Stringent Covid controls take their toll on GDP growth

MERICS Economic Indicators Q2/2022

MERICS Q2 analysis: Goodbye growth target: A quick recovery looks increasingly unlikely as troubles mount

China’s economy is stuck in low gear, with the ever-present risk of sharper slowdown. The government’s stern Covid-19 control measures continue to act as a drag on growth, despite the lifting of the harsh regional lockdowns that froze the city of Shanghai and several key manufacturing areas in April and May. There is no sign of a strong rebound coming soon and little reason for optimism amid never ending lockdowns holding back domestic demand and the worsening global economic outlook. The official growth target of “around 5.5 percent” now looks out of reach as the government scrambles to stabilize the economy. As the political elite make final preparations for 20th Party Congress at which President Xi Jinping expects to claim a third term in power, slow growth and pessimistic sentiment will be a real stress test for the economy.

GDP expanded by 0.4 percent in the second quarter, and 2.5 in the first half of the year. Current developments are hitting China’s aspiring middle class hard: securing a good job with a high salary has become secondary to getting a job at all. This summer, a record number of new university graduates will enter one of the worst job markets ever.

The real estate sector captures a lot of the problems currently in the economy. Construction, land and apartment sales are all down significantly. Falling sales adds to cashflow problems of indebted real estate developers and diminishes tax revenue of local governments. Falling building sales reflects weak sentiment of the middle class. Falling prices are eroding wealth and punishing buyers who bought at a higher price but are waiting for construction to be completed.

