Evolving Made in China 2025

China’s industrial policy in the quest for global tech leadership

Four years ago, China launched its ambitious industrial strategy Made in China 2025 and caused considerable irritation around the world. The blueprint for China’s path to becoming an industrial superpower has changed the way foreign companies, business associations, and governments view the country. They increasingly perceive the People’s Republic more as a systemic rival than a partner. Made in China 2025 has recently disappeared from official rhetoric of the Chinese leadership. But Beijing’s aims remain unchanged and its industrial policy is already being implemented: it wants Chinese companies to become global leaders in ten core industries by 2025. And it aims to be a global technological superpower by 2049.

The two MERICS authors, Max J. Zenglein and Anna Holzmann, describe Made in China 2025 as an effort by Beijing to optimize its hybrid state-capitalist system. Their study “Evolving Made in China 2025: China‘s industrial policy in the quest for global tech leadership” traces how Beijing has adjusted its industrial policy, reacted to setbacks, set up pilot projects, and invested heavily in research and development in strategically important industries in the recent past.

Download the MERICS Paper on China as PDF here or read the Executive Summary below:

Executive Summary

From blueprint to implementation: “Made in China 2025” is here to stay

Four years ago, China launched an ambitious plan to become a leading global technological superpower by 2049. Party and state leader Xi Jinping himself made the strategy “Made in China 2025” (MIC25) his signature project, reflecting how crucial it is to China’s future development. The strategy defines ten core industries, such as robotics, power equipment and next-generation IT, in which China wants to achieve major breakthroughs and create globally competitive companies.

Backed by industrial policy, massive financing, and subsidies in the hundreds of billions of US dollars, both state and private companies aim to build the technological foundations of the “China Dream,” a revitalization of the nation the Chinese Communist Party (CCP) has been promoting vigorously under Xi ahead of two important centenaries. For the party’s 100th birthday in 2021, China aims to become a moderately prosperous nation, while for the 100th anniversary of the People’s Republic of China in 2049, it aspires to become a “global manufacturing”, “cyber”, and “science and technology innovation superpower”.

In Western industrialized countries, China’s ambition has caused considerable irritation. Businesses and experts assessed that China was using unfair business practices and stealing technology in its efforts to become the world’s tech superpower. MIC25 has fueled concerns that foreign competitors would be pushed out of the lucrative Chinese market and face fierce competition in third markets, while China becomes not only more competitive in innovative sectors of its own domestic economy, but also as the market shares of Chinese companies abroad grow.

China has responded to this criticism from abroad by toning down its references to the plan. Beijing directed media coverage and official statements on MIC25 to be dialed back. Even the name “MIC25” and trigger words such as “self sufficiency rate”, considered indicative of China’s efforts to replace foreign products and tech, were largely dropped from policy papers. Xi did not mention “Made in China 2025” at this year’s Central Economic Work Conference, nor did Premier Li Keqiang in the Government Work Report for the annual National People’s Congress – two key events Chinese leaders traditionally use for setting strategic directives.

Dropping the rhetoric of MIC25 is strategic

This is a tactical move: China has not at all abandoned its economic – and strategic – goal of catching up with Western industrialized countries and gaining a competitive edge in high-tech and emerging technologies. Four years after its official launch, the strategy has moved from blueprint to implementation. The MIC25 program is here to stay and, just like the GDP targets of the past, represents the CCP’s official marching orders for an ambitious industrial upgrading. Advanced economies around the globe will have to face this strategic offensive.

In the last decade, China’s growth has continuously slowed. In 2018, the economy expanded by 6.6 percent, the weakest pace since 1990. The country also risks being caught in the middle-income trap, a problem many developing countries faced when rising wages eroded their comparative advantage, making them unable to compete with the productivity and innovation of advanced economies. For China’s leadership, there is no alternative to substantially upgrading its industrial and economic base. It has to keep growth levels between six and seven percent to fulfill its promise of prosperity and maintain its legitimacy.

MIC25 is rooted in East Asian development approaches and constantly adjusted to changing realities

To some extent, China and MIC25 follow the blueprint of Japan, South Korea, Singapore and Taiwan in breaking through the ceiling of low-tech and labor-intensive manufacturing that restricts the growth of developing and emerging economies. This “East Asian development model” is characterized by industrial policies that target strategic sectors, and a strong government that effectively aligns business interests (state-owned as well as private) with national targets. Using this template, China hopes to successfully overcome the middle- income trap and reduce its reliance on foreign technology.

