The accelerator state: Small firms join the fray of China’s techno-industrial drive

China is creating an "accelerator state” through a multi-layered system to identify and fast track the growth of high-tech SMEs in strategic sectors. Certified high-tech SMEs enjoy unique advantages, most notably privileged access to public and private financing. An analysis of the “Little Giants” program—a central feature of the accelerator state—proves that selected firms are indeed benefiting from enhanced financing. The study also reveals flaws in its selection process. The implications for foreign actors are significant. The accelerator state aims to replace imports in key value chains, which poses a direct challenge to foreign firms. The blurred lines between state support and market forces in the scheme also make it more difficult for foreign governments to track distortionary practices and enforce fair competition.

This brief is part of a special series organized jointly by the University of California Institute on Global Conflict and Cooperation (IGCC) and the Mercator Institute for China Studies (MERICS). This analysis was originally presented at the Conference on the Chinese National Innovation and Techno-Industrial Ecosystems in Berlin, September 5–6, 2023.

This brief is part of a special series organized jointly by the University of California Institute on Global Conflict and Cooperation (IGCC) and the Mercator Institute for China Studies (MERICS). This analysis was originally presented at the Conference on the Chinese National Innovation and Techno-Industrial Ecosystems in Berlin, September 5–6, 2023.

Key findings

- The emergence of an “accelerator state” in China marks a dramatic extension of the industrial focus of Chinese policymakers toward smaller companies. High-tech small and medium-sized enterprises (SMEs) are being supported to specialize in niche markets, develop domestic alternatives to foreign inputs, and reinforce China's industrial supply chain.

- Beijing’s tiered cultivation system combines state guidance with market forces. China has developed a dynamic multi-level evaluation and support system, active at the local, provincial and national levels, to first identify specialized high-tech SMEs and then fast-track their growth. Government-certified high-tech SMEs are labeled as “Specialized SMEs” or “Little Giants.”

- The support system seeks to cover all the needs of its SMEs. The government is guiding both public and private actors to help high-tech SMEs. This means increased collaboration with public research institutes and cooperation with large firms. Beijing has also mobilized financial institutions and is pushing private investors to direct capital toward government-certified start-ups and SMEs.

- The application of the Little Giants program in the robotics sector shows its benefits and drawbacks. The system is channeling more funding to high-tech SMEs, some of which are advancing self-reliance in core technologies. Yet, there are also signs of weaknesses. The system relies on the capacity of officials to identify the most promising firms, which could result in misallocated investments and misused funds.

- Foreign actors should be prepared for challenges in navigating China’s accelerator state. Foreign manufacturing firms ought to be aware of the large pool of state-backed SMEs which could target their core business. In addition to increased competition within China, these SMEs will be able to leverage their home market advantages to increase their market share abroad. By blurring the lines between state support and market forces, Beijing has made it more difficult for foreign governments to track distortionary practices and enforce fair competition.

Introduction: The rise of small firms in China’s industrial policy

China's industrial policy is undergoing a remarkable transformation centered on the role of high-tech small and medium-sized enterprises (SMEs). These agile companies, specializing in niche markets, are becoming a new driving force behind China's self-reliance efforts and industrial supply chain reinforcement. The ultimate ambition is not only to excel in the domestic market, but to compete internationally.

Traditionally, Beijing's industrial policy emphasized large-scale projects and the nurturing of national champions. However, China is now evolving into an “accelerator state”, which champions smaller firms as well as large companies. Officials are seeking to smooth the pathway for innovative SMEs in strategic sectors to develop core technologies and scale up. In a sense, the government has turned into a coach for high-tech SMEs. It is conducting trials and offering support to build up a highly competitive “Olympic team” of innovators across a wide range of sectors.

The accelerator state brings together a broad array of stakeholders, including banks, investors, firms, and universities, to offer comprehensive support measures. It embodies the “whole-of-nation” approach promoted under Xi Jinping, enlisting SMEs—together with other actors—to advance national strategic goals.

