Accelerator state: How China fosters "Little Giant" companies

Key findings

- High-tech small and medium-sized enterprises (SMEs) have emerged as key new players in China’s industrial policy: They have the potential to specialize in niche markets, develop domestic alternatives to foreign inputs and reinforce China’s industrial chain. Beijing has established a comprehensive support system for these firms, as originally outlined in the Made in China 2025 strategy.

- The emergence of an “accelerator state” in China marks a dramatic extension of the industrial focus of Chinese policymakers towards smaller companies: Previous industrial policy primarily directed resources to larger firms to achieve strategic goals. Smaller firms are now seen as valuable sources of innovation.

- Beijing’s tiered-cultivation combines state guidance with market forces: China has developed a dynamic multi-level evaluation and support system, active at the local, provincial and national levels, to first identify specialized high-tech SMEs and then fast-track their growth.

- Government-certified high-tech SMEs are labeled as “Specialized SMEs” or “Little Giants”: They benefit from a comprehensive system of direct and indirect state support. But these firms cannot rest on their laurels as the system is set up to promote competition and after three years the government support has to be earned once again.

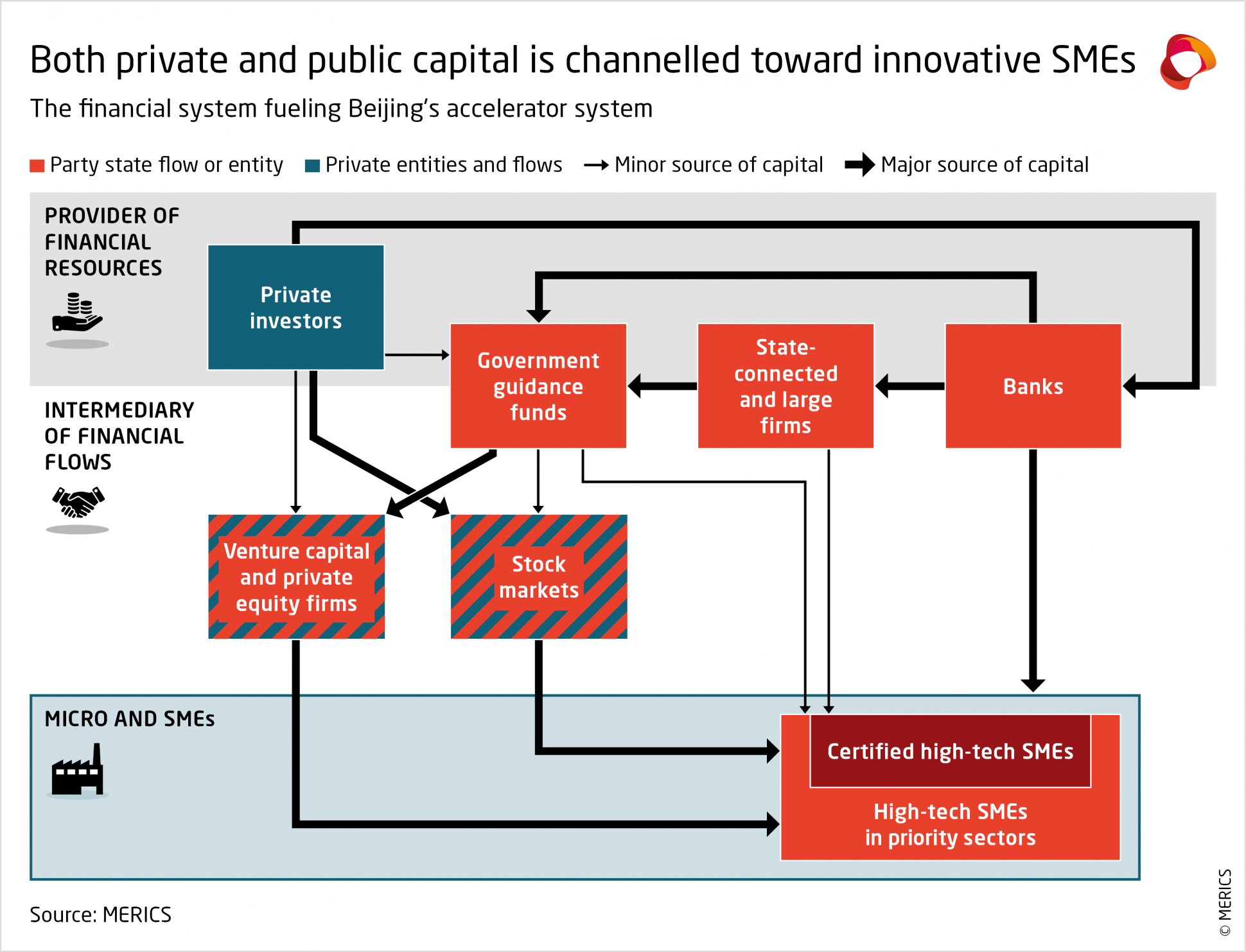

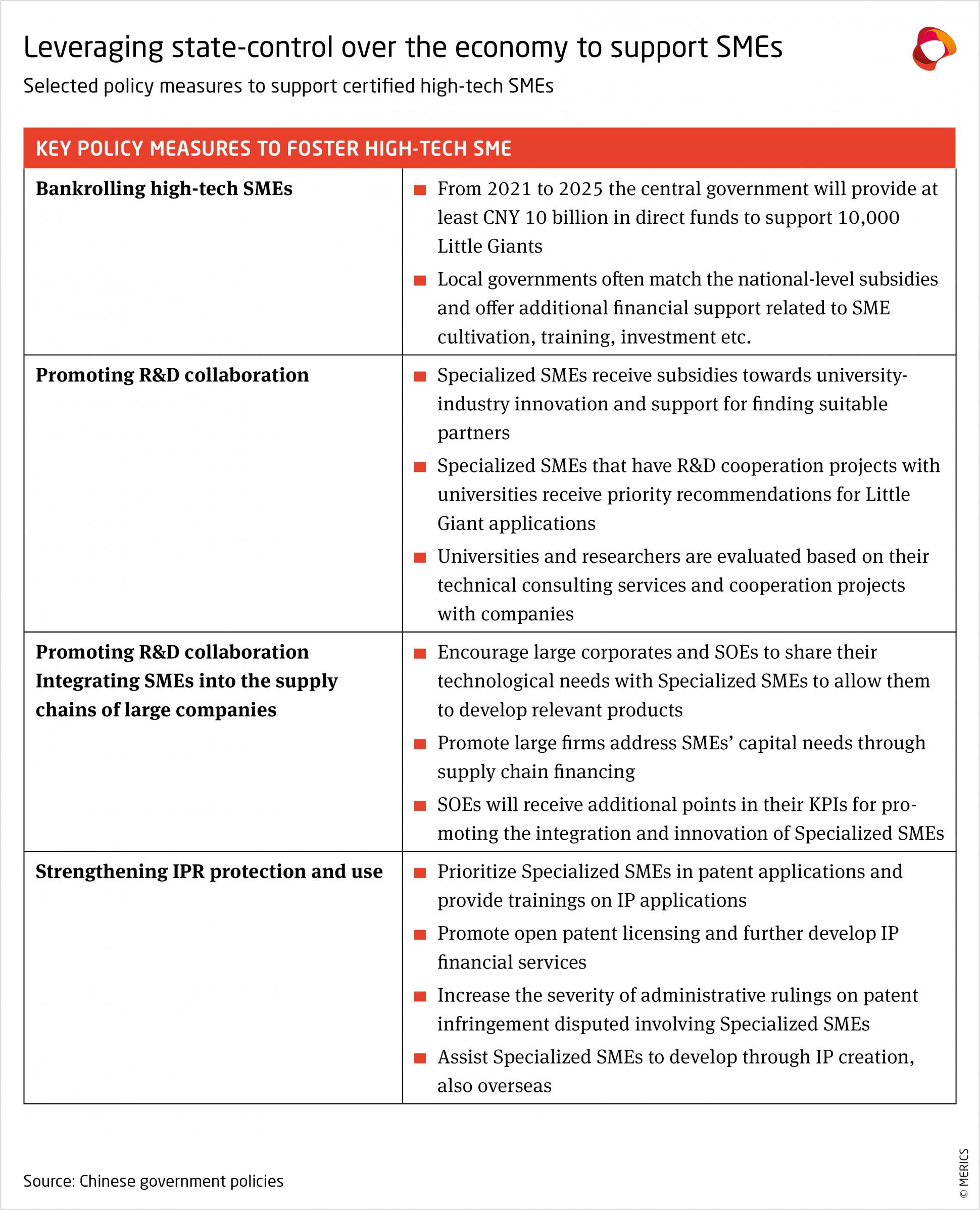

- Officials are channeling ever more finance towards high-tech companies: Beijing has mobilized public financial institutions and is pushing private investors to direct capital towards government-certified start-ups and SMEs, worth tens of billions of yuan. The government has increased loan financing through the banking system and expanded access to equity markets for high-tech SMEs.