Taking the Asian Tiger nations – South Korea, Taiwan, Singapore and Hong Kong – as an example, MIC25 aims to move more sophisticated parts of the value chain and high-caliber research and development into China. If successful, it would replicate achievements of the electronics industry in other high-tech sectors. In electronics and ICT, companies like Haier, Lenovo, Huawei, or DJI have today become international household names.

Because of its comprehensive and adaptive nature, the efficiency and success of MIC25 are difficult to evaluate. Since 2015, there have been setbacks due to planning mistakes that resulted in overcapacities and inefficient allocation of funds.

But its implementation gained momentum two years ago in response to a slowdown of GDP growth and the unfolding trade dispute with the United States. The strategy is constantly being adjusted to newly emerging challenges. By the end of 2018, the Chinese government had issued a total of 445 authoritative documents detailing implementation measures. Local governments continue to be highly active translating Beijing’s national vision into local directives.

Chinese policy makers have also constantly readjusted the ambitious targets for increasing domestic market share in certain innovative sectors. According to the Technology Roadmap 2017, specifying the implementation of MIC25, China wants to reach a 90 percent market share for new energy vehicles (NEV) and an 80 percent share for IT products for vehicles by 2025. Other targets include a certain number of patents per 100 million CNY in revenue, and the development of quality brands.

China is determined to dominate smart and emerging technologies

Chinese companies from more traditional high-tech sectors like aerospace, machine tools, or software engineering face the challenge of catching up with foreign competitors. They do not prioritize the development of top-notch products and global leadership and are content to overcome existing technology gaps by building up sufficient (as opposed to state-of-the-art) domestic expertise.

This is completely different for sectors crucial to the fourth industrial revolution currently unfolding worldwide. In smart manufacturing, digitalization and emerging technologies, China wants to leapfrog and leave foreign competitors behind. Technology gaps in these fields are more fluid, and China sees the opportunity to assume a leading position right from the start. The tables have already started to turn: Today, China is setting the pace in many emerging technologies – and watches as the world tries to keep pace.

China has forged ahead in fields such as next-generation IT (companies like Huawei and ZTE are set to gain global dominance in the roll-out of 5G networks), high-speed railways and ultra-high voltage electricity transmissions. More than 530 smart manufacturing industrial parks have popped up in China. Many focus on big data (21 percent), new materials (17 percent) and cloud computing (13 percent). Recently, green manufacturing and the creation of an “Industrial Internet” were given special emphasis in policy documents, underpinning President Xi Jinping’s vision of creating an “ecological civilization” that thrives on sustainable development.

China has also secured a strong position in areas such as Artificial Intelligence (AI), new energy and intelligent connected vehicles. The electric vehicle (EV) battery market is a powerful example of how quickly such dynamics may unfold and global value chains are absorbed. In 2017, seven of the top ten EV battery companies were Chinese, accounting for 53 percent of the global market share. The expansion of China’s battery manufacturing capacities is in the pipeline and could amount to three times that planned in the rest of the world.

Foreign tech dependency is China’s achilles heel

The Chinese government pushes the development of future technologies by providing financial support and by creating demand through, for instance, beneficial regulations or tax incentives to quickly turn ideas from niche industries into products suitable for mass consumption.