The Little Giants initiative—arguably the core of China’s accelerator state system—supports SMEs in the key industries outlined in the Made in China 2025 plan, such as next generation information technology (IT), high-end machinery, medical equipment, and robotics. The initiative also reflects a hybrid approach combining market forces with state guidance to nurture a vibrant ecosystem of entrepreneurial talent.

This analysis uses the robotics sector as a case study for the implementation of the high-tech SME cultivation system. The recent Five-Year Plan for the sector highlighted the need to foster several internationally competitive firms and incubate innovative SMEs.1 The latter is a new addition that signifies Beijing's renewed determination to enhance the capabilities of its indigenous robotics firms, particularly in the high value-added core components segment, where foreign firms continue to dominate.

The accelerator state and Little Giant robotics firms

Cultivating high-tech SMEs: The emergence of China’s accelerator state program

China has gained a new appreciation of the role played by private enterprise and small firms in driving innovation. In emerging sectors characterized by continuous technological evolution, SMEs are pivotal actors who experiment with new technologies, production methods, and business models. In areas where established players dominate, SMEs can exploit niche markets or serve as critical suppliers. While larger firms still play a central role, Beijing aims to augment the contributions of smaller enterprises.

Leaderdrive is a prominent example of a high-tech SME that has developed domestic alternatives to foreign inputs to reinforce China's industrial chain. In 2021, Leaderdrive ranked second in terms of domestic market share for harmonic reducers, a core component for robots. It has garnered acclaim from the Chinese Institute of Electronics for its success in achieving breakthroughs in “bottleneck” technologies and developing core technologies in the robotics field.2,3

