MERICS Global China Inc. Tracker

No. 4, December 2021

What you need to know

The Belt and Road evolves as competing Western initiatives gather speed

China is changing the Belt and Road Initiative’s (BRI) focus while the EU rebrands its connectivity work to compete with China. At the same time, the US is pitting democracy against authoritarianism, attempting to recover its image as leader of the free world. In this contest of narratives, all sides are pushing the concept of sustainability. In this edition of the Global China Inc. Tracker, we explore what sustainability and the green transition mean in terms of China’s overseas investments.

President Xi told the third high-level symposium on the BRI in Beijing on November 19 that the BRI should “serve a new development pattern” characterized by “high-quality” and “green” development. The linkage between the BRI and sustainability is not new. However, Beijing has started to set out guidelines that could enact genuine change.

President Xi spoke of the need for a project risk assessment platform, indicating a new level of risk aversion. He also called for the prioritization of “small and beautiful” projects, breaking with the BRI’s established pattern of financing megaprojects in transport and energy sectors.

A scaled-down BRI was also evident at the triennial summit that plays a central agenda-setting role in China’s policy towards Africa. The 8th ministerial conference of the Forum on China-Africa Cooperation (FOCAC) was held in Dakar from November 29-30.

At this year’s summit, President Xi trimmed China’s funding commitment to Africa for the first time. The amount of pledged credit was cut from USD 20 billion to USD 10 billion, and rather than supply African governments with the credit for Chinese-built projects, the initiative will give African financial institutions the credit to develop African companies.

This movement away from big ticket infrastructure items reflects a more cautious approach and brings Beijing closer to Western norms of smaller scale funding for private enterprise. Echoing sustainability focused Western initiatives, President Xi also stressed the “green,” “digital,” and “health” aspects of cooperation, promising to lead Africa in its clean energy transition. China’s new “Global Development Initiative,” which was launched in September and mentioned in President Xi’s FOCAC speech, is also intended to signal Beijing’s commitment to the United Nation’s 2030 Sustainable Development Agenda.

The shift in China’s approach comes while Western challenges to the BRI have been picking up speed. On December 1, the European Commission revealed its plan for the EU’s renewed connectivity agenda, known as the “Global Gateway,” which is seen as a response to China’s BRI funding for infrastructure in developing countries.

The 14-page document gives fresh details about the initiative’s institutional structure: the Vice President of the European Commission will be responsible for implementation and a Global Gateway Board will provide strategic guidance. It also puts an ambitious price tag on Global Gateway – EUR 300 billion between 2021-2027, including EUR 26.7 billion of new funding in partnership with the European Investment Bank (EIB).

The document includes several sections called “Global Gateway on the ground,” however it names no new specific projects and leaves out concrete details about the initiative’s implementation. It shows that Global Gateway, like China’s BRI, is largely a repackaging and branding of existing funding mechanisms.

On the other side of the Atlantic, US President Joe Biden convened the first of two virtual “Summits for Democracy” on December 9. In his opening remarks,1 President Biden announced USD 424 million of funding to support independent media and anti-corruption work around the world. He claimed that the world stands at an “inflection point” that will determine the course of democracy in the coming decades, positioning the United States as leader of a global democratic revival.

The inclusion of Taiwan at the summit was particularly irksome to Beijing, which fears that the platform might pave the way toward international recognition of Taipei. Other countries have also expressed displeasure at the summit or sidestepped invitations. Hungary, the only EU nation not invited, tried to block President von der Leyen from speaking at the summit.

Tensions between China and the West are increasingly reflected in competing initiatives and attempts to carve out spheres of geopolitical allegiance. In his speech at the BRI symposium in November, President Xi recognized these tensions, positing “cooperation and struggle” as a central theme of the new BRI. Moving forward, competition with Western initiatives like the US’ Build Back Better World (B3W) and the EU’s Global Gateway, will be a principal concern of the BRI.