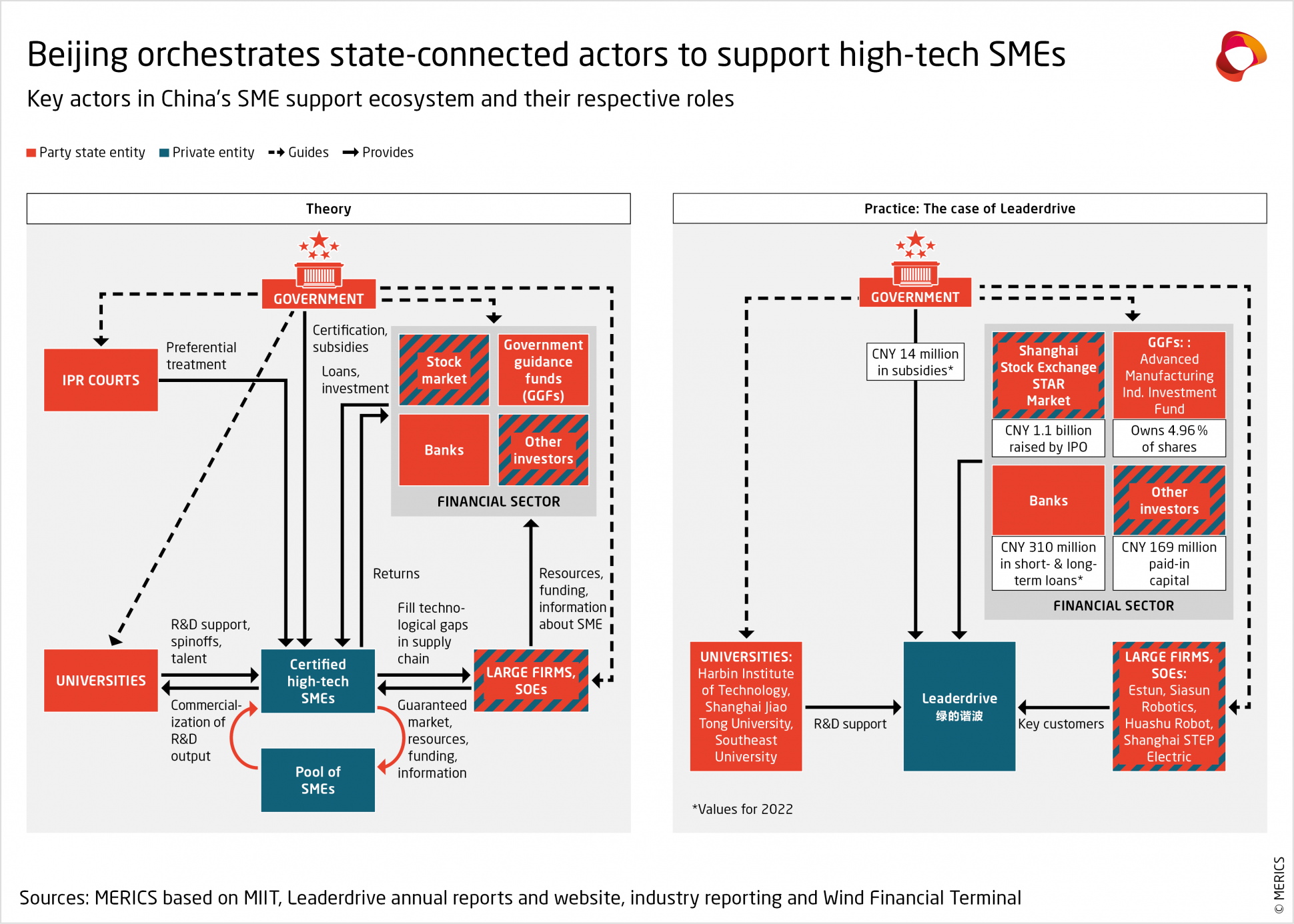

- The support system seeks to cover all the needs of its SMEs: The government is encouraging all state-connected entities to help high-tech SMEs. This means more state subsidies and R&D support, increased collaboration with universities and research institutes and a more favorable intellectual property system. Officials are also directing large firms to act as financiers, clients and mentors.

- The model presents both risks and rewards: The system is channeling more funding to high-tech SMEs. Several state-backed firms such as Leaderdrive and Endovastec in the robotics and MedTech sectors are advancing self-reliance in core technologies. Yet, there are also signs of weaknesses. The system relies on the capacity of officials to identify the most promising firms, which may be flawed. Support measures could result in significant bad investments and misuse of funds.

- Foreign companies need to be prepared for the challenge: Foreign manufacturing firms ought to be wary of the large pool of state-backed SMEs which could target their core business area. In addition to increasing competition within China, Little Giants have already begun their entry into foreign markets.

The new players on Beijing’s team: SMEs enter the stage of industrial policy

“High-quality small and medium-sized enterprises have strong innovation capabilities and good growth potential. They are the basic force for improving the stability and competitiveness of the industrial supply chain and an important driver for promoting high-quality economic development.”

Ministry of Industry and Information Technology1

China evolves its gameplan: The start of state-led SME acceleration

One of the most significant evolutions in China’s industrial policy approach is its recent focus on cultivating high-tech SMEs. Officials are striving to boost the development of China's most promising and innovative small firms by combining the allocative and entrepreneurial benefit of the market with state guidance. The end goal is to create an Olympic team of SMEs which not only rise to the top of China's domestic market, but also can succeed at the international level.

The emergence of an “accelerator state” in China marks a dramatic extension of the industrial focus of Chinese policymakers towards smaller companies, true to the “new- style national team” approach to reaching strategic goals.2 Beijing’s original model was marked by large-scale projects, the creation of new markets and the fostering of national champions. State support was more concentrated on fewer and larger firms, along the lines of mantras such as holding to the “commanding heights” of the economy and “picking the winners.” Beijing’s playbook has been expanded from prodding and funding large firms to pursue national goals, to nurturing a large pool of potential winners and harnessing market forces to help pick the final winners.

The government has gained a new appreciation for the importance of private enterprises and small firms as drivers of innovation. In emerging markets and sectors with continual technological innovation, Beijing realizes that SMEs can act as key actors in experimenting with new technology, production methods and business models. In other areas where established players already dominate the market, SMEs can occupy niche markets or have a role as critical suppliers. Larger firms still play a central role, but Beijing is attempting to enhance the contribution of smaller firms.

High-tech SMEs such as BWT Beijing, Leaderdrive and Endovastec have developed domestic alternatives to foreign inputs and are gradually reinforcing China's industrial chain. In 2021, BWT Beijing and Leaderdrive both ranked second in terms of domestic market share for their respective main products, namely semiconductor lasers and harmonic reducers (a core component for robots).3 Leaderdrive has been lauded by the Chinese Institute of Electronics for its success in achieving breakthroughs in “bottleneck” technologies and developing robotics core technologies.4 In the medical device sector, Endovastec developed the first indigenously-made abdominal aortic stent graft, and its aortic products occupy 28 percent of the domestic market.5

Scores of innovative SMEs now receive a plethora of government benefits as part of the newly formed acceleration system. Like a sports coach developing elite athletes, Beijing is rolling out a raft of measures to boost their growth and cultivate thousands of firms of similarly high caliber. Promising candidates are granted special status as government certified high-tech SMEs and ranked according to their abilities. The Ministry of Industry and Information Technology (MIIT) has identified more than 70,000 “Specialized SMEs” (专精特新中小企业), and over 12,000 “Little Giant” (小巨人) SMEs.6 BWT Beijing and Leaderdrive were both selected in the first batch of Little Giants in 2019.

These “government certified” SMEs gain access to significant support through access to finance, direct subsidies, research funding, collaboration with state entities and so on. In addition to deploying government resources, Beijing is also seeking to activate private firms and investors who, after recent crackdowns on tutoring and internet companies, are paying even more attention to government signals. But certified high-tech SMEs are required to excel, or else they could lose the government’s favor.

The mission for state-backed SMEs: Innovation, manufacturing strength and self-reliance

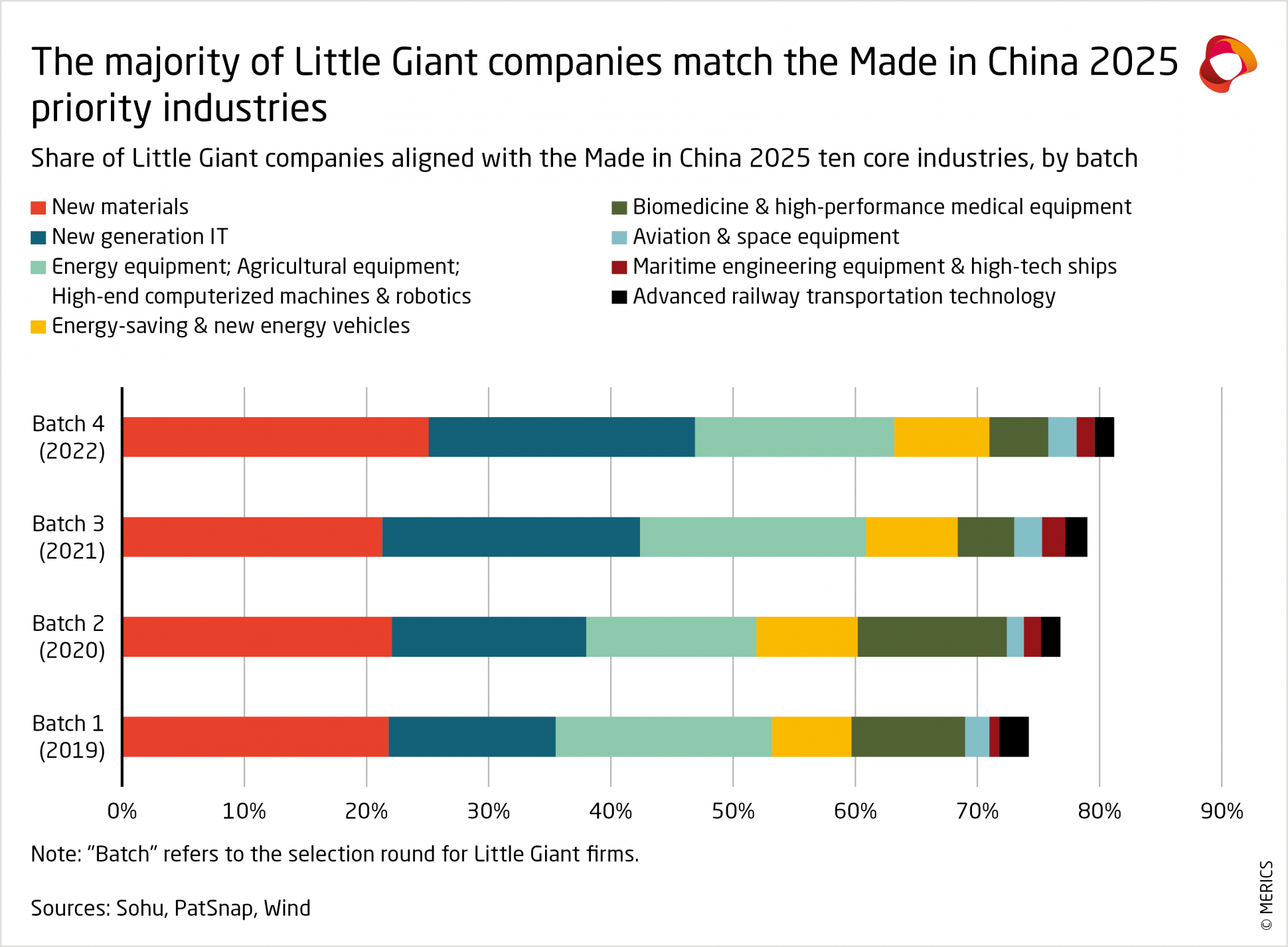

The core objectives of the accelerator state reflect the strategic goals of China’s government and their evolution in recent years. In fact, Beijing’s program of high-tech SME support is part and parcel of the Made in China 2025 (MiC2025) strategy. The Little Giants initiative – a centerpiece of the accelerator state – was first announced in 2016 in one of the implementation documents of that strategy. At its official launch in 2018, the Little Giants program was focused on pushing forward innovation in core technologies and products in the ten strategic manufacturing sectors outlined in the MiC2025 strategy, ranging from chips to robots to airplanes. About 80 percent of all Little Giant firms approved to date fit into these ten key sectors (see Exhibit 1).7

The sectoral focus of high-tech SME support matches Beijing’s focus on industrial upgrading and desire to prioritize the development of hard technologies over soft technologies, i.e., hardware and equipment over consumer-oriented software applications. Even though the latter generated huge revenue for China’s leading internet-based companies in recent years, the former has taken on the importance of underpinning the resilience of the manufacturing sector going forward.