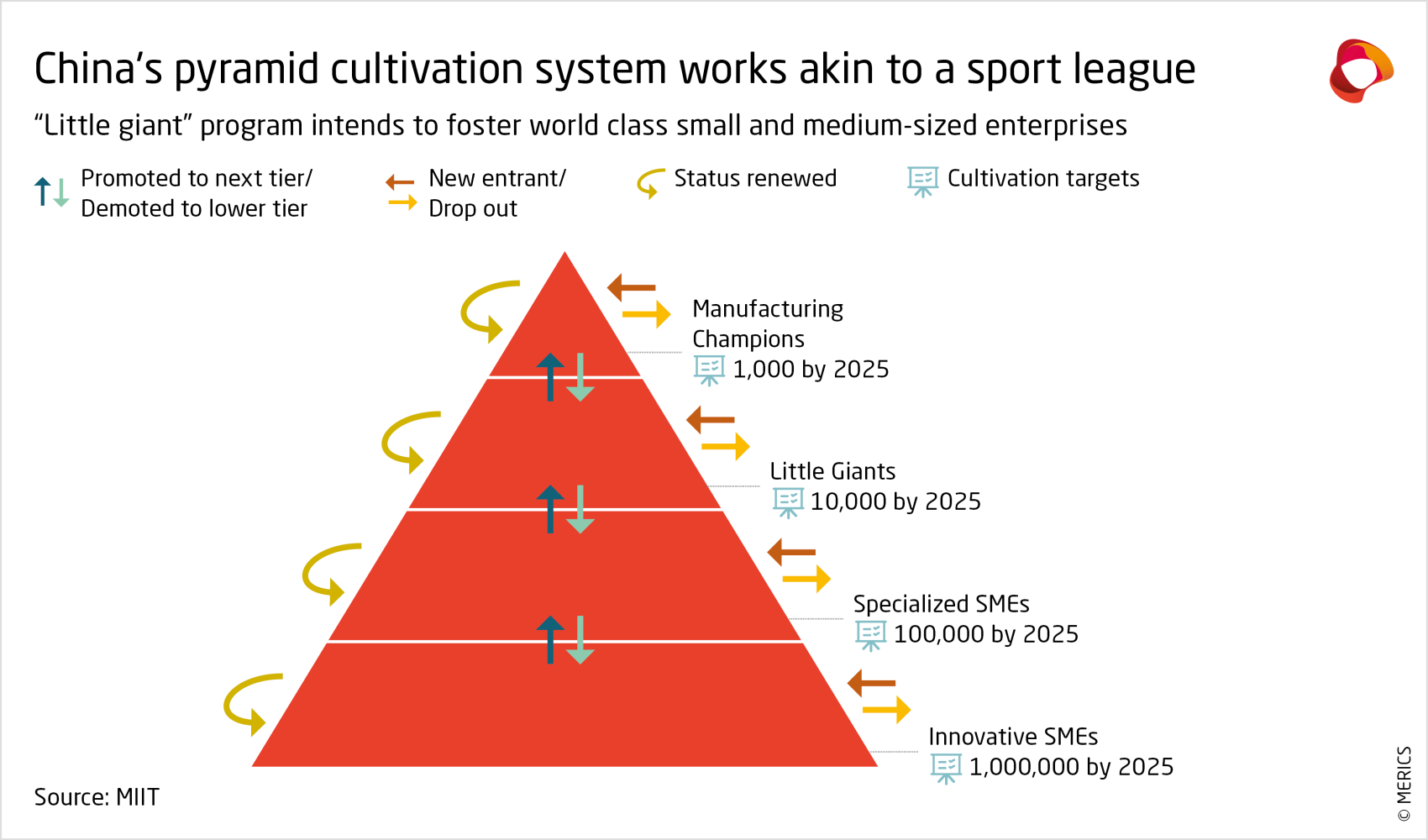

To replicate this model, China has established a dynamic multi-level evaluation and support system that operates at the local, provincial, and national levels to identify and help grow specialized high-tech SMEs (see Exhibit 1).4

This system categorizes companies as “Innovative SMEs” and “Specialized SMEs” at the provincial level, and “Little Giant” firms at the national level. Once they have risen to become leading firms in a particular product—by which stage, they may no longer be an SME—companies can be recognized as industry leaders in specific subsectors or “Manufacturing Champions.”

Each category of firms adheres to distinct selection criteria, with escalating standards for innovation and competitiveness. For instance, "Little Giant" status is granted to firms that align with Made in China 2025 priority sectors or contribute to China's industrial localization and import substitution objectives. Further evaluation factors include economic performance in terms of revenue and profit, as well as exports. The status is valid for three years, meaning firms must stay competitive to retain their privileged label as a government-backed enterprise.

To date, provincial authorities have identified 98,000 "Specialized SMEs," while national authorities have selected over 12,000 "Little Giants" for preferential government support. Furthermore, 268 Little Giants firms have been promoted to the level of “Manufacturing Champion”, making up 22 percent of the 1,200 current Manufacturing Champions.5 In the most recent batches of Manufacturing Champion announcements, almost 40 percent of companies were drawn from the pool of Little Giants.6 Leaderdrive's rapid ascent within this framework, going from a Little Giant in 2019 to a Manufacturing Champion in 2020, shows the potential for SMEs to thrive in China's evolving industrial landscape.7