In this edition of the Global China Inc. Tracker, the “Regional Spotlight” section looks at competition between China and the EU in green technologies, focusing on Chinese wind sector investments within Europe. Aiming to diversify their portfolios and gain expertise in offshore wind technology, China’s state-owned enterprises have acquired a substantial portfolio of wind projects in Europe since 2016.

The “Key Player” focuses on the investments in mineral resources that will underwrite the clean energy transition. It describes Chinese overseas acquisitions of four key battery minerals: Cobalt, Copper, Lithium, and Nickel. China’s footprint in these four mineral markets is the result of efforts to address its own strategic vulnerabilities, and a forward-looking agenda that anticipated clean energy demand several years before it became topical in the US or Europe.

Finally, in “Global China Inc. Updates,” we provide succinct updates on the overseas activity of Chinese companies these past three months.

Regional Spotlight: China’s wind energy forays into Europe

Competition enters the safe space of climate change cooperation

Beijing will increasingly vie with Europe and the United States for the narrative prize of global leadership on climate issues. For instance, Beijing’s pledge at the FOCAC summit2 to guide Africa in its clean energy transition poses a competitive challenge to similar aspirations embodied in the EU’s Global Gateway, and its Africa-EU Green Energy Initiative.

Leadership and market share in green technologies will also be at stake as economies become increasingly shaped by environmental imperatives.

The EU has pledged to be carbon neutral by 2050, and China by 2060. Both have pinned their hopes on the development of high-tech industries like wind energy, “green” hydrogen, and electric vehicles (EVs) to achieve their carbon-neutral goals. China’s 14th Five-Year Plan (FYP) highlights green technologies as “new pillars of the industrial system,” while the European Green Deal envisions investment of EUR 1 trillion in a technology-driven transition to a green economy.

Green energy investments are focused on developed markets

A large part of Beijing’s efforts to achieve leadership in green technologies will unfold at home, through research and development initiatives, but foreign markets and international acquisitions also play an important role.

Since the Second Belt and Road Forum in 2019, the adjectives “green, open, and clean” have often been tagged to the BRI. This year, President Xi told the United Nations General Assembly that China would stop building new coal plants overseas in his video-link speech in September.3

The BRI is slowly becoming greener. However, developing countries still struggle to obtain Chinese state finance for “clean energy” projects due to obstacles and inadequate incentives. The bulk of Chinese state finance in developing countries is channeled into transport, fossil-fuel energy projects, and resource extraction.

In Europe, the opposite is true. Chinese-financed energy projects are overwhelmingly green. The EU is one of the world’s largest markets for clean energy systems and countries like Germany, Denmark, and Spain are world leaders in these technologies. European markets therefore present Chinese companies with valuable opportunities to gain market share and know-how.

Chinese electric vehicle manufacturers are rising up the value chain

Chinese EV manufacturers such as BYD and Nio have established themselves as global competitors to European car makers. They have risen up the value chain partly through overseas investments - new production plants, R&D centers, and overseas acquisitions sponsored by central and local governments. In a MERICS China Monitor published in September,4 Gregor Sebastian provides an in-depth exploration of the European ambitions of China’s EV makers.

Europe is crucial to the success of China’s wind turbine manufacturers

Like many of China’s high-tech industries, wind power has developed in three broad phases: 1) reliance on imports; 2) manufacture for domestic markets, frequently based on own-designed or co-designed turbines; 3) followed by forays into global markets.

Wind turbines differ from solar panels in that they are difficult to transport and assemble, so local manufacture is important. An export-based business model is unlikely to be viable. However, Chinese turbine manufacturers have begun looking at localizing production in Europe. In September, Ming Yang Smart Energy Group Ltd. announced it was planning to set up a major manufacturing facility in Germany, with an eye to Europe’s growing renewable power market.