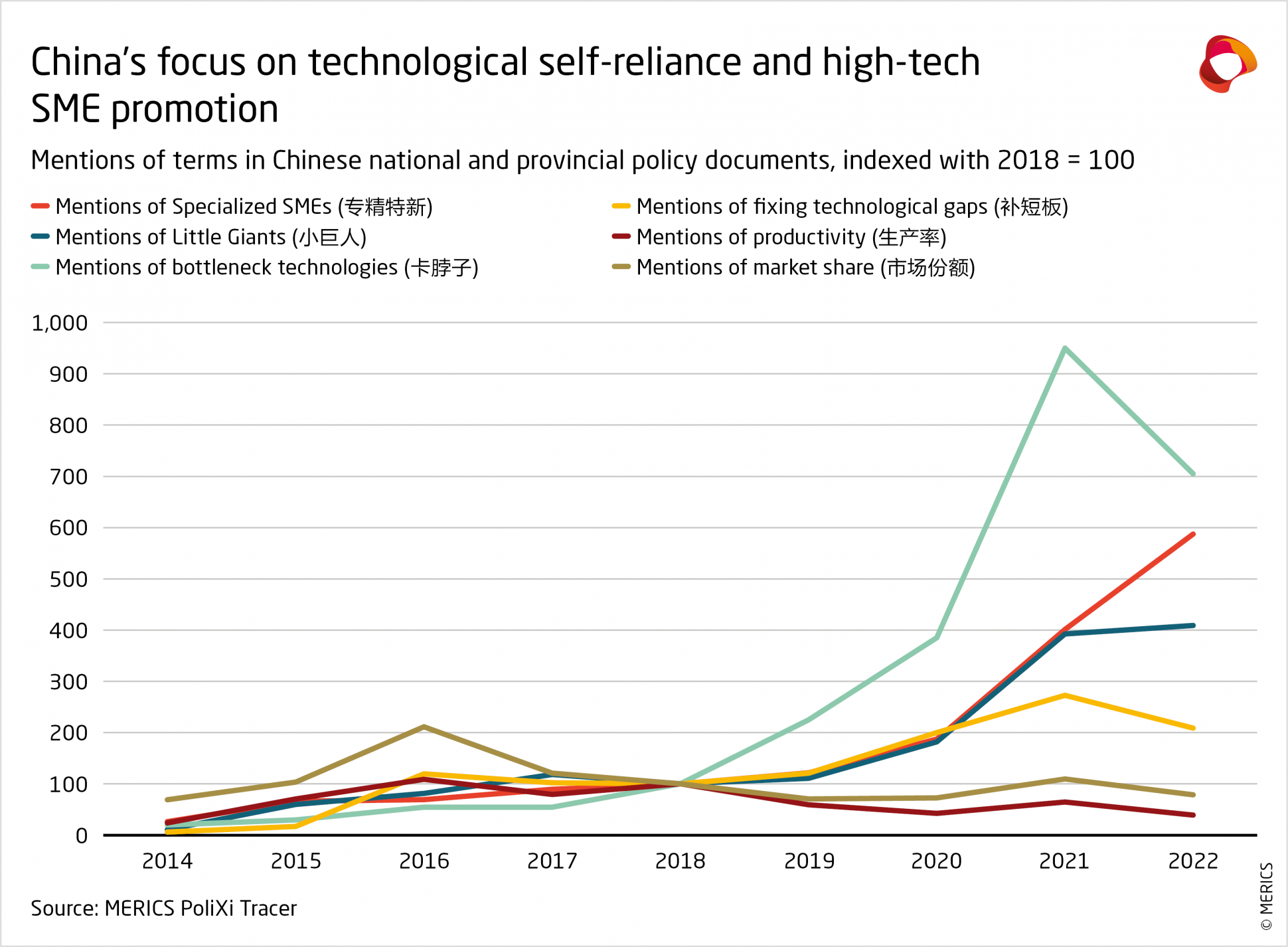

Economic security is the other key objective of the accelerator state. In light of growing tensions with the United States, including the risk of having its access to foreign technology cut-off, Beijing has redoubled efforts to enhance innovation and plug gaps in local supply chains. References to bottleneck technology gaps that need to be plugged have become more and more commonplace in Chinese industrial policy documents (see Exhibit 2). SMEs have a vital role in providing technological breakthroughs and industrial security.

In Beijing’s eyes, among the most prized SMEs are those offering basic and foundational technologies and components, such as highly specific industrial machinery, measuring devices or robotic components.8 These niches are often occupied by a handful of European, American or Japanese suppliers, that tend to serve China through exports. For instance, 41 out of 44 Chinese metro systems use operation and maintenance measurement devices supplied by the Austrian company NEXTSENSE with fewer than 100 employees.9

Many listed Little Giants are openly pursuing Beijing’s goal of import substitution. An analysis of 719 annual reports from Little Giant firms in 2021 found that 44 percent mentioned the term domestic substitution (国产替代) at least once.10 The application forms for recent batches of the Little Giants program include questions on how firms are contributing to efforts to localize and replace foreign inputs. As such, high-tech SMEs are explicitly intended to progressively replace foreign companies in China, and then challenge them in markets abroad.

Tryouts, training and tiers: How China fosters high-tech SMEs

“The birth of a hidden champion is not a one-day effort. It requires a cultivation process with strategic patience … We should further enhance the cultivation and development of hidden champions in advanced manufacturing segments … especially those that can fill technological shortcomings …”

Dong Jingmei, Economic Forecasting Department at the State Information Center (affiliated with NDRC)11

The pyramid cultivation system: From Innovative SME to Manufacturing Champion

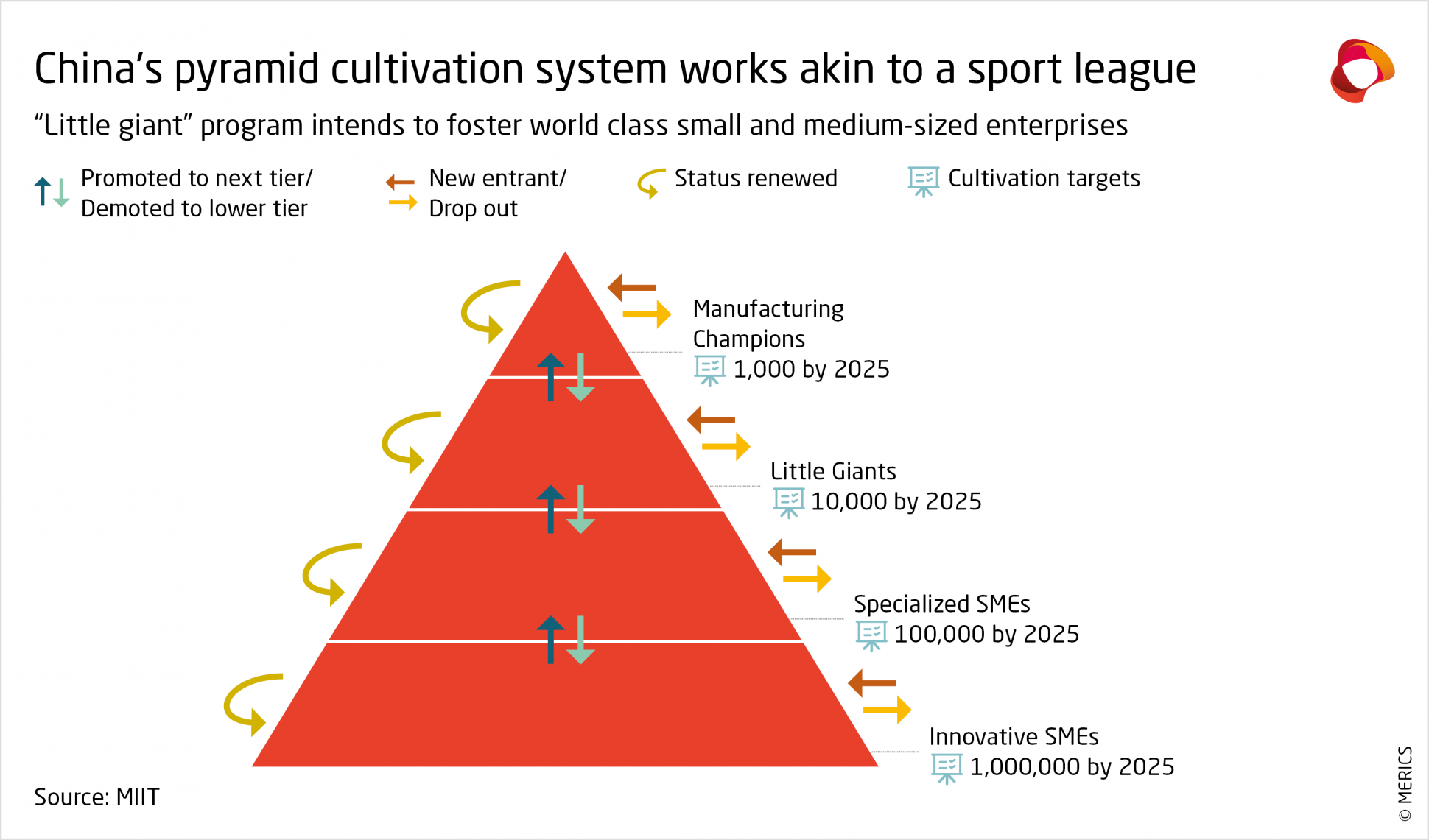

China has developed a hierarchical framework of SME support in the form of a “pyramid cultivation system” (梯度培育体系). Like a sports coach trying to develop an Olympic team, Beijing is continually hosting tryouts at different levels – testing the merits of companies – and awarding benefits accordingly. Local and central government officials evaluate high-tech SMEs against a broad suite of economic and innovation criteria. The best are granted special titles, receive access to subsidies and policy support, and are trained to become world-class competitors.

The system runs on a good dose of competition in the selection process to ensure that supportive measures and resources are allocated to the most competitive and promising players. Like competing athletes, companies must “run races” against other firms in the open market to acquire market share and technological capabilities to prove their “fitness.” Government titles and support are granted for three years. Afterward, firms are re-evaluated based on their economic and innovation performance.

The fourth and lowest-ranked league of the tiered system is composed of manufacturing- focused “Innovative SMEs” (创新型中小企业) identified at the provincial level. Provincial governments can draw on this pool of innovative SMEs to select more advanced “Specialized SMEs” (专精特新中小企业), which can tap into a wide array of support mechanisms. The cream of the crop is then promoted to national “Little Giant” (小巨人) status, and after reaching a certain size, can be recognized as industry leaders in specific subsectors (制造业单项冠军) hereon referred to as “Manufacturing Champions.” Little Giants and Manufacturing Champions are model firms in China’s pursuit of innovation-driven development.12 China has set targets for the number of firms in each of these categories to reach by 2025 and already achieved its goal of cultivating 10,000 Little Giants (see exhibit 3).13 14

Leaderdrive has risen swiftly through the ranks of this system thanks to its ability to grow and win domestic market share in an area traditionally dominated by foreign firms. To begin with, provincial officials in Jiangsu awarded Leaderdrive titles such as “high-tech enterprise,” “science and technology-based SME” and its harmonic reducer products were deemed a “Specialized SME product.”15 In 2019, the company was included in the first batch of national-level Little Giant companies, and by the end of 2020, it had risen to the rank of a Manufacturing Champion.16

The Manufacturing Champion, Little Giant and other initiatives have been launched at separate times and follow their own schedule for evaluating and announcing new awardees. Firms do not need to start from the bottom of the pyramid. For instance, in the last two batches of Manufacturing Champions, only about a quarter were derived from Little Giants, but the proportion has increased with each batch.17 Beijing is establishing a pipeline to track innovative firms from their early stages of development and accelerate their growth.