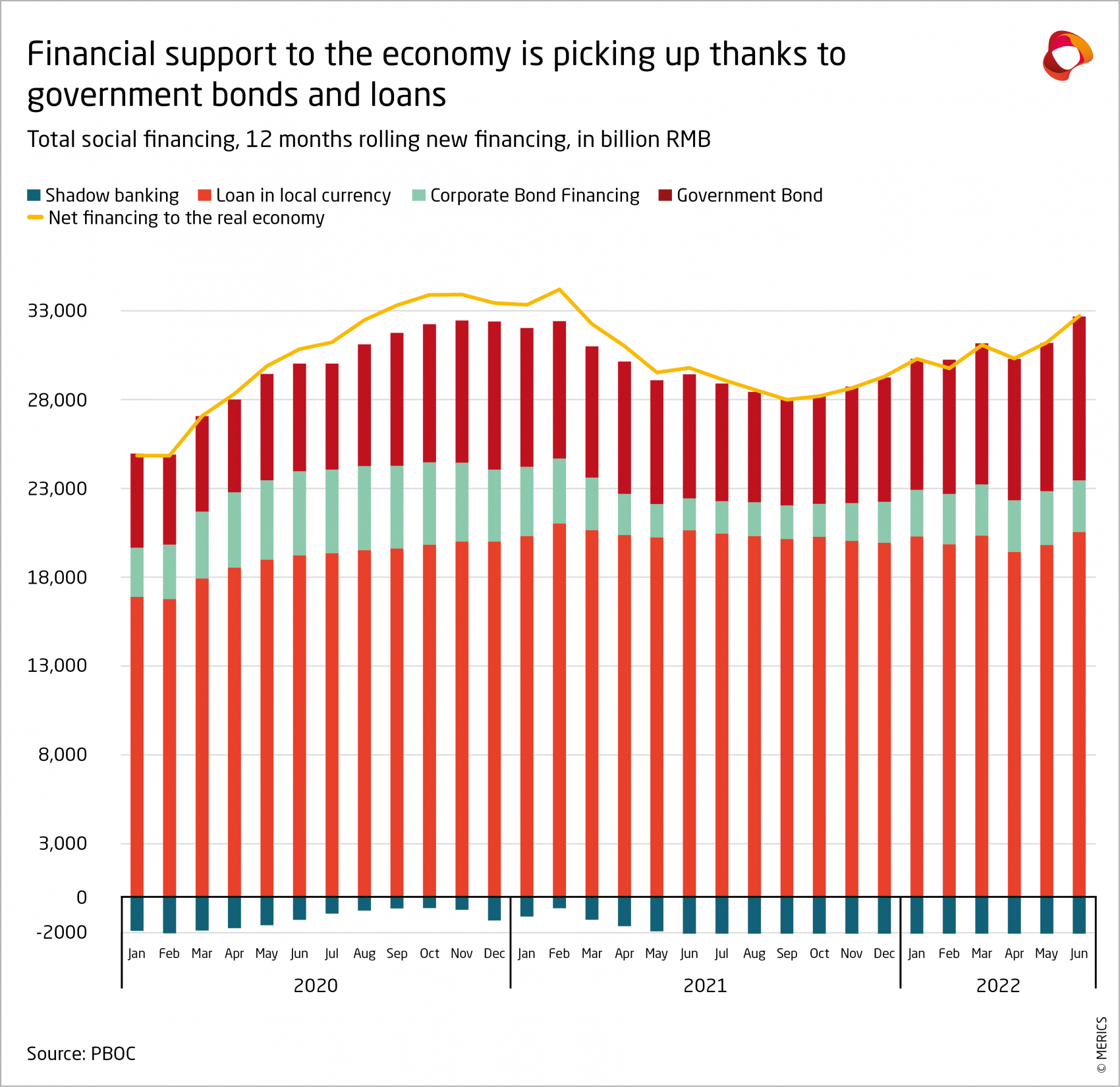

In May, the government began a rapid roll out of new stimulus measures. The State Council announced 33 measures, heavily focused on fiscal and monetary support for investment and consumption. This is a step-change from the cautious stimulus that began in late 2021 and tried to support growth without flooding the economy with cheap money and fueling inflation. The May measures include tax relief worth RMB 1.6 trillion and RMB 3.5 trillion in special purpose bonds. July saw another RMB 300 billion earmarked for special bonds for infrastructure projects and a fresh round of employment programs.

In short, the government appears to be reverting to a familiar policy toolbox. Unfortunately, the economy is now less responsive to stimulus measures focused on infrastructure and investment than it was during the global economic crisis of 2008. Nor do these measures address the corrosive risks posed by middle class disenchantment. University graduates who have suffered China’s intensely competitive exam system for the prize of white-collar work will not want construction jobs or factory work. Their job prospects have been dimmed by tight regulatory curbs that triggered layoffs in more desirable sectors, such as technology firms, finance and real estate.

The government might be able to stabilize the economy through more stimulus, but it will be at the expense of efforts to de-risk the financial sector and boost productivity growth. The biggest lift the government could give to growth would be to phase out ultra-stringent Covid control measures and fully reopen the economy. That seems to be unlikely to happen before sometime in 2023, at best.

The MCCI was first developed in Q1 2017.

Macroeconomics: 2022 growth target seems beyond reach after dismal Q2 growth

Exhibit 1

Exhibit 2

- Official GDP figures published by the NBS indicate the economy narrowly avoided a contraction in Q2. GDP growth slowed from 4.8 percent in Q1 to 0.4 percent in Q2, on a year-on-year basis. This was the second lowest quarterly figure on record after the start of the pandemic in Q1 2020. But a closer look at key economic indicators leaves a dire picture of the economy with few bright spots. Plummeting tax revenue is just one indicator of how deeply the economy is affected (see exhibit 1).

- Lockdown measures continued to disrupt the economy from April onwards. Despite some improvement in May and June, re-occurring lockdowns are preventing a sustainable recovery. In contrast to the V-shaped recovery after Q1 2020, China’s economy is limping along rather than bouncing back.

- China’s official annual GDP growth target of “around 5.5 percent” looks beyond reach as GDP H1 was only 2.5 percent. Broader stimulus measures might avoid a sharper slowdown but are unlikely to give the economy enough of a boost to reach the annual target in the remaining two quarters.

- Stimulus measures are piling on leverage and thus financial risks. The ratio of debt to GDP has ballooned to 284 percent, expanding by 30 points since the start of the pandemic (see exhibit 2). The hard-won gains of the deleveraging campaign are going into reverse. It looks as if credit is increasingly being funneled into less productive areas to prop up growth.

- Manufacturing activity contracted by 0.3 percent in Q2 year-on-year, down from 6.1 percent growth in the previous quarter. NBS figure show construction activity picking up, expanding by 3.6 percent, up from 1.4 percent in Q1. Services continue to be the weak spot with no prospects of change any time soon: growth contracted by 0.4 percent in Q2, down from 4 percent in Q1 year on year.