Chinese companies in sectors like electric vehicles (EVs) and wind turbine manufacturing benefit from some of the same conditions that dethroned European solar manufacturers in the 2010s, principally state support and a massive protected market at home.

Backed by a USD 6 billion credit line from China Development Bank, Xinjiang Goldwind Science & Technology Co., embarked on strategic overseas expansion over the last decade.5 By 2018, Goldwind had reached the number two spot in industry rankings by global market share.6

In September, Ming Yang secured an order for its second European offshore windfarm.7 It clinched its first such deal in January,8 to supply turbines to the 30 megawatt (MW) Taranto offshore windfarm in Italy. Goldwind announced its entry into the Greek market last year with two orders,9 and in September this year it also celebrated winning 600 MW of orders from Ukraine.10

Aiming to diversify their portfolios and gain expertise in offshore wind technology, China’s state-owned enterprises have acquired a substantial portfolio of wind projects in thirteen countries since 2016. The bulk of these acquisitions are the responsibility of China Three Gorges Corp.

China’s climate action plan centers on technological innovation, to be achieved through more active state involvement. China’s state capitalist interventions in global markets are the principal source of tensions between the EU and China, and this holds true for green technologies.

Top Chinese wind manufacturers have developed a winning cost-quality combination by utilizing their massive domestic base coupled with international exposure. Their offering now seems poised to capture global market share and compete with established European champions.

Key Player: Chinese mining companies

China is either the largest market or largest producer for all seven of the main minerals needed to build a typical electric car.11 These minerals are graphite, copper, nickel, manganese, cobalt, lithium, and rare earth elements (REEs) - a grouping of 17 separate, but similar metals, that are needed in small quantities for a huge range of modern manufactured goods.

Despite requiring hundreds of times more material during operation than a system based on renewable energy,12 clean energy technologies are much more material intensive to produce. According to a report from the International Energy Agency (IEA),13 production of an electric car requires six times more mineral inputs than its fossil-fueled counterpart, and an onshore wind plant nine times more minerals than a gas-fired power plant.

According to the World Bank, the current global production capacity of key minerals like copper, cobalt, and lithium will need to increase 500 percent by 2050 to meet the demands of the clean energy transition. Improved recycling can help soften this demand. Nonetheless, much of the 3 billion tons of material the World Bank estimates will be needed to keep global warming below 2 degrees centigrade comes from the earth’s crust.16

China already consumes as many battery minerals as the rest of the world combined, and as demand grows it has been forced overseas to secure its domination of battery supply chains. China has domestic manganese and graphite resources, but for copper, nickel, cobalt, and lithium, it has been imperative to look overseas.

Despite being poorly endowed with minerals like cobalt and lithium, China has nonetheless come to dominate global processing capacity. Taking its cue from the central role of oil in 20th century geopolitics, Beijing has made a concerted push to secure its supply of new energy minerals.

China’s overseas footprint in these four mineral markets is the result of efforts to address its own strategic vulnerabilities, and a forward-looking agenda that anticipated clean energy demand several years before it became topical in the US or Europe.

Manganese

Manganese has a range of industrial alloy uses and is also starting to be used in EV batteries to replace more expensive minerals. By a small margin, the EU considers manganese non-critical. Manganese ore is found in plentiful supply around the world, including within China but - as with many metals - it is in mid-stream processing capacity that China dominates. China produces 95 percent of refined, electrolytic manganese metal, which is important as an additive in steel. In March 2021, a state-backed alliance led by Tianyun Manganese Industry was formed to consolidate control of output; in April, several Chinese producers mounted a coordinated suspension of production, driving up prices.

Graphite

Though less well known than battery minerals like lithium, graphite is by far the weightiest ingredient in most EV batteries. Graphite comes in natural and synthetic forms, both of which are used for EVs. Synthetic graphite is an energy intensive byproduct of coal mining or oil refining, and China accounts for 69 percent of the global supply of natural graphite. China is the source of 47 percent of natural graphite used in EU markets and the EU classifies it as a critical raw material.