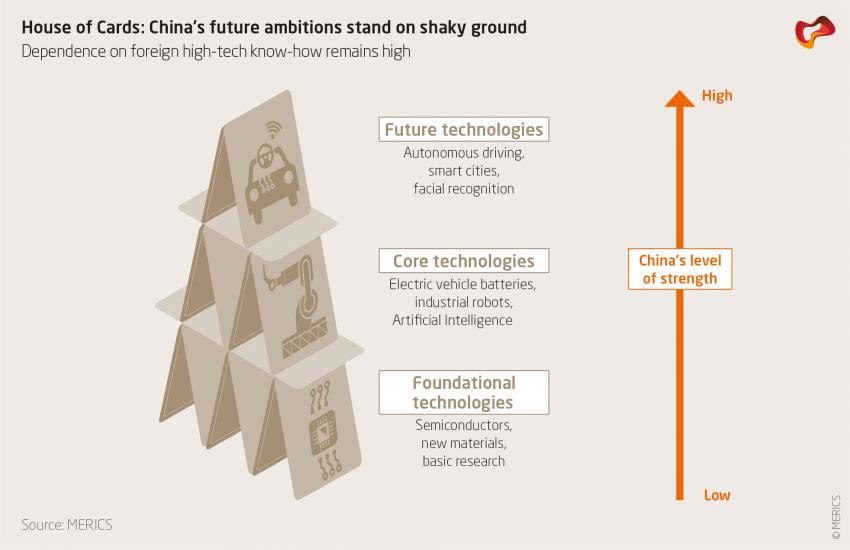

However, dependency on foreign core components is still a major bottleneck for China’s national tech ambitions. Its industry has considerable weaknesses in mastering foundational technologies essential for developing an advanced high-tech sector in certain areas, especially for the digital economy. This vulnerability is most evident in the fields of new materials, semiconductors and key components for advanced machinery and machine tools. Chinese tech firms have already experienced considerable difficulties when cut off from access to chips or other high-tech components from abroad, as US trade measures against companies like ZTE and Huawei recently illustrated.

Chinese planners are engaging on several levels to eliminate these weaknesses. First, the country invests heavily in research. In 2018, the country spent around 300 billion USD on research and development, nearly 2.2 percent of GDP. Sheer scale in absolute figures might, at some point, give China an advantage over smaller industrialized countries that spend much less. As a percentage of GDP, China’s R&D spending has already surpassed that of the EU (2.1 percent).

Second, the government is pushing to more centrally coordinate the implementation of MIC25 and related industrial policies. Each region is assigned to focus a particular aspect of tech development. Unlike previous national economic policy plans, MIC25 attaches more importance to private companies, entrepreneurship and market mechanisms while at the same time improving the competitiveness of state-owned enterprises (SOEs) that are still considered crucial for the innovation drive. In the eyes of China’s leadership, this is part of an effort to optimize China’s hybrid state capitalist system. But many contradictions associated with simultaneously strengthening market forces and the role of the state remain unresolved.

China mobilizes regions and private companies to make MIC25 a success

Since the official launch of MIC25 in 2015, the Chinese government has tried to learn from setbacks and mistakes. In moving from blueprint to implementation, the strategy is constantly being updated. In 2018, for instance, China’s Ministry of Industry and Information Technology (MIIT) listed its key focal points:

- Establishing local specializations and “MIC25 National Demonstration Zones”

- Industrial Internet, emerging industries, establishing world-class industry clusters

- Innovations in basic general technologies

- Establishing manufacturing innovation centers

- Fiscal support mechanisms

Pilot projects related to MIC25 serve as key drivers for the introduction of new technologies into the real economy. In the past two years, around 90 percent of the almost 4,000 projects were announced. Since the inauguration of the first MIC25 pilot city in Ningbo (Zhejiang), 30 more have been established nationwide. Each is tasked with developing specific MIC25-related industries. A government plan details over 50 sub-industries and 115 industrial sub-fields, ranging from aviation engines to functional fiber and products using China’s Beidou navigation system.

In 2018, the so-called MIC25 National Demonstration Zones (NDZ) were introduced as upgraded versions of pilot cities and city clusters. The majority (65 per cent) of China’s most promising top-20 smart manufacturing hubs have emerged from these zones. In addition, the innovation center scheme envisions 40 national-level “core” centers and numerous “supplementary” centers at provincial level.

China’s current advances in many technological areas would not have been possible without the flourishing private sector, the origin of most innovative business models particularly in the digital economy. Industrial policies like MIC25 seek to pair market vitality with strategic ambitions. The development of business models involving AI, alternative energy vehicles, facial recognition, big data, and digital payment and communication systems was mainly driven by private companies vying for business opportunities. The state has created the space for this entrepreneurial spirit to thrive by pursuing a light regulatory approach.

Chinese state-owned enterprises (SOEs) continue to play a critical role for the development of strategic industries and high-tech equipment associated with MIC25. In so-called key industries like telecommunications, ship building, aviation and high-speed railways, SOEs still have a revenue share of around 83 percent. In what the Chinese government has identified as pillar industries (for instance electronics, equipment manufacturing, or automotive) it amounts to 45 percent. The success or failure of SOE reforms will therefore have a direct impact on the ambitious MIC25 endeavor.

Increasingly, the private sector is expected to contribute to improving the competitiveness of state assets. Pilots in mixed ownership reform have seen private companies taking stakes in some of China’s largest SOEs. In another effort to improve their operation, the government strives to achieve consolidation through mergers of private and state-owned entities.