A key source of inspiration for China’s acceleration system are Germany’s “hidden champions,” highly specialized and often unknown SMEs that dominate niche markets globally. The concept has been developed by German management theorist and consultant Hermann Simon to explain the success of German SMEs in global markets.18 These firms emerged organically from the economic and social circumstances present in Germany, such as excellent vocational training, close ties to social banks, and a distinctive corporate culture.

Longing after the manufacturing might displayed by Germany’s hidden champions, Chinese policy, think tank and investment banking documents regard them as a model to emulate.19 Beijing thinks that it can replicate their success through state intervention, essentially turning a bottom-up process on its head. The very different social and economic environment in China means that it is down to government officials to orchestrate the emergence of local hidden champions. Hence the cultivation system has been set up to identify potential success stories and channel state support.

Rigging the race: The shaping and misapplication of selection criteria

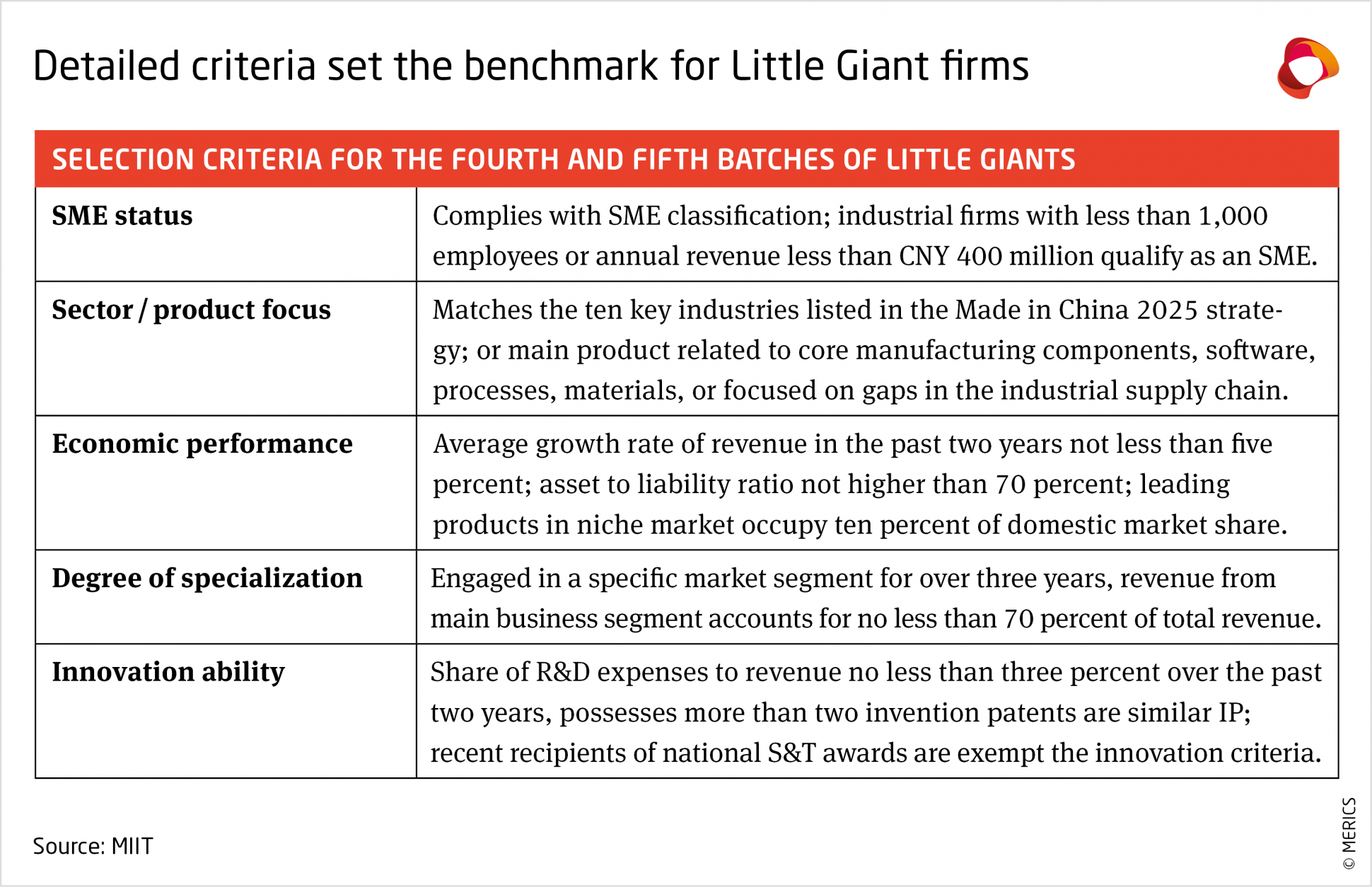

The government uses selection criteria to choose Little Giants and other types of high- tech SMEs. Officials at the municipal and provincial levels rely on them to evaluate and pick companies which they then recommend to higher authorities for further support. The criteria are broad in scope and cover aspects such as niche product focus, growth performance, the number of invention patents and R&D intensity (see Exhibit 4).

Such detailed criteria ought to enhance the identification of innovative SMEs. However, close examination of the firms granted special titles shows they do not necessarily tick all the boxes, and some appear to contradict the purpose of the accelerator program. Out of a sample of 44 robotics firms selected in the first two batches of the Little Giants program, many appear to fall below the selection standards or to undermine its objectives:20

- Too big: Efort and Sanfeng Intelligent Equipment both had over CNY 1 billion in revenue and over 1,400 employees in 2018 and 2019 respectively, well beyond the SME threshold of CNY 400 million and 1000 employees.

- Lacklustre economic performance: Haozhi Industrial did not achieve the required average revenue or profit growth rate of 10 percent over the past two years. Ningxia Juneng Robotics recorded a liabilities-to-assets ratio over the ceiling of 70 percent.

- Parent companies piggyback on subsidiaries: Nine of the 44 companies are fully owned subsidiaries of larger firms. Siasun Robot & Automation and Shanghai STEP Electric Corporation are among China’s leading robot manufacturers, yet their subsidiaries were both successfully selected as Little Giant firms.21

The MIIT does allow for some exceptions to be made for firms which score well in almost all areas but fail in others.22 Yet the frequency of leniency with selection criteria suggests that authorities have trouble finding enough firms that meet their prescribed benchmarks. It may also indicate that the scheme is being repurposed to suit local priorities, or that personal connections are influencing the results. China’s previous efforts to stimulate high- tech SME R&D efforts through the Innofund program have faced similar selection issues.23 The lax implementation of the selection process and apparent inability of the central government to enforce official criteria reflects an underlying weakness in China’s cultivation system.

Fast-tracking SME growth: Beijing’s complete framework for SME promotion

“Guide more funds to the advanced manufacturing and strategic emerging industries, provide better service to key core technology research enterprises and Specialized SMEs.”

Yi Gang, Governor of the People’s Bank of China24

The golden ticket to an exclusive sponsorship program

Certified high-tech SMEs are granted a golden ticket to special treatment from public authorities. They are effectively the privileged sponsored athletes of China’s state acceleration system. The government is encouraging all state-connected entities to smooth the development pathway for high-tech SMEs. This means more state subsidies and R&D support, increased collaboration with universities and research institutes and a more favorable intellectual property (IP) system. Officials are also pushing for larger firms, especially SOEs, to engage more with local SMEs and incorporate them into their supply chains.

Most notably, policymakers are guiding the financial system to provide additional capital to innovative SMEs. These steps mark a notable shift in direction for financial institutions in China. The structure of the financial system has for decades directed more capital towards large state-connected firms, at the expense of SMEs. The government only recently began attempts to limit these entrenched biases.25 Greater tolerance of defaults and insolvency weakened the implicit state guarantee associated with such large firms. However, these reform efforts appear to be half-baked.26 To overcome ongoing financing challenges, Beijing has more directly increased access to loans, reformed domestic stock markets and activated dedicated funds to support innovative SMEs.27

The importance of equity financing, as well as other diverse sources of state support, is evident from the example of Leaderdrive. The robotics Little Giant firm received a large windfall following its listing on the STAR market in 2020. Moreover, it is the beneficiary of direct equity investments from private and public investors, including government guidance funds. The firm has secured significant bank loans. On the R&D front, Leaderdrive has developed long-term collaborative partnerships with several universities and was involved in four National Key R&D programs between 2017 and 2019.28 Some of the largest indigenous producers of industrial robotics provide steady and ongoing demand for Leaderdrive’s products.

A key aspect of China’s new blend of state capitalism is the certification effect, i.e., the impact of the government’s stamp of approval. Earning the “Specialized SME” or “Little Giant” label indicates that an SME is a leader among their peers with significant growth and innovation potential, as well as preferential access to government support. This sets in motion a virtuous cycle for certified high-tech SMEs, whereby state benefits increase their growth outlook, leading to more funding from investors, faster expansion, additional opportunities to access state support, and so on, with some firms eventually listing on the stock market.

Explicit government-backing can work as a form of last-mile guidance for investments on top of the list of sector priorities produced by the party state. For instance, power equipment producer Guizhou Changtong Electric Ltd. received CNY 100 million from state-backed funds and further interest from other investors soon after being granted the Little Giant title in 2021.29 Considering Beijing’s recent tech rectification campaign, Little Giants are increasingly viewed as sound investment options. According to Bloomberg, one venture capital firm only invests in Little Giants.30 Numerous bank reports also highlight Little Giants as aligned with government policy and displaying strong growth potential.31

A shot of adrenaline: Carving out dedicated financing channels for high-tech SMEs

Not content with market forces determining where capital flows, Beijing is further increasing its guidance over where capital should be allocated. China’s accelerator state directly invests and guides private investors about where they should put their money. More of that cash now ends up in the pockets of government-certified SMEs.