Graphite is relatively abundant. Turkey, not China, has the world’s largest graphite reserves. Graphite mining outside of China is advancing with rising demand, but the world remains almost entirely dependent on China for the processed anode material used in batteries.

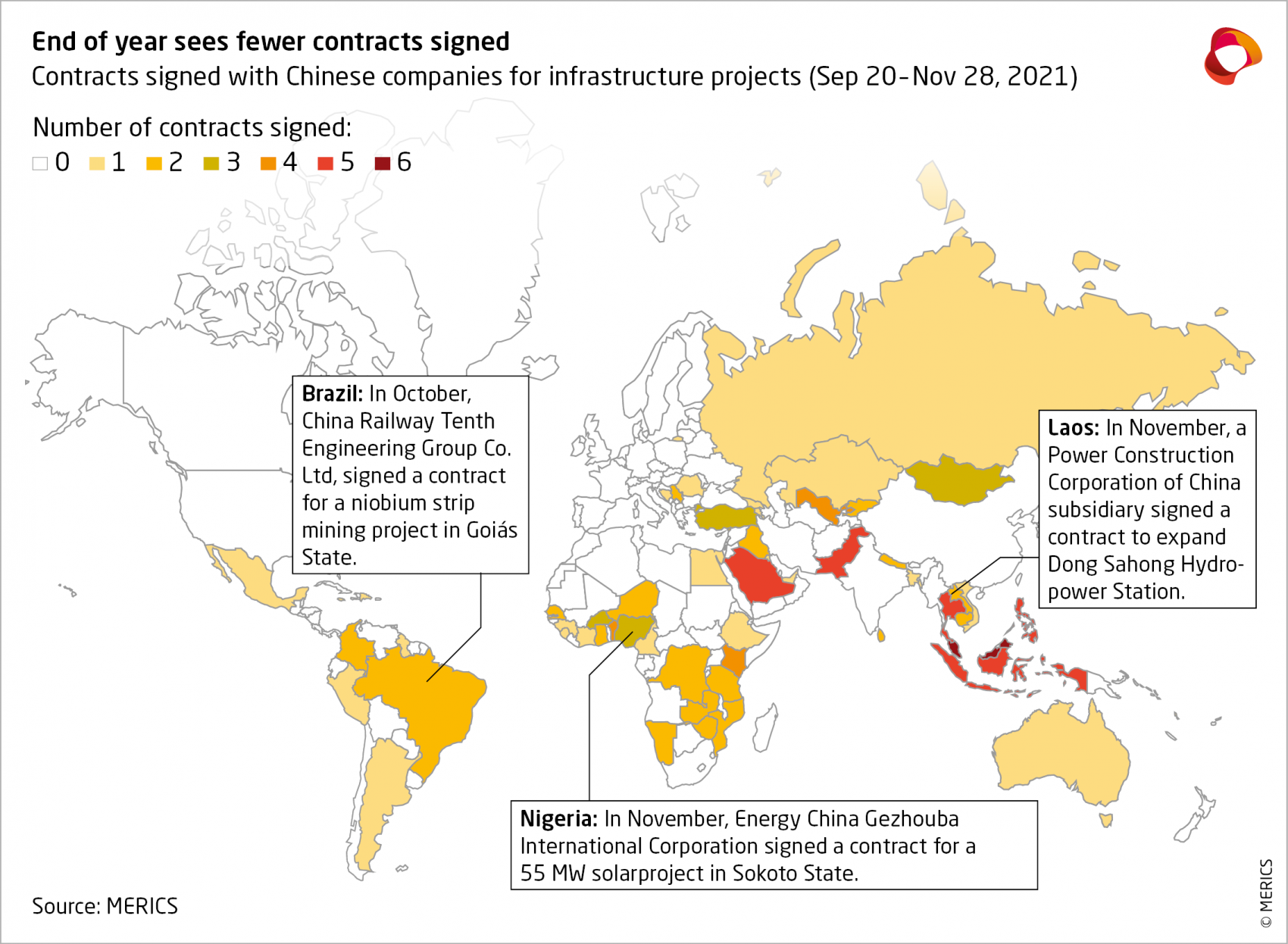

Global China Inc. Updates

ENERGY

Firsts in Chinese clean energy projects for Vietnam and Kyrgyzstan

On October 18, a 50 MW wind power project in Ningshun, Vietnam, entered commercial operation. It was constructed by China Energy Engineering Group Co. Ltd and was the first Vietnamese wind project backed by a Chinese company, and the first onshore wind power project to use Chinese wind turbines. In Kyrgyzstan, China Railway 20th Bureau Group Co. Ltd has signed an agreement to build the country’s first large scale solar project – 1000 MW planned in Issyk Kul. As global demand for clean energy systems increases, Chinese companies are finding more opportunities to deliver on Beijing’s promises of a “Green Silk Road.”

Huawei enters the clean energy business

Huawei Digital Power Technologies announced on October 18 that it had signed a contract to build what it claims will be the world’s largest energy storage project in Saudi Arabia.17 The battery project is attached to a 400 MW solar plant being built by Chinese company SEPCOIII Electrical Power Construction Co. Ltd. Huawei Digital Power was established in June 2021 by Huawei Technologies Co. Ltd in a bid to tap into growing demand for clean energy. In recent years, China has strengthened its presence in renewable energy in the Arab states of the Persian Gulf as they look to a post-oil future.

TRANSPORT AND LOGISTICS

Flagship BRI railway completed in Laos

On December 3, the Laos-China Railway was officially inaugurated. The USD 5.9 billion, 414 km railway is the first link in a long-envisioned Belt and Road route running south from China to Singapore. Of the costs, USD 3.54 billion was paid for with a loan from China Exim Bank, while total costs were equal to almost one third of Lao’s GDP. The project was developed by the Lao-China Railway Company, with 70 percent Chinese and 30 percent Laotian ownership.