The golden ticket: Key support measures for state-backed SMEs

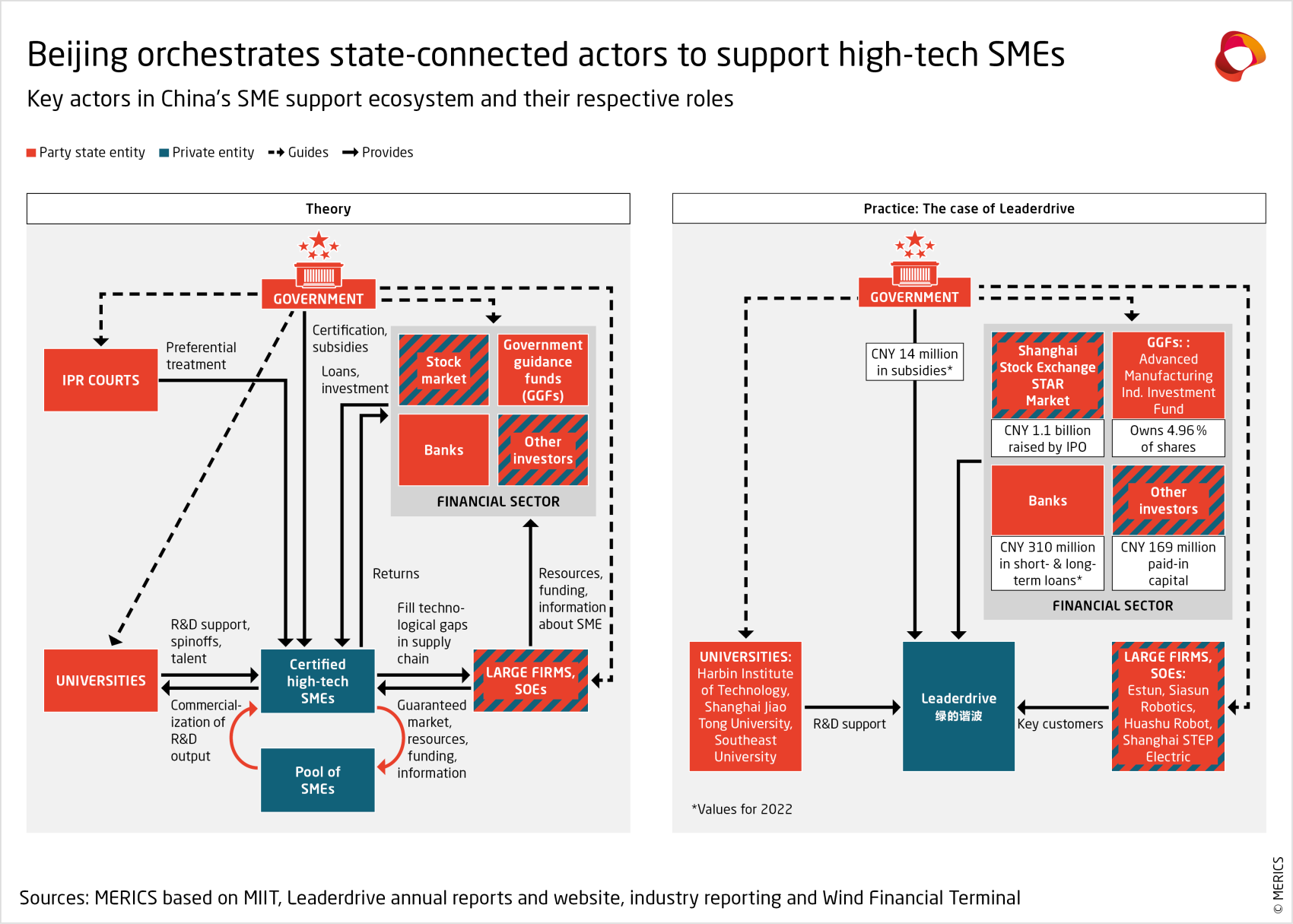

Certified high-tech SMEs in China enjoy unique privileges akin to sponsored athletes. Like Olympic athletes that have access to a state-funded salary and training facilities, government-backed SMEs benefit from greater state subsidies, increased collaboration with universities and research institutes, and a more favorable intellectual property (IP) system. The government encourages all state-connected entities to smooth the development pathway for high-tech SMEs, exemplary of the “whole-of-nation” approach (see exhibit 2). Officials are also pushing for larger firms, especially state-owned enterprises (SOEs), to engage with local SMEs and incorporate them into their supply chains.

