinese families continue to bet on higher education as the path to success for their children, even as white-collar jobs become harder to come by. A record 13.4 million high schoolers took the June 7 college entrance exam, over half a million more than in 2023. They will eventually compete for jobs in a labor market that last year left around a fifth of college graduates unemployed. This year, 11.8 million new graduates will be looking for jobs – preferably in the public sector, tech and services. An increasing number of them look set to end up in blue-collar jobs, an area of the job market that has seen applications from under 25-year-olds increase by 165% since 2019.

What to watch: Xi Jinping acknowledges that these structural contradictions are affecting livelihoods and has pledged to “make employment a priority in governing the country.” But instead of addressing graduates’ aspirations to work in white-collar jobs, Xi has suggested they should lower their expectations in the apparent hope that some will return to their home villages to help develop rural areas. Faced with a meagre job supply and lower income potential, graduates are increasingly joining the gig economy to make ends meet, sometimes on top of their full-time jobs.

MERICS analysis: “Providing stable career perspectives to a highly educated generation remains a challenge for China’s state-driven economic model that focuses on select strategic sectors,” says Katja Drinhausen, Head of the Politics and Society Program at MERICS. “If Xi Jinping fails to restore business vitality and build a service- and knowledge-based economy, the hopes of China’s aspiring middle class will be dashed.”

Media coverage and sources:

- Caixin Global: Record number sit college entrance exam amid vocational education drive

- Caixin Global: Charts of the day: China’s youth unemployment hits another record high at 21.3%

- SCMP: China’s college graduates to hit record high 11.79 million in 2024, adding to job market pressure

- Xinhua (CN): 2024届高校毕业生规模预计达1179万人 (11.79 million graduates are expected to enter the labor market in 2024 according to the Ministry of Human Resources and Social Security)

- Qiushi (CN): 习近平在中共中央政治局第十四次集体学习时强调 促进高质量充分就业 不断增强广大劳动者的获得感幸福感安全感

- Caixin Global: Blue-collar work surges in popularity among China’s young job seekers

China’s new export controls are no antidote to more EU sanctions over Russia

The facts: China’s support for Russia in circumventing Western sanctions over Russia’s invasion of Ukraine has rankled with the US and its allies. China now said it will impose export controls on key aerospace and shipbuilding sectors, including materials for bullet-proof helmets and armor. Framing the new controls as part of its commitment to international law and non-proliferation, Beijing appears intent on convincing the EU to drop plans to broaden sanctions by blacklisting more Chinese companies. China has criticized recent US export controls and restrictions on Chinese companies as “relentless measures” to exert control over China. Meanwhile, Beijing has imposed its own export controls on metals gallium and germanium, graphite and drones.

What to watch: The new controls come as US Secretary of State Antony Blinken is pushing for further sanctions against Chinese entities supplying dual-use technology to Russia. The EU is reportedly discussing such measures for the 14th sanctions package it is planning. Despite Beijing’s aim to position itself as an internationally responsible actor, its attempts are unlikely to avert further sanctions. Western countries like the US, Germany, and France are the main markets for the Chinese products covered by the new export controls – and China is not backing off its support for Russia. In the current climate, the EU and US aren’t likely to reconsider.

MERICS analysis: “China is expanding its use of export controls to signal its commitment to non-proliferation, while at the same time calling out the US for widening its export controls,” says MERICS Senior Analyst Antonia Hmaidi. “Considering China’s continued exports to Russia, its commitment to being a responsible global power does not seem credible.”

Media coverage and sources:

- Chinese Ministry of Commerce (CN): 商务部 海关总署 中央军委装备发展部公告2024年第21号 关于对有关物项实施出口管制的公告 (General Administration of Customs and Central Military Commission’s Equipment Development Department announce export controls on dual-use goods and equipment)

- SCMP: Could China’s new export controls on military-related tech and materials backfire?

MERICS China Digest

The Chinese green energy supplier GCL Technology announced plans to establish its first overseas granular silicon production in the United Arab Emirates. The company expects the facility to become the world's largest high-quality polysilicon research and development and manufacturing location. (24/06/04)

Four US academics stabbed in park during China visit (The Guardian)

Four teachers from a US university were stabbed – allegedly by a Chinese citizen – while visiting a public park in Jilin province in north-eastern China. The attack happened as both Beijing and Washington are seeking to intensify people-to-people exchanges to improve bilateral relations. (11/06/2024)

Beijing is offering a subsidy of USD 1,380 to car owners willing to swap their petrol-driven vehicles for electric ones before the end of the year. The incentive scheme is expected to boost EV sales by as many as 2 million units in 2024 as the pace of electrification in China’s auto industry accelerates. (10/06/2024)