- Regions with lockdowns have seen their economy hit hard. In Q2 Shanghai’s GDP contracted by 13.7 percent year on year. Similar “rolling recessions” will continue to affect different parts of the country throughout the year, severely harming economic activity.

What to watch: Debt is likely to surge even higher as more stimulus measures are introduced.

Business: Lockdowns put major strain on China’s industrial activity

Exhibit 1

Exhibit 2

- Regional lockdowns took a heavy toll on industrial activity early in the second quarter. In April, value-added industrial output shrank by 2.9 percent on the same month a year prior, a record low. By June, production had recovered slightly, but only grew by 3.9 percent, far below 9.6 percent growth in June 2021. Once again, mining and high-tech industries propped up headline growth, expanding by 8.7 percent and 8.4 percent year-on-year respectively.

- Foreign companies suffered the greatest declines, in part because they are heavily concentrated in Shanghai. Foreign enterprises’ output declined by 16.1 percent in April, year-on-year. Chinese enterprises, both private and state-owned, fared better, with only minor declines in April of 1.1 percent for private companies and 2.9 percent for state firms.

- Automotive production was suppressed by lockdowns in Shanghai and Jilin – major production hubs – (see exhibit 1). Production shrank by 31.8 percent in April year-on-year, though it resumed at most carmakers from late April. Industrial activity had picked up by 16.2 percent year-on-year by the end of the quarter, helped by stimulus measures that include tax cuts and new license plates quotas.

- The government’s infrastructure push was not enough to offset the reduction in real estate projects, so energy-intensive industries continued their year-long decline in output (see exhibit 2). Cement output shrank by 12.9 percent and crude steel output was 3.3 percent lower in June year on year.

- The services sector continues to be heavily battered since the beginning of the pandemic. In June rail and air travel hit their lowest levels since Q1 2020; rail travel dropped 79.8 percent while air travel was 84.6 percent lower than in June 2021.

- Small and medium sized enterprises (SME) find themselves in an especially vulnerable position. Beijing has responded with new support programs including a 10-point plan to help SMEs including to provide liquidity as well as well as preferential treatment for government procurement projects.

What to watch: Business sentiment picked up in June, but new Covid-outbreaks and subsequent lockdowns could easily lead to another downturn.

International trade and investment: Exports continue to give the economy a crucial lifeline – for now