Direct financing strengthened through equity markets

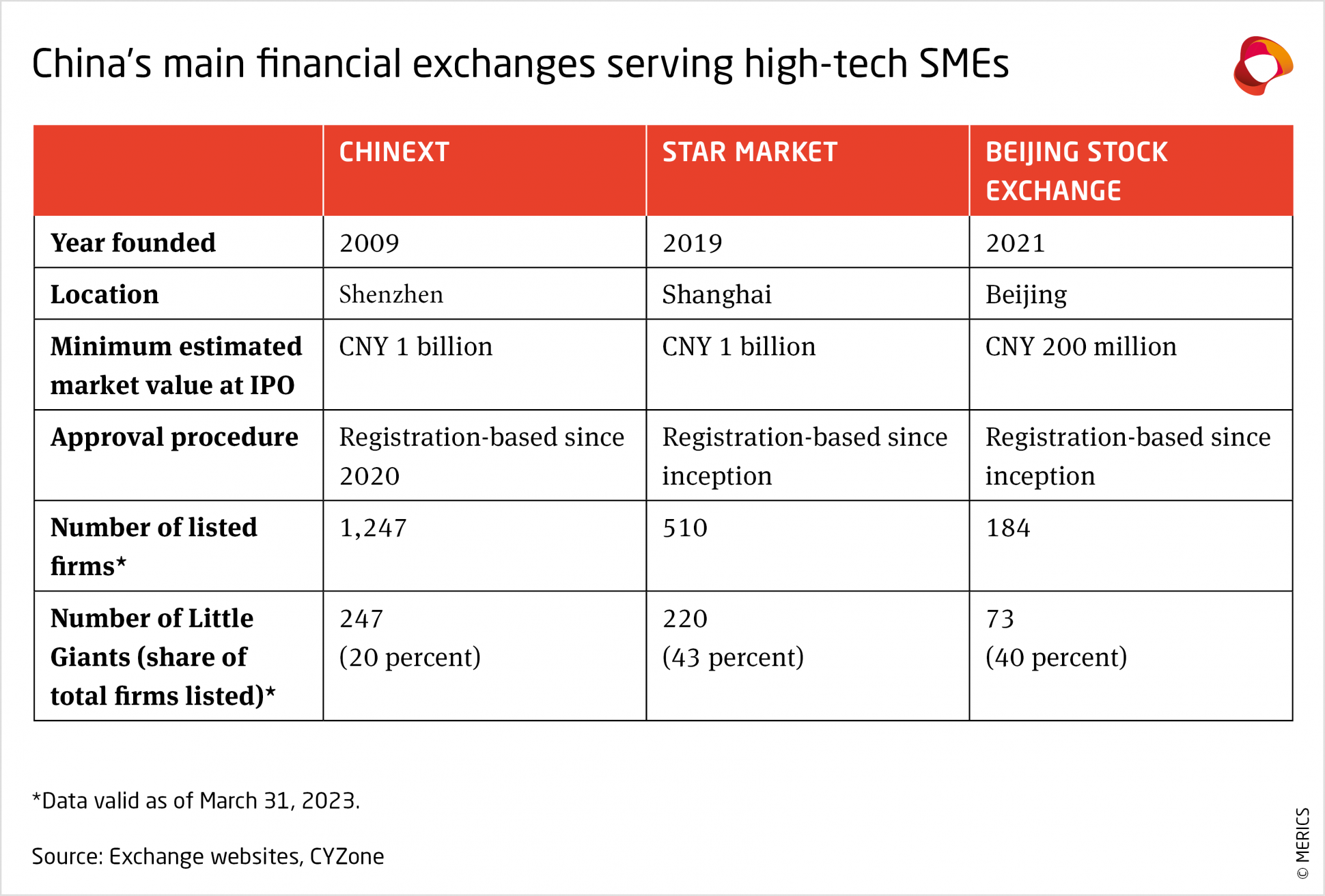

Beijing aspires to blend state intervention with market forces by creating a multi-tier capital market that can channel more direct financing to priority firms like Little Giants throughout their development.32 To fulfill this objective, the government has vastly expanded listing opportunities for high-tech SMEs on the mainland stock markets.

- Regional over-the-counter trading markets have emerged as an important tool for promoting the development of innovative SMEs.33 As of November 2022, 20 out of China’s 35 regional equity markets had set up Specialized SME boards and ten more had plans in place.34

- The new Beijing Stock Exchange (BSE) was created in 2021 to expand listing opportunities. It provides a complementary steppingstone between the provincial OTC markets and the more mature markets dedicated to tech-intensive firms (see below).35 To match the characteristics of SMEs, the exchange has wider volatility bands than other mainland exchanges and has more flexible listing criteria.

- Policymakers have also liberalized the smaller and tech-intensive STAR and ChiNext stock markets. The STAR market was the first to trial a registration-based IPO approval procedure, which was later expanded to the ChiNext market, the Beijing Stock Exchange, and eventually all Chinese stock exchanges. This procedure grants stock exchanges the authority to determine whether a company can issue public stocks, solely based on official criteria, rather than requiring verification by the CSRC.36

So far only a small share of Little Giant firms have managed to go public, yet they make up a significant share of new listings on China’s stock exchanges. In 2022, 40 percent of listings on the Shanghai, Shenzhen and Beijing stock exchanges were made by Little Giant companies.37

The amount of capital raised through IPO by Little Giant companies in recent years typically falls in the range of CNY 100 million to CNY 4 billion. Notable examples of listings in early 2023 include:38

- Unicomp Technology (CNY 3 billion in funds raised), a provider of X-ray smart inspection technology for semiconductors, electronic manufacturing and new energy batteries;

- Naruida Technology (CNY 1.8 billion in funds raised), a producer of radar hardware and detection systems, used for weather detection, water conservancy monitoring and civil aviation;

- Nanjing Gova Technology (CNY 1.3 billion in funds raised), a manufacturer of pressure sensors, temperature sensors, accelerometers, motion detectors, applied in aerospace, rail transportation and metallurgy sectors.

Not as significant as the stock markets for SME financing, bond markets have also been reformed to help SMEs. Leading ministries issued instructions to support high-quality SMEs to issue bonds in the capital market.39 The regulators and main industrial federation issued a notice aiming to ease bond issuance by private firms, especially in strategic sectors, covering collective bonds for SMEs.40

Beijing pushes the banking sector to provide more loan financing

China’s fully state-controlled banking system has sprung into action to increase lending to high-tech SMEs. In the words of a Beijing-based joint stock bank credit manager, no matter whether the Specialized SME is certified by the central or local government, banks will now approve loans more quickly and under more generous conditions.41

Notable policy developments dedicated to boosting loans to high-tech SMEs include:

- Monetary policy guidance targeting SMEs: The PBOC has guided banks to channel extra financing capacity freed up by multiple cuts in the required reserve ratio toward SMEs. This relaxation has pushed down the ratio to be set aside for each loan from 16.5 percent in 2017 to 7.8 in 2023 on average, freeing up roughly CNY 19 trillion of liquidity.42

- Specialized PBOC financing instruments: Since 2018, specific PBOC financing and refinancing facilities have been established that target SMEs or innovative firms, to incentivize banks to provide such loans. For instance, in 2022 the PBOC set up a CNY 200 billion quota for a science and technology innovation refinancing instrument that also covers Specialized SMEs.43 This is part of a clear ambition to “guide more funds to invest in advanced manufacturing and strategic emerging industries, and better serve key core technology research enterprises and Specialized SMEs”.44

The political shift in lending practices is trickling down through China’s banking system. The China Development Bank, one of China’s policy banks, announced that it provided CNY 13.1 billion in loans to 44 Little Giants and 71 Specialized SMEs in the first three quarters of 2022. Local level financial institutions are also following through. For instance, the Guangdong government together with three banks has pledged CNY 600 billion in financing support for Specialized SMEs during the 14th FYP period. Banks, like the Chengdu branch of Minsheng Bank, are trying to improve their services for high-tech SMEs by introducing new SME departments.45

Government guidance funds channel additional capital to priority firms

Government guidance funds (GGFs) have become one of the main tools to directly channel financial resources toward China’s industrial objectives. This is a clear sign that Beijing is not leaving it up to market forces to capitalize strategic firms. Promoted on a national scale from 2014 onward, estimates suggest that GGFs had raised around CNY 6 trillion of capital by mid-2021.46 High-level policy documents on the cultivation of SMEs underline the key role of GGFs in supporting high-tech SMEs and manufacturing.47 As such, it is quite common to see such funds among the shareholders of Little Giant firms.

In line with guidance from Beijing, GGFs bring in shareholders or limited partners in a structure similar to venture capital and private equity funds.48 This makes them naturally suited to provide capital to growing and smaller firms. GGFs frequently operate as funds of funds, which effectively transfers the political objectives of their investments to other venture capital and private equity firms and increases the number of public and private funds channeling equity towards high-tech SMEs.49 GGFs collect capital from banks, local governments, SOEs and private investors (although private investment is small and far off government targets) to guide the flow of financial resources to priority areas.

The limited prospects for SMEs to list publicly is one of the main challenges hindering the growth of a more dynamic Chinese venture capital scene. Hence GGFs and the stock market reforms mentioned above are highly complementary, with public listings potentially allowing GGFs to generate hefty returns that can be then re-invested into new firms.50

Full body workout: Diverse measures help SMEs to innovate and compete

While directing financial flows towards high-tech SMEs is the most powerful item on Beijing’s training plan, the government is introducing a well-rounded training regime to facilitate the development of SMEs into internationally competitive champions. The government is embedding them in China’s innovation system and matching SMEs with large firms – as financiers, clients and mentors.

Providing cash to cultivate Little Giants

The government is providing subsidies to cash-strapped high-tech SMEs often active in capital-intensive manufacturing sectors. Vast regional differences remain, and wealthy local governments often go above and beyond to support their local high-tech SMEs. Guangzhou is a particularly generous patron51:

- Cultivation: Guangzhou offers CNY 500,000 to provincial-level Specialized SMEs and CNY 2 million to Little Giants

- Rent: One-off rent subsidies of up to CNY 2 million

- Investments: New investments into land or production facilities are subsidized by 5 percent up to CNY 100 million

- Relocation: Little Giants that relocate to Guangzhou receive an additional CNY 2 million

- Technologies: Up to CNY 500,000 for selling equipment listed that has been listed on government catalogs

- Talent: Up to CNY 200,000 for talent support

Close relations with local governments can have a massive impact on Chinese SMEs. Little Giant Guizhou Anda Technology & Energy (Guizhou Anda) produces new lithium battery cathode materials and is a key supplier of BYD. In 2022, a year after becoming a Little Giant, the firm formed a JV with the Nanning and Hengzhou city governments (both in Guizhou) to produce lithium iron phosphate – benefitting China’s downstream EV industry. The city governments not only granted the land and production equipment, but an industrial investment fund also covered 49 percent of the JV’s investment costs allowing Guizhou Anda to scale.

Collaboration between universities and high-tech SMEs

High-tech SMEs can use cooperation projects to outsource research, innovation and training activities. However, China’s SMEs have had difficulties in identifying suitable university partners and making collaborations work. The central government has made clear that it wants this to change. Beijing expects – and makes funding dependent on – universities and research institutes to cultivate high-tech SMEs, for instance by supplying them with waiting-to-be-commercialized research.

Central policy measures are trickling down to local governments. The city of Nanjing intends to cultivate 1,000 Specialized SMEs, 300 Little Giants and 30 Manufacturing Champions and has issued a dedicated policy to boost SME-university collaboration. Shanghai Jiaotong University together with the Shanghai Municipal SME Development Service Center established an SME empowerment platform. This program grants 16 certified high-tech SMEs, among them Shanghai Recoen Laser Tech and medical device supplier Push Medical, access to training and consulting opportunities. 14 of the university’s professors act as dual-employed mentors for Little Giants.

Integrating Specialized SMEs into the supply chains of large firms

The relationship between Little Giant ComNav Technology and Guangzhou-based Manufacturing Champion South GNSS Naviation is indicative of the ties Beijing wants to foster between high-tech SMEs and large corporates. ComNav produces specialized computer chips and computer boards for high-precision navigation positioning. The company was established to provide a local alternative to South GNSS Navigation, a producer of satellite receivers, which previously sourced the same components from expensive foreign suppliers such as American company Trimble Inc.52

Both sides ought to benefit from greater linkages. Beyond acting as a reliable customer, large companies can help SMEs by addressing their external financing difficulties. As banks hesitate to lend to small firms, large corporates are expected to become financial backers and intermediaries – as they have a more granular understanding of their suppliers’ operations.53 In April 2022, State Grid’s Jiaxing subsidiary started supplying CITIC Bank with information on the electricity usage of SMEs to improve their financing.54 For their part, SMEs are expected to fill gaps in the domestic supply and value chains of large corporates. Their role is to advance import-substitution as quickly as possible, through their specialization, dynamism and flexibility.