It remains difficult to put a price tag on MIC25

China is investing hundreds of billions in making MIC25 a success, but it is difficult to put a price tag on the strategy. Far beyond classical industrial subsidies, the implementation of MIC25 is backed by a large variety of financial tools, ranging from insurance compensation schemes to tax incentives, facilitated SME financing, and direct funding for MIC25-related demonstration zones and (pilot) projects.

Major state-owned banks such as the China Construction Bank (CCB), the Industrial and Commercial Bank of China (ICBC) and the China Development Bank (CDB) offer financing. In November 2016, CDB pledged an estimated 300 billion CNY to the implementation of MIC25 over the next five years. Reportedly, in March 2018, there were more than 1,800 government industrial investment funds with an aggregate size of about three trillion CNY.

The variety of financing schemes, often involving local governments, SOEs and banks, make a precise estimate almost impossible. Local authorities clearly tend to overstate the size of collected funds in order to signal compliance with central government policies, and funds pledged are often much higher than those eventually deployed.

European participation in China’s tech ambitions is a double-edged sword

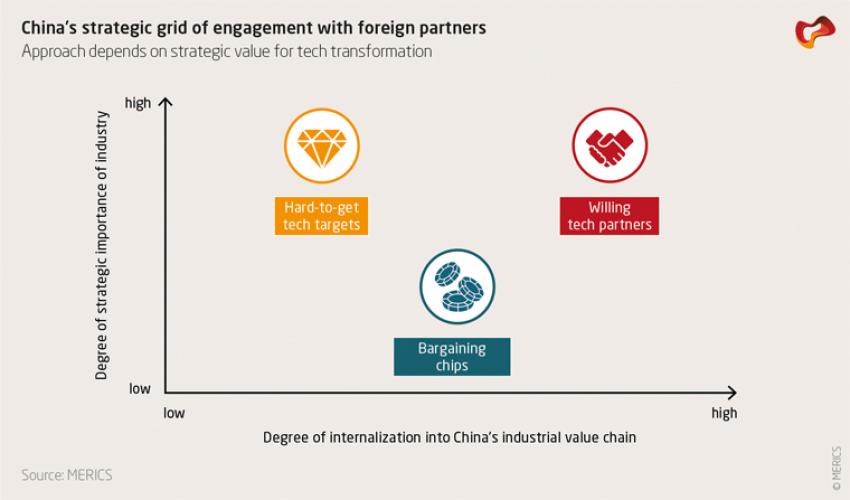

China’s MIC25 strategy is mainly a domestic policy aimed at boosting indigenous capabilities. It is complemented by outward-facing approaches to secure access to foreign know-how and reduce tech dependency. To reach its ambitious goal of moving entire high-tech production cycles into the country, China is pursuing a multi-pronged approach in dealing with foreign partners. These can be categorized in three groups:

Bargaining chips: These are foreign companies in industries that China’s economic planners consider to be of lower strategic value. This is the case for consumer goods such as restaurant franchises or retail. The automotive sector has also moved into this category, as much of its production has already moved to China and is less important for further upgrading. Measures like dropping the joint venture requirement in the automobile sector are used by Chinese interlocutors as bargaining chips in reciprocity negotiations. But they are far less significant for foreign companies than they would have been a decade ago.

Willing tech partners: The Chinese government strives to convince foreign companies to move the most sophisticated parts of their value chain to China, with the aim of upgrading domestic industry and either directly or indirectly leading to the desired incorporation of value chains into the economy. The consumer electronics sector is an example of the successful implementation of this strategy: China started off merely assembling products but now produces more sophisticated foundational technology and other key components.

Hard-to-get tech targets: Leading foreign tech companies that retain the most important parts of their value chains outside China are more difficult to approach. In seeking access to their know-how and technologies, the Chinese government uses different strategic approaches, such as a) attracting companies with offers of improved market access or more lenient joint-venture requirements, b) acquiring companies or know-how crucial for MIC25 via Foreign Direct Investment, c) head-hunting or even industrial espionage or cyberattacks. In 2018, 58 percent of the value of Chinese FDI in Europe could be attributed to core industries of the MIC25 strategy.