Exhibit 2

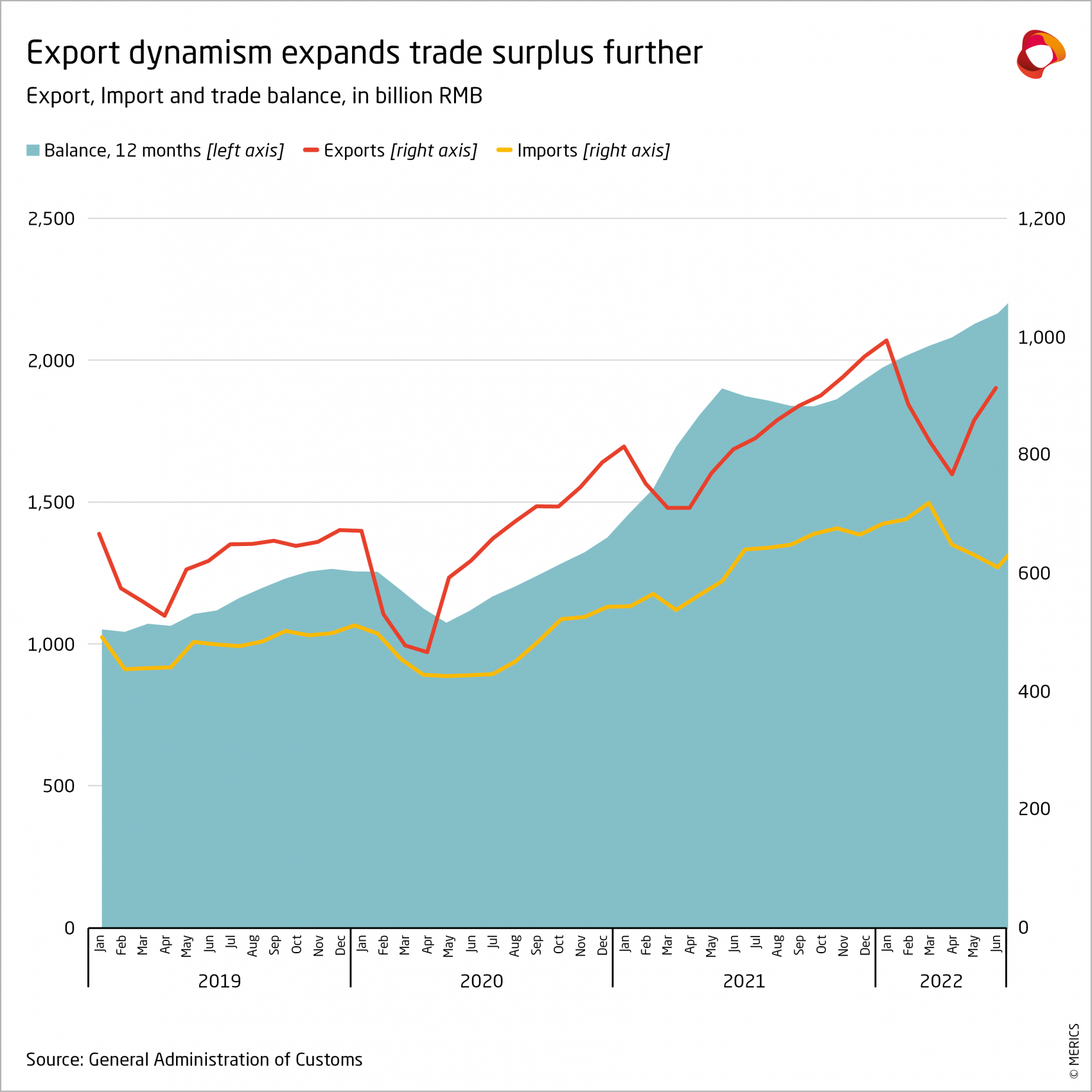

- Exports have rebounded in the aftermath of massive disruptions to production and logistics caused by strict regional lockdowns. Year-on-year growth in US dollar terms bounced back to 17.9 percent in June as goods flowed again and the bottlenecks eased; it had fallen to just 3.9 percent at the start of Q2. Quarterly growth slowed to 12.8 percent from 15.6 percent in Q1; the reduction was due to weak growth in April coupled with high growth in the comparable period of 2021.

- The widening gap between import and export growth has pushed China’s trade balance to new records (see exhibit 1). China’s trade surplus at the end of the first half of the year was almost 60 percent up on H1 2021.

- Demand for consumer goods continues to be the mainstay of Chinese exports, but car exports are becoming more significant, reaching new records in June. China exported over 1.3 million vehicles (incl. chassis) in the first half of the year, or 41 percent more than in the first half of 2021.

- High inflation and interest rate hikes in key markets, paired with ongoing pandemic related disruptions, are a major risk to China’s high levels of export growth. The outlook for exports seems bound to change, eroding their vital role in lifting GDP growth while other growth drivers struggle.

- Imports levels remain stricken by lackluster demand and lower prices for key commodities, with the exception of energy (see exhibit 2). As a result, imports of key industrial inputs were lower in value and quantity. For example, iron ore imports contracted 4.4 percent in quantity and 30 percent by value in the first six months of the year compared with January to June 2021. The broad underlying weakness in demand meant that imports of automobiles fell by 1.2 percent, while machine tools fell by 10.7 percent during the same period.

What to watch: We have said it countless times already: The era of exports as China’s major growth driver is coming to an end.

Financial markets: PBOC is in a dilemma on how to support the economy and preserve financial stability

Exhibit 2

- The People’s Bank of China (PBOC) is maintaining an accommodative position to stabilize the struggling economy. Unlike many central banks, the PBOC does not need to battle surging inflation by hiking interest rates, giving it more flexibility to assist growth. But its approach to monetary easing remains cautious. It must juggle complex challenges that include rising capital outflow pressure prompted by higher interest rates abroad and high domestic debt levels.

- The 5-year loan prime rate (a key reference interest rate for mortgages) was cut by the largest amount on record in May, slashed by 15 basis points to 4.45 percent. However, the short-term prime rate has stayed at 3.7 percent since January. The PBOC takes a cautious view of lowering interest rates, wary of stoking financial risk if creditors use lower rates to refinance rather than to invest in the real economy.