Long delayed Hanoi metro project finally operational

On November 6, service began on the first metro line in Vietnam, Hanoi’s 2A metro running from Cat Linh to Ha Dong. The line, built by China Railway Sixth Group Co. Ltd, was approved in 2008 and due to open in 2013. It was delayed by several design changes and contractual conflicts. The total cost jumped by 57 percent from the original cost estimate to more than USD 868 million, of which 77 percent was funded by Chinese loans.

DIGITAL AND HEALTH

Cainiao digital logistics hub officially opened in Liege

Cainiao Smart Logistics Network Limited, the logistics arm of Alibaba Group Holding Limited has opened a new logistics facility at its Liege Electronic World Trade Platform (eWTP) hub at Liege airport, Belgium. The smart logistics hub forms part of a EUR 300 million investment by Cainiao, under a 2018 deal between Alibaba and the Belgian government to join the eWTP initiative. Alibaba has also established a rail link between Liege and Zhengzhou in central China. Liege is the frontline of Alibaba’s push into Europe to challenge the supremacy of Amazon.com Inc.

MANUFACTURING, CONSTRUCTION, AND RESOURCES

Chinese companies scoop up lithium projects

In the scramble to secure new energy supply chains, four Chinese companies have acquired access to over 2 million tons of lithium resources over the next 35 years.18 On September 1, International Lithium Corp said it would sell its remaining 8.58 percent stake in the Argentine Mariana lithium salt lake project to a subsidiary of Jiangxi Ganfeng Lithium Co. Ltd. On September 28, Chinese battery maker Contemporary Amperex Technology Co. Ltd (CATL) said it would buy Canada’s Millennial Lithium Corp, granting it access to Pastos Grandes and Cauchari East in Argentina.