Crucially, policymakers have also redirected the financial system to channel additional capital toward innovative SMEs. This marks a noteworthy departure from the traditional focus on large state-connected firms, which often disadvantaged SMEs. Beijing's initiatives include expanded access to loans, domestic stock market reforms, and dedicated funds to bolster innovative SMEs.8

A case in point is the substantial support received by Little Giant robotics firms. A sample of 44 robotics firms selected in the first two batches benefited from annual financing equivalent to approximately 13.7 percent of their annual revenue between 2016 and 2021. This support included direct subsidies, state-guided equity investments, and below-market debt.

China's government acts as a patient investor in early-stage high-tech SMEs, leveraging government guidance funds and directing state-owned banks to lend to the firms. Some banks have even established dedicated high-tech SME departments in collaboration with government authorities to facilitate low-interest loans.9

Simultaneously, China's recent stock market reforms were designed to encourage the listing of innovative SMEs. In 2022, 40 percent of listings on the Shanghai, Shenzhen, and Beijing stock exchanges were made by Little Giants.10 These listings incentivize private investors to bet early on such firms in the pursuit of large profits when they go public.

The surge in listings by government-backed SMEs demonstrates the effectiveness of China’s new blend of state capitalism. Despite their concentration in industrial sectors—which tend to be capital-intensive, difficult to scale, and thus requiring more caution from investors—Little Giants are increasingly viewed as attractive investment options.11

The dangers of ignoring political signals has become even more clear for investors following Beijing’s recent tech rectification campaign.12 Since November 2020, China’s largest tech companies have been under intense government scrutiny for practices of unfair competition, violations of data and cybersecurity laws, and misalignment with Beijing’s interests.

Deficiencies in the high-tech SME cultivation system

China's accelerator state is a pivotal force in promoting high-tech SMEs, but it appears to suffer from local political interference. Officials at the municipal and provincial levels employ detailed selection criteria to identify innovative SMEs by considering aspects like niche product focus, growth performance, patent possession, and research and development (R&D) intensity. However, close examination of the firms selected reveals that not all align with the accelerator program's objectives. Large firms are obtaining Little Giant status for themselves or their subsidiaries. The program will only be as effective as its selection process allows.

Among the sample of 44 Little Giant robotics firms mentioned above, approximately one-in-four appear to fall short of selection standards or contradict program objectives. Two companies exceed the SME threshold in terms of revenue and employees, while another two demonstrated lackluster economic performance. Nine of the 44 companies were fully owned subsidiaries of larger firms. For instance, Siasun Robot & Automation and Shanghai STEP Electric Corporation are among China’s leading robot manufacturers, yet their subsidiaries were both selected as Little Giant firms.

The Ministry of Industry and Information Technology (MIIT) allows some exceptions for firms which score particularly well in some areas but fail in others.13 Yet leniency with selection criteria suggests challenges in finding enough firms that meet prescribed benchmarks. It may also indicate that the scheme is being repurposed to suit local priorities, or that personal connections are influencing the results. China’s previous efforts to stimulate high-tech SME R&D efforts through the Innofund program have faced similar selection issues.14 While the accelerator state system demonstrates impressive scope and resource allocation capabilities, it is susceptible to the misdirection of funds toward less innovative firms.

Outlook: Increased challenges for foreign actors

China's accelerator state program, aimed at nurturing high-tech SMEs, has far-reaching implications for foreign companies and governments. First, it threatens the position of foreign firms in China and abroad. The program explicitly targets foreign-dominated sectors, aiming to replace imports in key value chains. With almost 100,000 Specialized SMEs and more than 12,000 Little Giants receiving state support, foreign enterprises need to prepare for heightened competition. While the program may not deliver immediate results in all areas, government pressure to adopt indigenous suppliers will steadily increase across the board.