The government steers the large-small firm coupling and has released guidelines on how to do so.55 One way is through match-making events. The first such event at the national level was held in Qingdao in June 2022. There, local heavyweight Haier put forward 63 matchmaking demands focused on intelligent home appliances, biomedicals and industrial internet. The MIIT think tank China Academy for Information and Communications Technology (CAICT) has since built an online platform to match large firms with SMEs.56 SOEs are also expected to support high-tech SMEs. They will be evaluated based on their contributions.

Supporting SMEs to use research outputs and protect their IPR

Beijing also intends to spur innovation and cultivate high-tech SMEs by tweaking intellectual property rights (IPR) regulations.

Situated in one of China’s four silk capitals, textile equipment producer Huzhou Modern Textile Machinery (Huzhou Textile) – a Specialized SME – had faced difficulties to develop equipment that can weave fabrics thinner than 2 mm. But then Huzhou Textile came across a Zhejiang university professor who held an important patent. The patentee and Huzhou Textile are now jointly developing a prototype that could raise revenues by up to 30 percent. The collaboration is not accidental. Huzhou Textile found the patent via Zhejiang’s open licensing platform set up in 2021 which allowed firms to access 379 patents without having to pay royalties or license fees.

Apart from open licensing, the government also wants to better protect the IPR of high- tech SMEs. As access to foreign technology becomes more cumbersome and Chinese firms edge closer to the global technological frontier, policymakers have come to prioritize IPR protection. The local patent office in Jinan, Shandong, has trained 48 Specialized SMEs on IPR protection and Sichuan’s provincial government has formed a research team to survey the IPR needs of local SMEs. Local IP authorities are instructed to pay special attention to high-tech SMEs, which could lead to special treatment in court rulings in favor of such companies to the detriment of other high-tech firms – both local and foreign.

Going for gold: Assessing the impact of China’s state acceleration system

“The cultivation work has achieved certain results and has attracted widespread attention from society, but it also faces problems such as inconsistent standards, inaccurate services, and unbalanced development.”

Ministry of Industry and Information Technology57

Risks and rewards: The potential outcomes of China’s new approach to industrial policy

Four years on from the release of the first batch of Little Giant firms, China’s acceleration system appears to be delivering on its primary objectives. The system has identified innovative SMEs and some have already risen to become leaders in their field. Among the first three batches of Little Giant enterprises, 114 grew into Manufacturing Champions.58 Little Giant firms such as Leaderdrive, Endovastec and Unicomp Technology are helping to enhance China’s industrial self-reliance. They have contributed to advancing localization in strategic sectors such as robots, medical equipment and semiconductors.

Perhaps the most important achievement so far is how Beijing’s new financing model is channeling more capital toward SMEs. Data shows that more loans and investments have gone to SMEs since 2019. The share of micro-, small- and medium-sized enterprises in total bank loans has risen from 35 percent from 2015 to 2019 to 41 percent in September 2022.59 The share of capital raised on SME-oriented stock exchanges has also grown from 33 percent in 2018 to 43 percent in 2022.60 According to figures compiled by CYZone (a Chinese start- up platform), over CNY 900 billion in capital has been raised by Little Giants between 2018 and October 2022.61 The number of Little Giant firms going public has also increased each year since the start of the program, rising to 137 in 2021 and adding 133 during the first ten months of 2022.62

Nevertheless, inherent tensions and conflicting priorities within the accelerator state approach pose underlying risks, such as bad investments and misuse of funds earmarked for high-tech SMEs. This can be seen, for instance, in the process for identifying innovative firms. There is a risk that due to political distortions, a significant share of resources dedicated to the Little Giants program will flow into large parent companies or underperforming firms rather than promoting the growth of dynamic, independent firms. This is the weakness of what remains a primarily top-down approach, in contrast to how specialized SMEs developed elsewhere.

The government’s attempt to steer private investment toward certain industries and firms undermines the ability of the private sector to respond to market signals. Through the state- led cultivation system, the government is pointing to where the honey pot is, reflecting its constrained embrace of market mechanisms. This is not without its drawbacks:

- Government signaling on priority sectors and specific companies could exclude firms with strong innovation potential that have been left out of the scheme while directing more resources to underperforming firms that play the “government-certified” card. Insiders from the government and industry could also exploit the certification effect provided to government-backed firms, by pumping and dumping related stocks.

- Recent analysis suggests that firms with investments from entities with government ties perform worse than their more private counterparts, and that investment from state- connected entities also makes firms less attractive for other private investors.63

- Concerns have been raised about the viability of the Beijing Stock Exchange given its focus on smaller firms, which are generally less suited to public trading. Small companies issue fewer shares, leading to less liquidity and difficulties in trading the stock.64

The accelerator state system is not perfect and like all government intervention is bound to generate a certain amount of duplication, misuse or misallocation of resources. Ultimately for the government, the priority is future proofing local industry and it is willing to pay a premium to advance that aim. Self-sufficiency is not feasible, but Beijing is eager to get as close as possible to independent supply chains in certain strategic areas. To what extent it can meet these lofty goals, and what the costs will be, remains to be seen.

From rookie to champion: The looming challenge for foreign firms

The strategic sectors identified by Beijing are often dominated by foreign, especially European SMEs and the selection criteria of the fourth and fifth batch of Little Giants explicitly aim to replace foreign firms in key value chains. Foreign manufacturing firms, large and small, ought to be wary that one of the over 70,000 Specialized SMEs and more than 12,000 Little Giants could target their core business area. These magnets of state support are not only likely to compete more effectively in China’s domestic market but also to increase competition in third markets.

The sheltered position of China’s high-tech SMEs within their huge home market is a crucial advantage over their foreign competitors. Once they have scaled up domestic production and reached a size enabling them to invest more in R&D and overseas expansion, they are very well placed to tackle foreign markets. European firms do not have access to this sort of “safe haven.” The impact will be felt particularly in areas of emerging technologies where China expects Little Giants to act as key innovators and lead market growth, such as renewable energy, power equipment, medical technology, EVs etc.

Little Giants have already begun their entry into foreign markets. BWT Beijing, the producer of semiconductor lasers, sells its products in more than 70 countries around the world.65 Medtech firm Endovastec’s international business covers 22 countries in Europe, Latin America, Southeast Asia.66 In addition, Unicomp Technology has exported its industrial X-ray equipment to more than 60 countries and regions.67 These firms have a global reach and will naturally seek out new markets once they have established themselves at home.

The blurry lines between private ownership and state backing will make it difficult to hold China accountable and ensure a level-playing field. Foreign firms will likely be reluctant to challenge the preferential treatment granted to government-certified SMEs for fear of retaliation and therefore need to rely on the efforts of their home governments to advocate on their behalf. However, the new system of state support is in large part opaque, given the incorporation of further market mechanisms and private actors. This will render the application of anti-foreign subsidy laws more difficult.

China’s ambitious program to develop an “Olympic team” of high-tech SMEs is nearing full scale and seeks to challenge the position of foreign companies in China and abroad. Over the coming years, Chinese authorities will continue to refine the system and draw on a pool of thousands of promising firms to advance its technological capabilities in key areas. There is no guarantee that China will succeed in any particular product or sector, and as shown above, the system has its flaws. Yet in many areas, SMEs aligned with national strategic objectives will gain a significant boost thanks to Beijing’s new industrial focus. Foreign firms will need to continue to innovate and deepen their own competitiveness to stay ahead.

- Endnotes

-

1 | Government of the PRC (2022). “Interpretation of Interim Measures for Gradient Cultivation and Management of High-quality Small and Medium-sized Enterprises (《优质中小企业梯度培育管理暂行办法》解读).” June 3. https://www.gov.cn/zhengce/2022-06/03/content_5693839.htm. Accessed: July 10, 2023

2 | China’s “new-style national team” or “new type whole nation system” (新型举国体制) concept reflects a revival of government-organized consortiums set up to achieve strategic goals. Tan, Xiao and Song, Yao. The Diplomat (2022). “China’s ‘Whole Nation’ Effort to Advance the Tech Industry.” April 21. https://thediplomat.com/2022/04/chinas-whole-nation-effort-to-advance-the-tech- industry/. Accessed: July 10, 2023.

3 | OFweek Laser Network (2023). “Kaplein Sci-Tech Innovation Board’s IPO has been accepted and plans to raise 952 million yuan to invest in high-power, semiconductor, and fiber laser projects (凯普林科创板 IPO获受理 拟募资9.52亿元投入高功率、半导体、光纤激光器项目).” May 10. https://laser.ofweek.com/2023-05/ART-8120-2400-30596097.html. Accessed; July 10, 2023; Zheshang Securities (2022). “Humanoid Robots Wind up, Core Components Help Sail Away --Robot Industry in-Depth Report (人形机器人风起,核心零部件助力扬帆远航 ——机器人行业深度报告).” October 17.

4 | The Chinese Institute of Electronics is an academic institution with over 100,000 members under the direct management of Ministry of Industry and Information Technology. Chinese Institute of Electronics (2021). “China Robotics Industry Development Report (2021) (中国机器人产业发展报告(2021 年)).” https://www.cie.org.cn/about_107/. Accessed; July 10, 2023.

5 | Endovastec (2023). https://www.endovastec.com/24/. Accessed: July 10, 2023.

6 | The first four batches of Little Giants included 8997 companies. Media reports, based on the compilation of local government announcements from July 2023, claim that an additional 3671 companies were included in the fifth batch of Little Giants. Ministry of Industry and Information Technolgy (2023), “National Industry and Information Technology Work Conference Held in Beijing (全国工业和信息化工作会议在京召开).” January 11. https://wap.miit. gov.cn/xwdt/gxdt/ldhd/art/2023/art_f1e1bfd142e5406b98a917e5d4543e46.html. Accessed: July 10, 2023. Tobse (2023). “The fifth batch of Little Giants is announced: 3671 in total, Jiangsu, Guangdong and Zhejiang still lead (第五批国家级专精特新“小巨人”正公示:总计3671家,苏粤浙仍领跑全国).” July 16. https:// web.archive.org/web/20230719095256/https://www.tobse.cn/2411.html. Accessed: July 19, 2023.

7 | Luming Finance and Economy (2022). “Biomedical and high-performance medical device Little Giants have an average of 38 effective invention patents (生物医药及高性能医疗器械“小巨人”平均有效发明专利量 38件).” October 27. https://www.sohu.com/a/600259094_99990181. Accessed: July 10, 2023.

8 | NMSAC (2022). “Industrial Base Innovation Development Catalogue (2021 Edition) 产业基础创新发展目录(2021年版).” 2022. http://www.cm2025.org/uploadfile/2022/0805/20220805013919818.pdf. Accessed: July 10, 2023.

9 | NEXTSENSE (2021). “How China’s Metros Are Benefitting from Faster, More Reliable Profile Measurements.” Railway News Magazine Issue 3 2021: 146-147.