On October 8, it was announced that Zijin Mining Group Co. Ltd will buy Canada’s Neo Lithium Corp for USD 737 million,19 gaining access to one of the world’s top lithium reserves, the Tres Quebrada Salar salt lake. Finally on November 4, Shenzhen Chengxin Lithium Group Co. Ltd announced plans to acquire a 51 percent majority stake in Zimbabwean mining venture, Max Mind Investment Ltd, for USD 76.5 million.20

Kamoa-Kakula copper project smelter

On 23 November, Zijin Mining Group Co. Ltd announced its board had approved investment in a USD 769 million smelter for its Kamoa-Kakula copper project in the Democratic Republic of Congo (DRC). The contract to build the smelter was awarded to China Nerin Engineering Co. Ltd. The copper project is a joint venture with Canadian firm Ivanhoe Mines Ltd, and holds the world’s highest grade copper.

- Endnotes

-

1 https://www.whitehouse.gov/briefing-room/speeches-remarks/2021/12/09/remarks-by-president-biden-at-the-summit-for-democracy-opening-session/

2 https://www.fmprc.gov.cn/mfa_eng/zxxx_662805/202112/t20211203_10461779.html

3 https://www.economist.com/china/china-promises-to-stop-backing-new-coal-power-projects-overseas/21804956

4 https://merics.org/en/report/drivers-seat-chinas-electric-vehicle-makers-target-europe

5 http://fec.mofcom.gov.cn/article/ywzn/xgzx/zlyj/201511/20151101187162.shtml

6 https://www.statista.com/statistics/272813/market-share-of-the-leading-wind-turbine-manufacturers-worldwide/

7 https://www.offshorewind.biz/2021/10/29/mingyang-secures-second-offshore-wind-turbine-order-in-europe/

8 https://renews.biz/65977/mingyang-makes-european-breakthrough-at-taranto/

9 https://zh-cn.facebook.com/GoldwindGlobal/posts/goldwind-in-joint-hand-with-its-european-holding-subsidiary-vensys-energy-ag-is-/137338391194765/

10 https://www.evwind.es/tags/goldwind

11 https://www.iea.org/data-and-statistics/charts/minerals-used-in-electric-cars-compared-to-conventional-cars

12 https://carbontracker.org/mineral-constraints-for-transition-overstated-by-iea/

13 https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

14 https://supchina.com/2021/09/02/the-rare-earth-myth/

15 https://ec.europa.eu/growth/sectors/raw-materials/areas-specific-interest/critical-raw-materials_en

16 https://www.worldbank.org/en/news/press-release/2020/05/11/mineral-production-to-soar-as-demand-for-clean-energy-increases

17 https://solar.huawei.com/eu/news/eu/2021/10/1300-MWh-Huawei-Wins-Contract-for-the-Worlds-Largest-Energy-Storage-Project

18 https://mp.weixin.qq.com/s?__biz=MzIyMTA5OTU1MQ==&mid=2650701782&idx=4&sn=2dd7851cc59afadec4685a4be6598e16&chksm=8fcb3ca6b8bcb5b08eededbafdbe9d7ca118b631c8dec73a132f78fdb7bd02250db8bb62d0aa&mpshare=1&scene=1&srcid=1021YxDaJRPSPjiXqtjswJfO&sharer_sharetime=1634808730495&sharer_shareid=f0c5da8ccb7adf0a445566e4315de8c7&exportkey=AcC9Y6f9rL0GI6TaDIZpYKY%3D&pass_ticket=PGDRl896v2JDiHJU4kE028kGGLvn3%2B6k9shZYS5QfT0BHvxkHOOsdinSM%2FX%2Fvtkp&wx_header=0#rd

19 https://www.reuters.com/article/neo-lithium-m-a-zijin-mining-idUSKBN2GZ010

20 https://www.yicaiglobal.com/news/chengxin-lithium-drops-after-battery-materials-supplier-plans-to-buy-stake-in-mostly-unexplored-mining-project