The sheltered position of China’s high-tech SMEs within their enormous home market is a crucial advantage. Once they scale up domestic production and invest more in R&D, they are well placed to tackle foreign markets. Foreign firms do not have access to this sort of “safe haven.” The impact will be felt acutely in emerging technologies where China expects its high-tech SMEs to act as key innovators and lead market growth, such as renewable energy, power equipment, medical technology, and electric vehicles.

Foreign firms need to invest more in innovation and digitalization to maintain their competitiveness. The rise of local Chinese companies such as Leaderdrive, which are acquiring market share in areas long dominated by foreign companies, ought to be a wake-up call for foreign firms. While many foreign companies have enjoyed favorable positions in China due to specialization and technological advantages, the tide may quickly turn.

Second, by further blurring the lines between state support and market forces, Beijing has made it more difficult to track distortionary practices and enforce fair competition. Foreign governments must recognize that many of China’s SMEs now enjoy the full backing of Chinese industrial policy and represent a new conduit for market distortions. Close exchange between governments and their businesses operating in China will be necessary to monitor developments and take remedial action.

In Europe, for instance, institutions like the European Union (EU)’s SME Trade Defence Helpdesk monitor market distortions that disadvantage European SMEs and take prompt action where needed. The application of a “government-backed” label to relevant Chinese high-tech SMEs should be considered by the EU to fend off subsidized foreign products and entities. EU ambitions to reform the international trade rulebook should also consider the challenges posed by China’s direct and indirect support for high-tech SMEs.

Foreign governments can engage in dialogue to encourage China to change course. It is important to make clear that undermining the position of foreign firms in China in turn both weakens the ties between China and other advanced economies and sets relations on a more adversarial footing.

Finally, on the macro level, the extensive and skewed ambition of China’s accelerator state program could slow economic growth in China. The broadly defined scope, which targets a wide range of industrial sectors, could be overly ambitious as Chinese firms are unlikely to make significant strides in all areas. Pursuing ever greater localization will lead to economic inefficiencies. The sectoral focus also excludes consumer-oriented service-based industries, such entertainment and education, which served as strong drivers of growth in recent decades. Growth-enhancing innovation may be more likely to come from areas like gaming, fintech, or e-commerce, but these are ignored in favor of hard technologies.

The government steerage of capital markets also harbors risks. Bad investments and misuse of funds earmarked for high-tech SMEs could further drag down growth. This can be seen, for instance, in the flawed process of identifying innovative firms. There is a risk that due to political distortions, a significant share of resources will flow into large parent companies or underperforming firms rather than promoting the growth of dynamic, independent firms.

That being said, to the degree that funds that would have otherwise been dedicated to large firms are now going to SMEs, the new approach could be considered an improvement. The accelerator state suggests that efficiency gains could be achieved by relying more on market forces as well as improving the technological and commercial parameters for directing funding.

Conclusion

China is extending its industrial policy toward small and medium-sized enterprises, heralding the emergence of an “accelerator state.” Government support is increasingly being directed toward high-tech SMEs that can specialize in niche markets and localize key industrial supply chains.

To do so, Beijing has created a tiered cultivation system that blends state guidance with market forces to address the holistic needs of SMEs, particularly by offering preferential access to finance. The Little Giants program demonstrates that the preferential treatment given to SMEs has its drawbacks. While some high-tech SMEs are advancing self-reliance in core technologies, others appear to be gaming the system through connections with local officials and large industry.

Foreign manufacturing firms should be aware of the risks posed to their business by Chinese state-back SMEs. These firms have developed an unfair advantage in their home market that can be leveraged to increase market share abroad. By creating ambiguities between state support and market forces, China has made it more difficult for foreign governments to track distortionary practices and enforce fair competition.

- Endnotes

-

1 | “Notice on Issuing the “14th Five-Year Plan” Robot Industry Development Plan," Ministry of Industry and Information Technology of the People’s Republic of China, December 28, 2021, https://www.miit.gov.cn/zwgk/zcwj/wjfb/tz/art/2021/art_14c785d5a1124f75900363a0f45d9bbe.html.