10 | EY and Zhejiang University (2022), “Report on the Innovation and Development of Specialized and Sophisticated Listed Companies (2022) (专精特新上市公司创新与发展报告(2022年)).” October 10, https://mp.weixin.qq.com/sbiz=MjM5OTYyODg4MQ==&mid=2653825940&idx=1&sn=3e65283d74538a65cb364970d840384a&chksm=bce212aa8b959bbc65c2ecc8f86f6bc5d13a4d3982bc02d6613d40c18cda886069b2842e8da7#rd.

11 | Dong, Jingmei (2021). National Development and Reform Commission. “【Expert Opinion】Invisible Champion Cultivation Path under the Construction of New Development Pattern 【专家观点】新发展格局构建下的隐形冠军培育路径.” November 29, https://www.ndrc.gov.cn/wsdwhfz/202111/t20211129_1305672_ext.html. Accessed: July 10, 2023.

12 | Zhou, Pingjun. “Specialized, Specialized and New’ SME Development Policy Orientation ‘专精特新’中小企业发展政策取向.” (Advanced Manufacturing Technology Business School, 2022), https://www.amtbs. cn/article/e8244eb50e794f388acb547a202ca9c6. Accessed: July 10, 2023.

13 | Xinhua News Agency (2022). “China Has Cultivated Nearly 9,000 ‘Little Giant’ Enterprises with Specialties and New Features, and the BSE Has Taken Many Measures to Help Small and Medium-Sized Enterprises Grow Bigger and Stronger 我国已培育近九千家专精特新‘小巨人’企业 北交所多措并举助力中小企业做大做强.” September 9. http://www.xinhuanet.com/money/20220909/a95d588358b64e1797021186c10aab33/c.html. Accessed: July 10, 2023; MIIT et. al. (2021). “14th Five-Year Plan to Promote the Development of SMEs ‘十四五’促进中小企业发展规划,” December 17. http:// www.gov.cn/zhengce/zhengceku/2021-12/17/content_5661655.htm. Accessed: July 10, 2023.

14 | The timeline to cultivate 10,000 Little Giants has been brought forward to the end of 2023. See: Ministry of Industry and Information Technology (2023). “Notice on Printing and Distributing Several Measures to Help Small, Medium and Micro Enterprises Stabilize Growth, Adjust Structure and Strengthen Capabilities助力中小微企业稳增长调结构强能力若干措施.” January 11. https://www.miit.gov.cn/zwgk/ zcwj/wjfb/tz/art/2023/art_0ac5cd8988084fff9e4a70da792baa10.html. Accessed: July 10, 2023.

15 | IMRobitic (2023). “Leaderdrive company profile.” https://www.imrobotic.com/integrator/13924/about. Accessed: July 10, 2023.

16 | Leaderdrive (2023). http://www.leaderdrive.cn/companyIntroducePage - See “企业资质” section. Accessed: July 10, 2023.

17 | Hao, Karen. The Wall Street Journal (2023). “China Cultivates Thousands of ‘Little Giants’ in Aerospace, Telecom to Outdo U.S.” March, 16. https://www.wsj.com/articles/china-cultivates-thousands-of-little- giants-in-aerospace-telecom-to-outdo-u-s-97ef9bdb. Accessed: July 10, 2023.

18 | Brown, Alexander. MERICS (2022). "China Relies on ‘Little Giants’ and Foreign Partners to Plug Stubborn Technology Gaps.” February 24. https://merics.org/en/short-analysis/china-relies-little-giants-and- foreign-partners-plug-stubborn-technology-gaps. Accessed: July 10, 2023.

19 | Sealand Securities (2022). “专精特新2023年度策略报告:补齐产业链短板,助力高质量发展.” December 12. https://data.eastmoney.com/report/zw_industry.jshtml?encodeUrl=MvU5vkWB177R4HPi5cckg4pzDvoYRAZeOUO9bQQEnWk=. Accessed: July 10, 2023

20 | The flexible approach to applying Little Giant standards continued during the reevaluation of first batch Little Giants carried out in 2022, as it had during the initial selection process. Siasun Co., Ltd. maintained its status despite being the subsidiary of major robotics producer Siasun Robot & Automation. Efort is also still much larger than the official definition of an SME, and it also failed to meet the economic performance requirement of five percent average growth in revenue or profit over the past two years. Rather, between 2019 and 2021 Efort’s revenue shrunk by 10 percent and its income losses deepened. Nevertheless, both these firms had their status as Little Giant companies renewed.

21 | The subsidiaries are Siasun Co., Ltd. and Adtech (Shenzhen) Technology Co., Ltd.. For background information on Siasun and the Shenyang Robotics Cluster where it is situated, see: Groenewegen-Lau, Jeroen and Laha, Michael. MERICS (2023). “Controlling the Innovation Chain. China’s Strategy to Become a Science & Technology Superpower.” February, 2. https://merics.org/en/report/controlling- innovation-chain. Accessed: July 10, 2023.

22 | Government of the PRC (2022). “Interpretation of Interim Measures for Gradient Cultivation and Management of High-quality Small and Medium-sized Enterprises" (《优质中小企业梯度培育管理暂行办法》解读). June 3. https://www.gov.cn/zhengce/2022-06/03/content_5693839.htm. Accessed: July 10, 2023

23 | Wang, Yanbo; Li, Jizhen and Furman, Jeffrey (2017). “Firm performance and state innovation funding: Evidence from China’s Innofund program.” Research Policy 46(6): 1142-1161.

24 | Yi, Gang (2022). “Report of the State Council on Financial Work - at the Thirteenth Session of the Standing Committee of the Thirteenth National People’s Congress on October 28, 2022国务院关于金融工作情况的报告——2022年10月28日在十三届全国人民代表大会常务委员会第三十七次会议上.” State Administration of Foreign Exchange, October 30. http://m.safe.gov.cn/safe/2022/1030/21646.html. Accessed: July 10, 2023.

25 | Geng, Zhe and Jun (2019). “The SOE Premium and Government Support in China’s Credit Market.” NBER, Working Paper: 26575. Jurzyk, Emilia M and Ruane, Cian (2021). “Resource Misallocation Among Listed Firms in China: The Evolving Role of State-Owned Enterprises IMF Working Paper 2021/075. Harisson, Ann, et al (2019). “Can a Tiger Change Its Stripes? Reform of Chinese State-Owned Enterprises in the Penumbra of the State.” Cerdeiro, Diego and Ruane, Ciane (2022 “China’s Declining Business Dynamism IMF, Working Paper 2022/032.

26 | Li, Bo and Ponticelli, Jacopo (2022). “Going Bankrupt in China.” Review Of Finance 26(3): 449–86.

27 | Ministry of Industry and Information Technology (2023). “Notice on the Issuance of Several Measures to Help Small and Medium-Sized Enterprises Stabilize Growth and Adjust Their Structural and Strong Capabilities 关于印发助力中小微企业稳增长调结构强能力若干措施的通知.” January 14, 2023. https://www.miit.gov.cn/zwgk/zcwj/wjfb/tz/art/2023/art_0ac5cd8988084fff9e4a70da792baa10.html. Accessed: July 10, 2023.

28 | Leaderdrive (2020). Initial Public Offering Prospectus. August 19, 2022. http://file.finance.sina.com.cn/211.154.219.97:9494/MRGG/CNSESH_STOCK/2020/2020-8/2020-08-25/6536262.PDF. Accessed: July 10, 2023. See “承担的重大科研项目” section - 国 家 重 点 研发计划

29 | Bloomberg (2022). “China’s ‘Little Giants’ Are Its Latest Weapon in the U.S. Tech War.” January 23. https://www.bloomberg.com/news/articles/2022-01-23/china-us-xi-jinping-backs-new-generation-of-startups-in-tech-war#xj4y7vzkg. Accessed: July 10, 2023.

30 | Bloomberg (2022). “China’s ‘Little Giants’ Are Its Latest Weapon in the U.S. Tech War.” January, 23. https://www.bloomberg.com/news/articles/2022-01-23/china-us-xi-jinping-backs-new-generation-of- startups-in-tech-war#xj4y7vzkg. Accessed: July 10, 2023.

31 | Citic Securities (2021). “Specialisation and the New Era of Manufacturing 专业化和新制造时代.” September 15. https://www.ligongku.com/resource/145629. Accessed: July 10, 2023; Everbright Securities (2021). “Discovering Specialized SME Small Giants.” October 23. https://pdf.dfcfw.com/pdf/H3_AP202110261525051169_1.pdf?1635266793000.pdf. Accessed: July 10, 2023; Sinolink Securities (2022). ““专精特新”中的“专精特新.” January 10. https://pdf.dfcfw.com/pdf/H3_AP202201131540135645_1.pdf?1642073790000.pdf. Accessed: July 10, 2023.

32 | Ministry of Foreign Affairs (2022). “Full Text of the Report to the 20th National Congress of the Communist Party of China.” October 25. https://www.fmprc.gov.cn/eng/zxxx_662805/202210/ t20221025_10791908.html Accessed: July 10, 2023; State Council (2018). “Liu He Chaired the First Meeting of the State Council Leading Group for Promoting the Development of Small and Medium Enterprises 刘鹤主持召开国务院促进中小企业发展工作领导小组第一次会议.” August 20. http://www.gov.cn/guowuyuan/2018-08/20/content_5315204.htm. Accessed: July 10, 2023; State Council (2019). “Guidance on Promoting the Healthy Development of Small and Medium Enterprises 中共中央办公厅 国务院办公厅印发《关于促进中小企业健康发展的指导意见》.” April 7. http://www.gov.cn/ zhengce/2019-04/07/content_5380299.htm. Accessed: July 10, 2023.

33 | China Securities Regulatory Commission, CSRS (2021). Annual Report 2021. http://www.csrc.gov.cn/csrc/c100024/c5799921/content.shtml. Accessed: July 10, 2023. CSRC (2020). Annual Report 2020. http://www.csrc.gov.cn/csrc_en/c102063/c1606114/content.shtml. Accessed: July 10, 2023. CSRC (2019). Annual Report 2019. http://www.csrc.gov.cn/csrc_en/c102063/c1606308/content.shtml. Accessed: July 10, 2023. CSRC (2018). Annual Report 2018. http://www.csrc.gov.cn/csrc_en/c102063/c1372574/content.shtml Accessed: July 10, 2023.

34 | International Center for Science & Technology Innovation, NCSTI (2022). “Several Measures on Further Promoting the High-Quality Development of ‘Specialized, Specialized and New’ Enterprises in the Beijing Sub-Center 关于进一步促进北京城市副中心‘专精特新’企业高质量发展的若干措施.” September 22. https://www.ncsti.gov.cn/kjdt/yqdy/zcwj/202209/t20220926_98660.html. Accessed: July 10, 2023.

35 | Lu, Lerong and Ye, Jiujing (2022). “Beijing Stock Exchange and Multi-Tier Capital Markets: How China Alters Share Listing and Trading Rules to Promote SME Finance?.” SSRN Electronic Journal 43, 2022.