MIC25 is already affecting Europe’s innovation environment

Foreign companies with sought-after technology can currently benefit from China’s industrial upgrading. However, governments, policy makers and companies should look beyond short-term business opportunities and take more systemic effects into account. China’s innovation offensive will affect the competitiveness of other nations in many high-tech sectors. Its dynamics are already affecting Europe’s innovation environment and industrial foundations on several levels:

- China’s pulling ahead in emerging technologies will change the market environment for European companies. This is already visible in areas such as AI, electric vehicles (EVs) and the EV battery industry.

- The ability to offer more competitive prices for technology that might not be top-notch but that is good enough will put pressure on European companies in a broader set of industries, also in third markets.

- Companies have started to divert R&D to China, especially in emerging industries. Europe will feel the heat of this shift: Carmakers like BMW, VW and PSA have already opened up facilities for electric vehicle R&D in China.

- Fierce competition from Chinese companies might erode the profitability of European companies and limit their ability to fund R&D. This could slow innovation in Europe, allowing Chinese companies to close existing technological gaps at an even greater pace.

Exemplary willing partner: Germany backs China’s innovation offensive in business and research

Germany is one developed nation whose economic base could be directly threatened by China’s ambitions. MIC25 is geared towards replicating the German concept of Industry 4.0. Sino-German tech, industrial and innovation collaboration ranges from fundamental research to more hands-on training and tech application. Attracted by generous conditions offered by Chinese counterparts, (mostly technical) universities and non-university research organizations such as Fraunhofer Society, Max Planck Society and the Helmholtz Association of German Research Centers are key actors in research collaboration with China.

So far, there has been little discussion over who profits most from this intense cooperation. Many German actors seem to neglect the risk of unwanted technology and know-how transfer in fields crucial for the advancement of their own industries.

Europe can learn from East Asia

Compared to a geographically distant Europe, China’s immediate neighbors are already experienced in dealing with China. Europe can learn from this approach and their experiences. China’s East Asian neighbors must manage a far more sophisticated set of challenges: they depend strongly on China economically and at the same time need to consider issues of national security. This is reflected, for instance, in a restrictive approach to investments from and research cooperation with China. Compared to Europe and the US, Chinese investment flows with East Asian countries are largely a one-way street. Taiwanese and Japanese investment in China is 26 and 35 times larger, respectively, than Chinese investment in both countries.

With China becoming more of a competitor in recent years, clear limits were put in place that defined the scope of cooperation. Although the responses are not identical, many have taken measures to safeguard technology, for instance by introduction of strict investment regulations for acquisition of high-tech companies and guidelines on preventing intentional and unintentional knowledge transfer, or the development of incentives to reduce companies’ dependence on Chinese market. The examples of the leading industrial nations in East Asia also show that taking active measures to safeguard key interests and know-how does not necessarily result in a breakdown of economic relations.

Recommendations

Our analysis shows how China’s industrial innovation is in full swing. MIC25 is here to stay. European industrialized countries need to find answers for dealing with the cooperative and competitive aspects of China’s offensive:

1. Improving Europe’s innovation system without copying China

- Combine joint EU responses with small-group efforts of leading member states to improve Europe’s innovation system and better exploit opportunities from current technological changes.

- Improve policy support for applied research by private entities. A better regulatory environment and financial instruments should stimulate research and technology adaptation in Europe.

- Facilitate greater research collaboration within the EU. Take steps to improve coordination and collaboration in Europe’s innovation landscape.

2. Doubling-down on the EU’s nascent China strategy for more economic sovereignty

- Reassert core liberal values for a China strategy by defining areas of mutual interest as well as division.

- Prepare for negative (economic) consequences in defense of EU’s core interests.

- Establish an efficient and reliable coordination mechanism to foster greater alignment between Brussels institutions and member states.

- Strengthen cooperation with like-minded countries and advanced East Asian economies to advance global fair competition and technology standards.

3. Fine-tuning European China strategies to address high-tech competition

- Recognize China’s persistent top-level push for tech independence and spell out conflicts of interest.

- Use China’s persisting dependence on foreign technology as leverage to promote European interests.

- Initiate steps to limit dependence on critical components from China.

- Strengthen the role and coordination of European business associations in assessing China’s high-tech policies and developing responses.

4. Safeguarding research and technological know-how

- Review and monitor Sino-European agreements on science and tech cooperation.

- Define criteria for government-initiated science and technology cooperation.

- Introduce better safeguards against technology transfers.

- Require mandatory reporting for cooperation in highly sensitive areas, also in basic research.