- A key PBOC goal is to direct credit to the real economy without significant changes to the leading policy rates and liquidity injections. Total social financing, a measure of aggregate credit, grew by its fastest pace in a year, expanding 10.8 percent in June year-on-year. Newly issued government bonds drove the uptick (see exhibit 1). Local government bond issuance picked up significantly over Q2 as central government channeled the stimulus through fiscal policy and towards infrastructure projects. But some of these funds might be used to plug budget gaps due to lower tax revenue.

- Both households and corporates have piled up short term financing over Q2. The trend likely reflects lack of economic confidence due to the 'zero-Covid’ policy and tighter regulation of the real estate and digital sectors. Weak credit demand was reflected in a sharp drop in the Banking Climate Index in June (see exhibit 2).

- The weaker economy is also putting pressure on the banking system, especially for smaller and regional banks that are crucial for many local businesses and private households. These banks are the most vulnerable to economic downturns and are heavily dependent on real-estate.

What to watch: More small and medium sized banks could come under pressure, as in Henan, exposing systemic risks in China’s banking system if the economy does not pick up.

Investment: Stalling real estate investment is dragging down growth

Exhibit 1

Exhibit 2

- Fixed investment gradually slowed over the quarter, falling from 6.8 percent for the first four months to 6.1 percent in the first half of the year, measured on a year-on-year basis. While new stimulus measures may have prevented a sharper slowdown, they were insufficient to counter weaker investment activity in key sectors, notably real estate.

- The real estate sector is undergoing a dramatic slowdown; key indicators are contracting at record levels (see exhibit 1). The real estate sector accounts for about 20 percent of China’s GDP, so the current plunging growth rates are detrimental to economic growth, personal wealth and local government finances.

- Confronted with stalling growth, the government announced several new infrastructure programs in Q2. And in early July, the State Council announced plans to raise RMB 300 billion in funds to finance new infrastructure projects. Details of specific projects have yet to be announced and so far the measurable economic effect of the stimulus measure is not very strong.

- Infrastructure investment picked up mildly over the quarter as more stimulus measures were unveiled. Growth for the first four months was 6.5 percent year-on-year, while it expanded by 7.1 percent for H1. But investments in transport infrastructure, including rail and highways, continued to contract, with rail down by 4.4 percent and highways down 0.2 percent by the end of June. Meanwhile investment in water conservancy and environment was up by 10.7 percent in H1.

- Construction of new facilities to implement the strict pandemic measures has produced surging investments in health care. Investment was up by 34.5 percent by the end of June year-on-year, in a stark reminder of the financial burden facing local governments.

- Investment in manufacturing has held up comparatively well, expanding by 10.4 percent. There are indications that state-owned enterprises have a critical role in maintaining stability (see exhibit 2).

What to watch: Infrastructure investment and investment by state-owned enterprises are likely to accelerate in the coming months as the stimulus broadens.

Prices: Inflationary pressure in China is well below the rest of the world

Exhibit 1

Exhibit 2

- Amid surging prices worldwide, inflation in China is bucking the trend. China is less affected by higher food prices due to a high degree of self-sufficiency and less susceptible to rising costs for imported consumer goods as Chinese producers make most of these in the country.

- Higher energy costs were the main factor pushing up the consumer price index (CPI) in the second quarter (see exhibit 1). Prices for vehicle fuel surged in June by 32.8 percent year-on-year, driving up the CPI to 2.5 percent at the end of Q2, compared to 1.5 percent at the close of Q1. June CPI was the highest in two years, but it was still below the central bank’s annual target of 3 percent.

- Low inflation owed much to the government’s harsh Covid-policies, which dampened consumption demand. In the first six months of 2022, CPI rose only 1.7 percent year-on-year. Core inflation, which excludes more volatile food and energy prices, was up 1 percent.

- The producer price index (PPI) steadily fell over the second quarter as production picked up again after China’s sweeping lockdowns in April and May. Fears of a global slowdown have also pushed down prices for commodities, such as iron ore or cooper. As a result, the PPI eased to 6.1 percent in June on a year-earlier basis, dropping from 8.3 percent at the end of Q1.