36 | However, the regulator has acknowledged it continues to influence listing approvals based on industrial priorities, in line with the broader ambition to develop a traffic light system for capital allocation He, Lifeng (2022). “High-quality development is the primary task of building a modern socialist country in an all-round way (高质量发展是全面建设社会主义现代化国家的首要任务).” The People’s Daily. November 11. http://dangjian.people.com.cn/n1/2022/1114/c117092-32565249.html. Accessed: July 10, 2023.

37 | As of March 31, 2023, 708 out of 8997 Little Giants released in the first four batches had gone public. Sina (2023). “In the first quarter, nearly 50% of the specialized and special new financing was concentrated in Beijing and Shanghai, and 30% of the newly listed companies in A-shares were Little Giant (一季度专精特新融资近五成集中在北京、上海,A股三成新增上市企业为小巨人).” May 15. https://finance.sina.com.cn/tech/roll/2023-05-15/doc-imytvrpe7311928.shtml. Accessed: July 10, 2023.

38 | Wind financial database.

39 | Ministry of Industry and Information Technology, et al (2021). “Guiding Opinions on Accelerating the Cultivation and Development of High-Quality Manufacturing Enterprises (关于加快培育发展制造业优质企业的指导意见).” July 3. http://www.gov.cn/zhengce/zhengceku/2021-07/03/content_5622135.htm. Accessed: July 10, 2023.

40 | China Securities Regulatory Commission, et al (2022). “Notice on Promoting the Bond Market to Better Support the Reform and Development of Private Enterprises(关于推动债券市场更好支持民营企业改革发展的通知).” July 23, http://www.gov.cn/zhengce/zhengceku/2022-07/23/content_5702437.htm. Accessed: July 10, 2023.

41 | Xiang, Jiaying (2022). “‘Professional and Special New Loans Have Become a Compulsory Course for Banks’—New Trends in Loan Issuance from the Perspective of a Credit Manager (投放专精特新已成银行必修课’—位信贷经理视角下的贷款投放新动向).” Sina, December 20. https://cj.sina.com.cn/articles/view/1657914910/62d1c61e02001c4w3. Accessed: July 10, 2023.

42 | People’s Bank of China, PBoC (2022). “China Monetary Policy Report Q4 2021”. February 11. http://www.pbc.gov.cn/en/3688229/3688353/3688356/4271098/4515014/2022032411414559365.pdf. Accessed: July 10, 2023; PBoC (2019). “China Monetary Policy Report Q2 2019”. August 27. http://www.pbc.gov.cn/en/3688229/3688353/3688356/3830461/3881238/index.html. Accessed: July 10, 2023; PBoC (2019). “China Monetary Policy Report Q4 2018”. February 21. http://www.pbc.gov.cn/en/resource/cms/2019/03/2019032115562784220.pdf. Accessed: July 10, 2023.

43 | Xinhua News Agency (2022). “200 Billion Yuan of Technological Innovation Re-Lending Will Provide Low-Cost Funds to 21 Financial Institutions 2000(亿元科技创新再贷款将向21家金融机构提供低成本资金).” April 28. https://www.gov.cn/xinwen/2022-04/28/content_5687929.htm. Accessed: July 10, 2023.

44 | Yi, Gang (2022). “Report of the State Council on Financial Work - at the Thirteenth Session of the Standing Committee of the Thirteenth National People’s Congress on October 28, 2022国务院关于金融工作情况的报告——2022年10月28日在十三届全国人民代表大会常务委员会第三十七次会议上.” State Administration of Foreign Exchange, October 30. http://m.safe.gov.cn/safe/2022/1030/21646.html. Accessed: July 10, 2023

45 | Sina (2022). “Specialized SME Financing Credit May Be More Flexible (专精特新企业融资授信或将更加灵活).” May 30. https://finance.sina.com.cn/roll/2022-05-30/doc-imizirau5634939.shtml. Accessed: July 10, 2023.

46 | Some authoritative estimates: 1,741 of such funds by Q1 2020 with total assets of CNY 4.8 Trn, and a cumulative targeted size of CNY 11 Trn (Zero2IPO [2020]. “Report on Performance Evaluation of Chinese Government Guidance Funds 2020” [2020年中国政府引导基金绩效评价研究报告]. November; 2k funds with CNY 10 Trn of assets by early 2019 (Fuller, D. B. (2019). Paper Tigers, hidden dragons. Oxford University Press).

47 | Ministry of Industry and Information Technology, et al (2021). “Accelerating the Cultivation and Development of High-quality Manufacturing Enterprises (六部门关于加快培育发展制造业优质企业的指导意见).” July 2021. https://www.miit.gov.cn/jgsj/zfs/qypy/art/2021/art_ad29811e3bbd4129851f63d125c2e456.html; Bureau of Small and Medium Enterprises (2022). “Notice on Several Measures for Intellectual Property Rights to Help the Innovation and Development of Specialized, Specialized and New SMEs (《关于知识产权助力专精特新中小企业创新发展的若干措施》解读).” November 24. https://www.miit.gov.cn/ jgsj/qyj/gzdt/art/2022/art_19dd17ebcd3d46419c693a1d324183da.html.

48 | Luong, Ngor; Arnold, Zachary, and Ben Murphy. CSET (2021). “Understanding Chinese Government Guidance Funds.” March 2021. https://cset.georgetown.edu/publication/understanding-chinese- government-guidance-funds/. Accessed: July 10, 2023.

49 | Luong, Arnold, and Murphy, “Understanding Chinese Government Guidance Funds”. Yue, Yue; Wang, Liwei, and Han, Wei. Caixin (2020). “Four Things to Know About the State’s Role in China’s Private Investment Market.” October 14. https://www.caixinglobal.com/2020-10-14/four-things-to-know-about-the-states-role-in-chinas-private-investment-market-101614377.html. Accessed: July 10, 2023.

50 | Malkin, Anton. “China’s Experience in Building a Venture Capital Sector: Four Lessons for Policy Makers” (CIGI Papers, 2021), https://www.cigionline.org/static/documents/documents/no.248_0.pdf; Xiang, D.W. and Li, Z.Y. (2016). “Government Equity Investment Guide Fund: Questions, Analysis and Recommendations”. Economic Research Reference, No. 19, 22-27.

51 | 梧桐树下V (2022). “Incentive standards for Little Giants: CNY 6 million/enterprise at the national level, 2 million per year (专精特新小巨人企业奖励标准:国家级600万元/家,每年200万).” January 11. https:// web.archive.org/web/20230703151213/https://www.861718.com/fagui/show-1694-2.html. Accessed: July 10, 2023.

52 | Hao, Karen. The Wall Street Journal (2023). “China Cultivates Thousands of ‘Little Giants’ in Aerospace, Telecom to Outdo U.S.” March, 16. https://www.wsj.com/articles/china-cultivates-thousands-of-little- giants-in-aerospace-telecom-to-outdo-u-s-97ef9bdb Accessed: July 10, 2023.

53 | Wasiuzzaman, Shaista, et al (2020). “Creditworthiness and Access to Finance of SMEs in Malaysia: Do Linkages with Large Firms Matter?” Journal of Small Business and Enterprise Development 27(2): 197- 217.

54 | Ma, Jiang (2022). “State Grid Jiaxing Power Supply Company Actively Promotes ‘Letter of Credit Payment’ Business 国网嘉兴供电公司积极推广‘信用证交费’业务.” Xinhua, April 9. http://zj.news.cn/2022- 04/09/c_1128545033.htm. Accessed: July 10, 2023.

55 | China Academy of Information and Communications Technology (2022). “Forum on Integration and Innovation of Large and Small Enterprises Held in Nanjing (大中小企业融通创新论坛在南京举办).” September 14. http://www.xieshouxingdong.cn/policy/41. Accessed: July 10, 2023.

56 | Ministry of Industry and Information Technology (2022). “Notice on Printing and Distributing the Operation Guide for the ‘Hundred Fields and Thousands of Enterprises’ Integration and Innovation Matchmaking Activities of Large and Small Enterprises (关于印发‘百场万企’大中小企业融通创新对接交流活动操作指南的通知).” September 9. https://jxt.hubei.gov.cn/bmdt/ztzl/zjtx/zcwj/202210/ t20221027_4374464.shtml. Accessed: July 10, 2023.

57 | Ministry of Industry and Information Technology (2022). “Interpretation of ‘Interim Measures for Gradient Cultivation and Management of High-quality Small and Medium-sized Enterprises (《优质中小企业梯度培育管理暂行办法》解读).” June 3. https://www.gov.cn/zhengce/2022-06/03/content_5693839.htm. Accessed: July 10, 2023.

58 | Wang, Yiming (2022). “765 specialized and special new "little giants" have been listed, focusing on the field of hard technology (聚焦硬科技领域 765家专精特新“小巨人”已上市).” STCN, September 10. https:// www.stcn.com/article/detail/682156.html. Accessed: July 10, 2023.

59 | Official People’s Bank of China (PBoC) and China Banking and Insurance Regulatory Commission (CBIRC) data retrieved via CEIC, calculations by MERICS.

60 | Shanghai Stock Exchange (SSE), Shenzhen Stock Exchange (SZSE), Beijing Stock Exchange (BSE) and National Equities Exchange & Quotations (NEEQ) data retrieved via CEIC.

61 | China Daily (2023). “Cyzone releases the ‘2022 Specialised New Small Giant Enterprise Development Report’ (创业邦发布《2022专精特新小巨人企业发展报告》).” January 3. http://finance.ce.cn/stock/ gsgdbd/202301/03/t20230103_38323052.shtml. Accessed: July 10, 2023.

62 | CDLF (2023). “2022 Specialised New Small Giant Enterprise Development Report 专精特新小巨人企业发展报告(2022年).” January 28. https://www.digitalelite.cn/h-nd-5791.html. Accessed: July 10, 2023

63 | Colonnelli, Emanuele; Li, Bo, and Liu, Ernest (2022). “Investing With The Government: A Field Experiment In China.” NBER, Working Paper: 30161.

64 | Quan, Yue and Zhang, Ziyu. Caixin (2022). “In Depth: Beijing Stock Exchange Fights to Make Its Mark.” December 7. https://www.caixinglobal.com/2022-12-07/in-depth-beijing-stock-exchange-fights-to- make-its-mark-101975460.html. Accessed: July 10, 2023; Jaramillo, Eduardo. The China Project (2023) “The Beijing Stock Exchange Is Struggling, despite Policymakers’ Best Efforts.” January 2. https:// thechinaproject.com/2023/02/01/the-beijing-stock-exchange-is-struggling-despite-policymakers-best-efforts/ Accessed: July 10, 2023.

65 | Laser Processing Committee of COS (2022). “Caplin plans to increase capital by 467 million to accelerate independent innovation of world-class technology (凯普林拟增资 4.67 亿,加速世界级技术自主创新).” June 22. http://www.chinalaser.org/index/news/detail?id=19. Accessed: July 10, 2023.

66 | Endovastec (2023). https://www.endovastec.com/24/. Accessed: July 10, 2023.

67 | Unicomp (2023). https://www.unicomp.cn/about.html#dw1. Accessed: July 10, 2023.

Acknowledgements

This report benefited from the “China Science, Technology, Innovation, and Industrial Eco-systems” project that is supported by the US State Department, and from a workshop hosted by the University of California at San Diego in October 2022.