2 | “Humanoid Robots Wind up, Core Components Help Sail Away -- Robot Industry in-Depth Report,” Zheshang Securities, October 15, 2022, https://pg.jrj.com.cn/acc/Res/CN_RES/INDUS/2022/10/15/5d546581-4fdc-4b14-aea8-7741818b8a97.pdf.

3 | “China Robotics Industry Development Report (2021),” Chinese Institute of Electronics, September 2021, http://www.worldrobotconference.com/uploads/202109/2021%E4%B8%AD%E5%9B%BD%E6%9C%BA%E5%99%A8%E4%BA%BA%E4%BA%A7%E4%B8%9A%E5%8F%91%E5%B1%95%E6%8A%A5%E5%91%8A.pdf.

4 | “Small and Medium Enterprises Service Month | Zhou Pingjun: "Specialized, Specialized, Special and New" Small and Medium Enterprises Development Policy Orientation,” Advanced Manufacturing Technology Business School, June 2022, https://www.amtbs.cn/article/e8244eb50e794f388acb547a202ca9c6.

5 | “Three "new" and one "hot" reflect the development potential of "little giant" enterprises,” Xinhua, September 20, 2023, http://www.news.cn/tech/20230920/909bea7e3d844472a5a639cb24eb0bae/c.html.

6 | Zhu Haibin, “[Open Source] Beijing Exchange Second Anniversary Special Topic 1: Born toward the sun,” golden key to wealth via Sohu, September 1, 2023, https://www.sohu.com/a/716938494_121123885.

7 | Leaderdrive, accessed January 19, 2024, http://www.leaderdrive.cn/companyIntroducePage.

8 | “Notice on Issuing Several Measures to Help Small, Medium and Micro Enterprises Stabilize Growth, Adjust Structure and Strengthen Capabilities,” Ministry of Industry and Information Technology of the People’s Republic of China, January 15, 2023, https://www.miit.gov.cn/zwgk/zcwj/wjfb/tz/art/2023/art_0ac5cd8988084fff9e4a70da792baa10.html.

9 | “Financing credit for specialized and special new enterprises may become more flexible,” Shi Qingchuan, Sina Finance, May 30, 2022, https://finance.sina.com.cn/roll/2022-05-30/doc-imizirau5634939.shtml.

10 | “Nearly 50% of the special new financing in the first quarter was concentrated in Beijing and Shanghai, and 30% of the newly listed A-share companies were small giants丨Specialized Special New Capital Market Quarterly Report,” Sina Finance, May 15, 2023, https://finance.sina.com.cn/tech/roll/2023-05-15/doc-imytvrpe7311928.shtml.

11 | “Discovering Specialized SMEs and Little Giants – Joint report on Specialized SMEs total number and sectors,” Everbright Securities, October 23, 2021, https://pdf.dfcfw.com/pdf/H3_AP202110261525051169_1.pdf?1635266793000.pdf.

12 | “Explainer | A timeline of China’s 32-month Big Tech crackdown that killed the world’s largest IPO and wiped out trillions in value,” Lillian Zhang, South China Morning Post, July 15, 2023, https://www.scmp.com/tech/big-tech/article/3227753/timeline-chinas-32-month-big-tech-crackdown-killed-worlds-largest-ipo-and-wiped-out-trillions-value.

13 | “Interpretation of the "Interim Measures for the Gradient Cultivation and Management of High-Quality Small and Medium-sized Enterprises",” Government of the People’s Republic of China, June 3, 2022, https://www.gov.cn/zhengce/2022-06/03/content_5693839.htm.

14 | Yanbo Wang, Jizhen Li, and Jeffrey L. Furman, “Firm performance and state innovation funding: Evidence from China’s Innofund program,” Research Policy 46, no 6, (2017): 1142-1161.