- Construction-linked stimulus measures are not reflected in the data. Purchasing prices for ferrous metals (including steel) contracted by 3.2 percent in June year-on-year, while price increases for building materials feel from 10 percent in March to 4.8 percent by the end of the second quarter. As the government increases its stimulus, construction related prices should etch upwards.

- Prices for new residential real estate in 2.9 of the 70 cities tracked by the National Bureau of Statistics fell over the second quarter. The slump is particularly affecting second and third tier cities: while real estate prices increased by 9.1 percent for first tier cities, prices in the rest of the country expanded only by 2.5 percent (see exhibit 2). In 17 cities prices contracted, up from only seven a year ago.

What to watch: PPI is likely to pick up as the government rolls out more stimulus, while weak consumer demand is likely to persist and keep CPI increases moderate.

Labor market: A record 11 million university graduates face a grim hiring season

Exhibit 1

Exhibit 2

- China’s strict Covid-control policy will suppress employment growth, despite the government’s attempts to maintain stability. The government is focusing on supporting a growing number of companies to retain existing staff. Due to the persistent economic uncertainty most companies remain hesitant to hire new staff. The lack of entry level position will hit hard as the labor market needs to absorb nearly 11 million university graduates.

- In the second quarter, a total of 3.7 million new urban jobs were created, the weakest figure on record after Q2 2020. Urban unemployment fell over the second quarter, dropping from a peak of 6.1 percent in April to 5.7 percent in June. But job prospects for recent graduates remain dim: the unemployment rate for 16-24 year-olds hit a new all-time record of 19.3 percent at the end of Q2 (see exhibit 1).

- University graduates are responding to the new challenges and lowering their wage expectations (see exhibit 2). A recent survey by Zhaopin, a recruitment website, found that 42.5 percent of recent graduates were seeking the relative safety with positions at state-owned enterprises (SOEs), up from 36 percent in 2021.

- The government has acknowledged the dire labor market situation by rolling out countless new measures to support new employment. They have introduced a new program to support entrepreneurship, and work programs such as the State Council’s Work Relief Program which includes for rural revitalization and infrastructure projects. The State-owned Assets Supervision and Administration Commission (SASAC) announced that SOEs would recruit more employees.

- The Ministry of Human Resources and State Security and the State Taxation Administration have been trying to ease labor costs to support struggling companies. They have offered a lifeline to 22 sectors hit hard by the government’s zero-Covid stance, which can defer social security premiums until 2023, an estimated cash relief of RMB 80 billion. The 22 sectors include retail, restaurants, tourism, transport and individual SMEs.

What to watch: More employment programs to boost new urban employment are likely, especially for recent graduates.

Retail: Consumer demand remains fragile amid uncertainty

Exhibit 1

Exhibit 2

- Domestic consumption remains in a dismal state as strict Covid controls have hit spending and confidence. Regional lockdowns corralled an estimated nearly 400 million people in April and May. Although the numbers have since come down to around 100 million, new lockdowns are being announced almost daily.

- Rolling lockdowns and economic insecurity continue to prevent any form of significant turnaround in retail spending. The situation is not to change anytime soon as consumer confidence is at an all-time low (see exhibit 1). The People’s Bank of China’s Urban Depository Survey – which looks at households’ inclination to save – found a record 58.3 percent preferred to save than to spend or invest.

- Retail spending improved over the quarter as lockdowns eased; in June, it expanded by 3.1 percent year-on-year, after April’s 11.1 percent decline. But the turnaround was not enough to generate growth in the first half of the year: H1 retail spending was down by 0.7 percent (see exhibit 2).

- Retail growth was inflated by higher costs for vehicle fuel which is included in the National Bureau of Statistic’s (NBS) retail statistics. Consumer spending for fuels accelerated throughout the quarter due to higher costs. By the end of June, spending had increased 14.7 percent. Excluding this price effect, actual retail growth would be even lower.

- Demand for customer facing services continues to be the hardest hit by lockdown measures, as people are cautious to use them even when allowed to. As a result, spending in restaurants was down by 4 percent in Q2, following a contraction in April of 22.7 percent, year-on-year. Similarly, demand for transportation is in tatters. Passenger railway journeys were down by 42.3 percent in H1 year-on-year, with little prospect of an uptick anytime soon.

What to watch: Without a clear exit path from the current ‘zero-Covid’ strategy, consumption and services will not improve.